The next is a visitor submit and evaluation from Shane Neagle, Editor In Chief from The Tokenist.

Though the Terra (LUNA) collapse pricked the crypto bubble in Might 2022, it took the FTX change disaster to firmly pop it on the 12 months’s finish. Ever since, the blockchain narrative has been supplanted by the AI hype. Furthermore, through the Biden administration, the crypto house entered a susceptible state of fixed harassment and debanking.

This was at a time when digital property wanted to shore up, evolve, and recuperate from the overleveraged string of busts throughout 2022. Fortuitously, the crypto-friendly Trump administration is now presenting an actual path to restoration — to a blockchain-based decentralized finance (DeFi). That is already evident by the rise in capital throughout dApps.

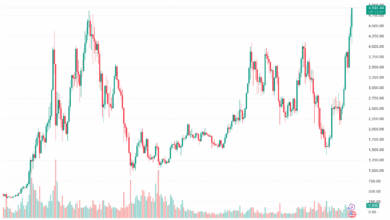

Now at $156 billion DeFi whole worth locked (TVL), this marks a return to the primary half of 2022. Likewise, Ethereum (ETH) worth drastically outperformed Bitcoin (BTC) during the last month, at +53% vs. -1%, respectively. It is a clear signal that an altcoin season is ramping up — however which main Layer-1 chains ought to crypto fans contemplate for long-term publicity?

Ethereum (ETH)

Because the second-largest blockchain community and the DeFi vanguard, Ethereum is an apparent alternative. But, it shouldn’t be neglected merely for that cause, albeit inside some caveats. There are two key facets to Ethereum which are enticing as the first publicity to the DeFi narrative.

Ethereum has the first-mover benefit, which generated the best developer exercise, ecosystem momentum, and scaling by way of Layer-2 networks equivalent to Base, Polygon, Unichain, Optimism, Arbitrum, and others.

After introducing the token-burning mechanism with EIP 1559, Ethereum’s inflation fee is on par with Bitcoin (post-4th halving) at round 0.75%. Though Bitcoin’s inflation fee will proceed to drop with extra successive halvings, ETH may very well be thought of sound cash in comparison with the greenback with its 2% goal inflation fee.

In different phrases, regardless of having an elastic token provide — generated by staking — in comparison with Bitcoin’s mounted provide, it’s self-adjusting. As dApp exercise rises on the mainnet, extra ETH is burned. And after the Pectra improve, which made L2 networks extra environment friendly with Blob Area, the burn fee has doubled.

Along with account abstraction and additional Ethereum scaling with sharding, Ethereum is future-proofing itself to deal with DeFi visitors whereas protecting transaction charges low. In flip, this ties in with the continuing stablecoin push with the GENIUS Act.

Ethereum has probably the most diversified stablecoin ecosystem, holding $138.6 billion in stablecoins. That is half of the overall $272.6 billion stablecoin market cap, in response to DeFiLlama. Because the bridging forex that brings the familiarity of the greenback in tokenized type, stablecoins are the primary interplay for most individuals, resulting in wider DeFi publicity.

Furthermore, when Circle introduced the launch of its ARC blockchain for stablecoin visitors, one ought to word it’s an EVM-compatible L1 community.

Superficially, this may occasionally appear bearish for Ethereum as stablecoin transactions may shift away from Ethereum. In actuality, it’s bullish as a result of it indicators Ethereum’s integration into enterprise-grade liquidity by way of cross-chains and Ethereum’s L2 ecosystem.

All of those components are actually driving up Ether accumulation throughout treasuries. In line with the Strategic ETH Reserve tracker, they’ve accrued 3.57 million ETH value round $16.58 billion. Successfully, Ether treasuries are prone to have the identical impact on ETH worth that spot-traded Bitcoin ETFs had on the BTC worth.

However does that imply buyers ought to go all in on ETH? For current ETH holders, they need to contemplate locking in income in the following couple of months. Traditionally, when Ethereum’s Market Worth to Realized Worth ratio (MVRV) is above 3.0, it indicators a peak earlier than a selloff.

After the Fed’s seemingly rate of interest reduce in September, Ethereum’s MVRV ratio ought to begin rising to that degree. Following the market correction, that is when new buyers ought to achieve ETH publicity. In line with a latest FundStrat forecast, ETH worth is prone to attain $10,000 by the 12 months’s finish.

Avalanche (AVAX)

Since its launch in 2020, this L1 community has caught consideration with its novel method to blockchain structure design. Particularly, Avalanche divides workload by way of X-Chain for asset change, C-Chain to execute EVM-compatible good contracts, and P-Chain for managing subnets, validators, and staking.

The implication of this design ends in an easy export of Ethereum dApps along with personalized subnets. If a corporation values monetary privateness, it may create distinctive governance and consensus guidelines for its subnet. This opens the door to a variety of use instances in banking, healthcare, provide chains, and personal funds.

Working example, FIFA picked Avalanche in Might for its NFT deployment. Most not too long ago, the Avalanche Basis launched its $50 million accelerator program to fund blockchain gaming.

When it comes to tokenomics, 90% of AVAX token provide is unlocked out of a complete provide of 458.1 million, from the preliminary mining of 360 million AVAX. In Q2 2025, the annualized inflation fee remained at 3.8%, following a dynamic schedule pushed by the quantity of AVAX staked and the staking interval.

Though this makes AVAX inflationary in comparison with Ethereum or Bitcoin, the AVAX token nonetheless has a tough cap of 720 million.

AVAX token worth is prone to go up as extra companies are launched. To call a number of: lending service Euler Finance, Nexpace (MapleStory N), VanEck’s VBILL treasury fund, Watr’s commodity buying and selling, and Dinari’s tokenized securities.

This burst of exercise elevated common every day lively addresses by 210% on a quarterly foundation, in response to Messari information. During the last month, AVAX is up 18%, presently priced at $25 per token. The potential for features is excessive, as AVAX reached a number of $50 peaks throughout 2024. Reminder: this was nonetheless through the crypto-hostile Biden administration.

Cardano (ADA)

Following an instructional method to blockchain growth, Cardano is carefully tied to Ethereum’s origins, as its co-founder Charles Hoskinson based Cardano because of variations in how Ethereum needs to be organizationally arrange. Over time, Cardano gained a notion because the “left-behind” chain, with Solana (SOL) gaining prominence as Ethereum’s competitor.

Nonetheless, Cardano’s roadmap is progressing, and its ecosystem is slowly build up. In early 2024, Cardano gained its personal USDM stablecoin, issued by absolutely compliant Moneta, even assembly Europe’s strict MiCA customary. Likewise, the Norwegian Block Change (NBX) onboarded USDM.

Within the scaling division, Cardano superior Hydra Layer-2 scaling for off-chain transactions and launched Mithril for light-weight node synchronization. By the 12 months’s finish, Ouroboros Peras is about to drastically scale back transaction settlement instances. Along with Ouroboros Leios, Cardano is prone to be as performant in transaction throughput as Solana.

Zero-knowledge (ZK) good contracts are additionally set for mainnet launch in late 2025, bringing privateness, scalability, and interoperability to the Cardano desk. Along with the privacy-focused Midnight challenge, Cardano is surrounded by constructive narratives.

One other constructive narrative from a sound money-wise perspective is that Cardano’s inflation fee is on par with Ethereum. In Q1, it was at 0.7% yearly, whereas trending downward owing to the interaction between 5-day 0.3% growth epochs, the exhausting cap of 45 billion ADA, transaction charges, and staking participation.

12 months-to-date, ADA is up 2.5%, nonetheless underneath the greenback per token. In September 2021, ADA reached its all-time excessive worth of $3.10. This makes it one of many least expensive blockchain exposures. And since Cardano has been dismissed so many instances, its upside potential is amplified if its roadmap delivers as deliberate. Within the inventory market, dividend development investing follows an analogous precept of persistence and compounding returns.