The US Treasury is exploring whether or not id checks needs to be constructed instantly into decentralized finance (DeFi) good contracts, a transfer critics warn may rewrite the very foundations of permissionless finance.

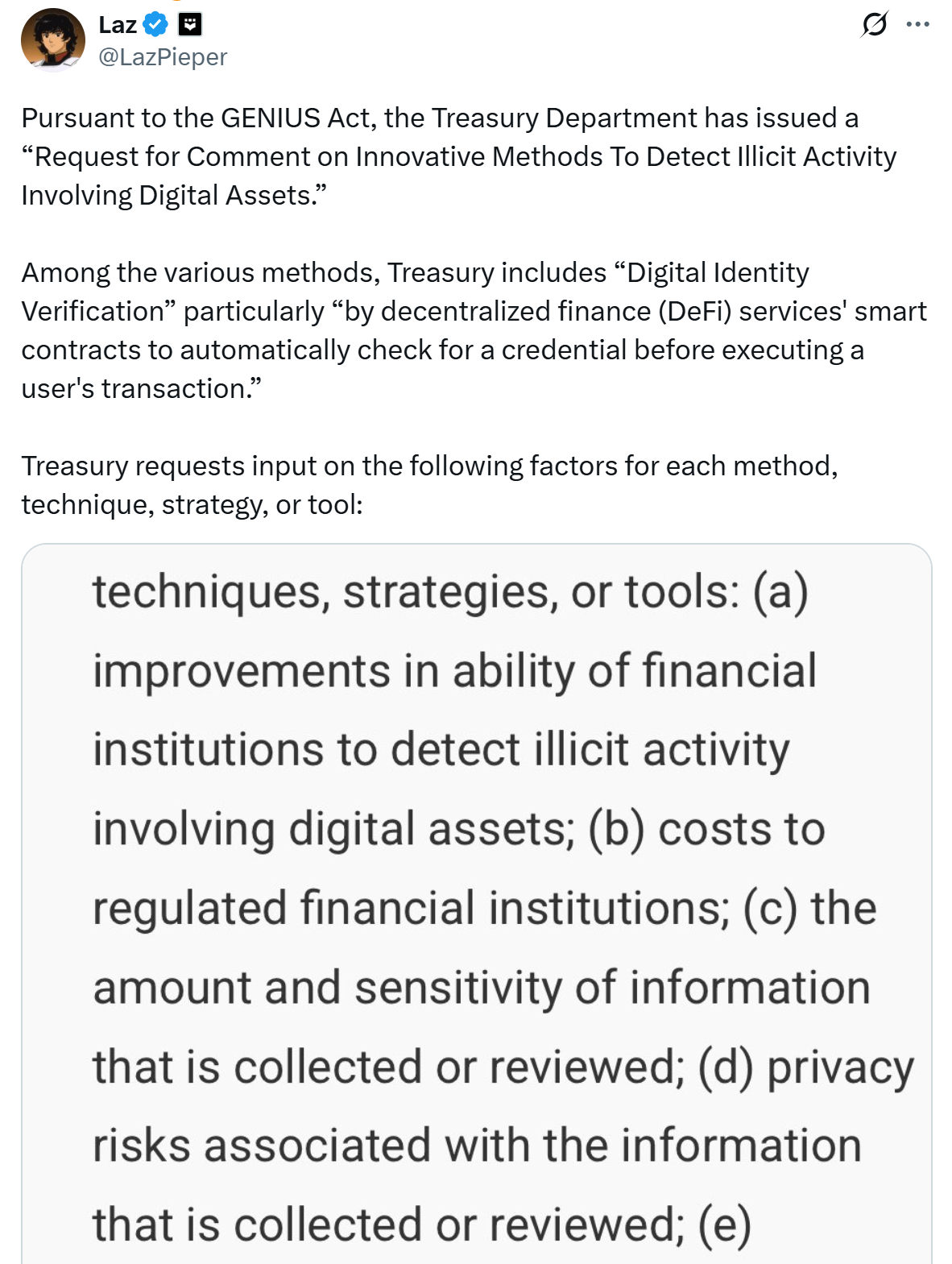

Final week, the company opened a session beneath the Guiding and Establishing Nationwide Innovation for US Stablecoins Act (GENIUS Act), which was signed into legislation in July. The Act directs the Treasury to guage new compliance instruments to struggle illicit finance in crypto markets.

One concept was embedding id credentials instantly into good contracts. In observe, this could imply a DeFi protocol may mechanically confirm a consumer’s authorities ID, biometric credential, or digital pockets certificates earlier than permitting a transaction to proceed.

Supporters argue that constructing Know Your Buyer (KYC) and Anti-Cash Laundering (AML) checks into blockchain infrastructure may streamline compliance and preserve criminals out of DeFi.

Fraser Mitchell, Chief Product Officer at AML supplier SmartSearch, advised Cointelegraph that such instruments may “unmask the nameless transactions that make these networks so enticing to criminals.”

“Actual-time monitoring for suspicious exercise could make it simpler for platforms to mitigate threat, detect and in the end stop cash launderers from utilizing their networks to clean the proceeds from a few of the world’s worst crimes,” Mitchell stated.

Associated: GENIUS Act to spark wave of ‘killer apps’ and new fee companies: Sygnum

DeFi ID checks: defend information or threat surveillance?

Mitchell acknowledged the privateness tradeoff however argued that options exist. “Solely the mandatory information required for monitoring or regulatory audits needs to be saved, with the whole lot else deleted. Any information that’s held needs to be encrypted at row stage, decreasing the chance of a significant breach.”

Nevertheless, critics say the proposal dangers hollowing out the core of DeFi. Mamadou Kwidjim Toure, CEO of Ubuntu Tribe, in contrast the plan to “placing cameras in each front room.”

“On paper, it seems like a neat compliance shortcut. However you flip a impartial, permissionless infrastructure into one the place entry is gated by government-approved id credentials. That basically modifications what DeFi is supposed to be,” Toure advised Cointelegraph.

He warned that if biometric or authorities IDs are tied to blockchain wallets, “each transaction dangers changing into completely traceable to a real-world particular person. You lose pseudonymity and, by extension, the flexibility to transact with out surveillance.”

For Toure, the stakes transcend compliance. “Monetary freedom depends on the correct to a personal financial life. Embedding ID on the protocol stage erodes that and creates harmful precedents. Governments may censor transactions, blacklist wallets, and even automate tax assortment instantly via good contracts.”

Associated: GENIUS Act yield ban might push trillions into tokenized belongings — ex-bank exec

Who will get left behind?

One other concern is exclusion. Billions of individuals globally nonetheless lack formal identification. If DeFi protocols require government-issued credentials, complete communities, migrants, refugees and the unbanked threat being locked out.

“It could prohibit entry for customers preferring anonymity or can not meet ID necessities, limiting DeFi’s democratic nature,” Toure stated.

Knowledge safety can be a flashpoint. Linking biometric databases to monetary exercise may make hacks extra catastrophic, exposing each cash and private id in a single breach.

Critics stress that the selection isn’t binary between crime havens and mass surveillance. Privateness-preserving instruments like zero-knowledge proofs (ZKPs) and decentralized id (DID) requirements provide methods to confirm eligibility with out exposing full id.

With ZKPs, customers can show they aren’t on a sanctions listing or over 18 with out revealing who they’re. DID frameworks enable customers to carry verifiable credentials and selectively disclose them. “As a substitute of static authorities IDs, customers maintain verifiable credentials they selectively disclose,” Toure stated.

Journal: Scottie Pippen says Michael Saylor warned him about Satoshi chatter