Welcome to Slate Sundays, CryptoSlate’s new weekly function showcasing in-depth interviews, knowledgeable evaluation, and thought-provoking op-eds that transcend the headlines to discover the concepts and voices shaping the way forward for crypto.

Crypto funds are having a second.

From Circle’s billion-dollar IPO to the GENIUS Act clearing a path for stablecoin regulation, the tailwinds are blowing a gale.

Even Wall Avenue’s largest names, together with JPMorgan and Visa, are busily incorporating stablecoin rails into their tech stacks, lastly bowing to a superior know-how that may switch worth trustlessly and (close to) immediately worldwide.

And all that is nice, besides…

There’s a flipside no person talks about: the UX is caught in beta.

It makes even the sanest of oldsters need to gouge out their eyeballs with a blunt spoon.

Why?

Crypto funds are strangled by regulators and purple tape

POV: crypto cost suppliers are quickly being co-opted by regulators and TradFi, slowed down in cumbersome practices like KYC and KYB, and strangled in purple tape.

After 9 years of reporting on crypto and being paid in each token beneath the solar, it’s a tragic actuality that receiving crypto funds has grow to be more durable, not simpler, regardless of the prevailing narrative on the contrary.

Living proof. I just lately had a UK-based shopper with a Gemini account who wished to ship a cost in USDC to my OKX tackle in Dubai.

After weeks of backwards and forwards, attempting to unfreeze her enterprise account and provide further obligatory KYB paperwork, she gave up, deciding that Revoult to my checking account can be sooner.

If that assertion wasn’t miserable sufficient already, right here’s the hammer blow:

It was additionally cheaper for her to ship the cost—and cheaper for me to obtain it.

No marvel Gemini registered a $280 million loss within the first half of 2025. They have to be shedding clients like rats from a sinking ship.

As for OKX? There isn’t any actual incentive to do higher within the UAE since all suppliers cost a flat crypto-to-fiat withdrawal charge of 75 AED (round $20).

And whereas many trade contributors are grateful for the regulatory readability, a few of us now should abdomen the double conversion: you may’t money out to fiat from USDC within the UAE, and you’ll’t receives a commission in Tether in Europe.

Face palm.

Changing USDC to USDT to AED (and getting royally horsewhipped each time) is like changing a horse and cart with a Ferrari, solely to insist on pumping the engine with molasses.

Don’t even get me began on being crypto native. Attempt telling a normie that in the event you by chance choose the mistaken community out of an ever-expanding checklist of choices, you’ll lose all of your cash eternally.

Or in the event you depart your funds on an change that will get hacked, you’ll lose all of your cash eternally.

Or in the event you resolve to self-custody and lose your seed phrase, you’ll…

Ay! Revolut, anybody?

You get the thought. Hype? It couldn’t be hypier. UX? Absolutely the pits.

Simply one other banking platform, solely more durable to make use of and dearer, with no backup or ensures. It looks like crypto funds are nonetheless beneath development.

Borderless funds work higher inside borders

That’s to not say crypto funds are doing nothing proper. They work fairly effectively transferring worth inside nationwide borders. However then, so do banks.

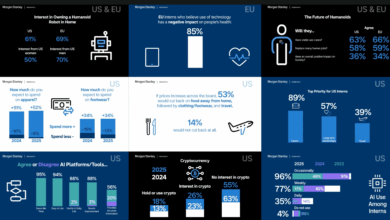

Almost 32% of SMBs within the U.S. have paid or accepted a cost in crypto, and of the 560 million estimated crypto homeowners, round a 3rd commonly use digital belongings for funds, dwarfing different DeFi actions like staking or farming.

The GENIUS Act has lastly supplied regulatory readability for stablecoin issuers after years of flying blind, and it walks the tightrope fairly effectively: regulators need client safety and anti-money laundering ensures. Markets need clear guidelines on what constitutes a safety. The GENIUS Act delivers each.

So why does crypto cost UX nonetheless ship a shiver down our spines? Aren’t blockchain transactions speculated to be cheaper and sooner?

Invoice Zielke is Chief Income Officer of BitPay, an OG crypto funds supplier that goals to scale back the price of cost processing and allow borderless crypto funds. He acknowledges that not all platforms are primed to offer the very best expertise, saying:

“This can be a honest concern, and one we hear typically from customers who’re navigating the world of wallets and exchanges that aren’t optimized for low-fee crypto transfers. In lots of circumstances, excessive prices come all the way down to poor charge transparency, suboptimal community decisions, and cash-out platforms that cost excessive spreads or withdrawal charges.”

He explains that BitPay’s method is totally different, centered on lowering factors of friction to combine assist for cost-efficient networks like Polygon, Arbitrum, Base, and Optimism. Whereas it’s nonetheless ‘choose the mistaken community at your peril’, at the least the charges don’t make you wince.

“Customers can ship and obtain funds with considerably decrease affirmation charges than on legacy networks like Ethereum or Bitcoin.”

Community choice is a vital issue, as charges may be unpredictable, and community congestion has been recognized to trigger gasoline charges to skyrocket.

Whereas most retail customers nonetheless depend on centralized exchanges, they routinely cost flat withdrawal charges, a la OKX. $20 is typical for cashing out, making small funds impractical.

Ben Weiss is the CEO of CoinFlip, a longstanding crypto-native firm that owns and operates greater than 6,000 Bitcoin ATMs worldwide. After a decade of working on this trade, he’s noticed how crypto funds have developed, sharing:

“Plenty of [crypto payments] is a flat charge. So in the event you’re sending Bitcoin, you would possibly pay the identical charge for sending $1 million as for $5… Crypto doesn’t work as effectively for smaller funds. That’s beginning to change, however actual effectivity takes time. There’s nonetheless lots of work to be carried out on the interface and usefulness. That lags a few years behind the core know-how.”

For cross-border transfers, crypto remains to be battling in opposition to entrenched infrastructure. For instance, the World Financial institution’s newest research experiences conventional remittance charges averaging 6.4-7%, whereas digital remittance by way of crypto and cell channels averages about 5%.

Many DeFi rails are cheaper, however they require customers to navigate arcane wallets and personal keys, or bridge between networks. Normies have left the constructing.

Being your individual financial institution sounds enjoyable till it isn’t

One other hurdle for crypto funds is custody. Blockchain permits actually peer-to-peer transactions and particular person sovereignty, letting anybody be their very own financial institution. However most individuals don’t need to be their very own financial institution.

Self-custody stays a nightmare for the uninitiated, and many individuals don’t perceive the necessity to retain monetary management, in the event that they’ve by no means had their account frozen or been systematically debanked. Weiss displays:

“Not everybody desires to self-custody or work out how one can open up a chilly storage pockets to ship or obtain crypto; they could simply need to purchase an ETF. Generally, I’m for something that makes the trade greater, and will get extra folks into crypto. There’s no proper or mistaken means.”

Zeilke provides:

“The core problem at the moment remains to be UX. Issues like establishing wallets, excessive community charges, or worry of sending belongings to the mistaken tackle create friction for on a regular basis customers. However we’re already seeing main enhancements, particularly with stablecoins and Layer-2 networks, that are dramatically lowering charges and settlement instances.

We’re not absolutely there but, however the basis has been laid and the framing is underway. With regulatory readability bettering and infrastructure changing into extra user-friendly, we’re transferring nearer to a future the place crypto funds are as intuitive as tapping a card.”

And till sending crypto funds is so simple as tapping a bank card, it would by no means take off as the popular option to transact worth worldwide.

Are we recreating the banking system we wished to flee?

Crypto promised to be sooner, cheaper, and easier than banks. But the sensible ache factors are cussed, and on the danger of sounding like Jamie Dimon, if crypto funds aren’t simpler than the financial institution, what’s the purpose?

And as TradFi rushes to “blockchainify” its programs, are we watching banks soak up crypto tech moderately than crypto changing banks?

UX fails, hidden prices mount, and if you lastly need to money out, you discover charges as punitive as wire transfers. Zielke displays on the problem:

“Mass adoption takes time, however I imagine we’re on the appropriate path. It took many years for bank cards to grow to be the norm, largely as a result of it required belief, constant infrastructure enhancements, and a refined person expertise. Crypto funds are following the same trajectory, however at a a lot sooner charge.”

So, the place are we headed? The trendlines are clear: extra institutional adoption, extra stablecoin rails, extra regulatory compliance, and an ever-increasing use of crypto for large-value funds and cross-border commerce.

But the street to the frictionless on a regular basis funds expertise (the one which places crypto on par with tapping a bank card) stays lengthy and winding.

The hurdles are not simply technical or regulatory, however experiential. Crypto must persistently undercut banks, particularly for small funds, and sending and receiving have to be easy, clear, and error-tolerant.

Crypto funds aren’t successful as a result of crypto is simple; they’re successful as a result of the previous system remains to be sluggish, closed, and uninclusive. Whereas we are able to take the win, we are able to additionally acknowledge vital room for enchancment. Successful by default isn’t the identical as successful by design.