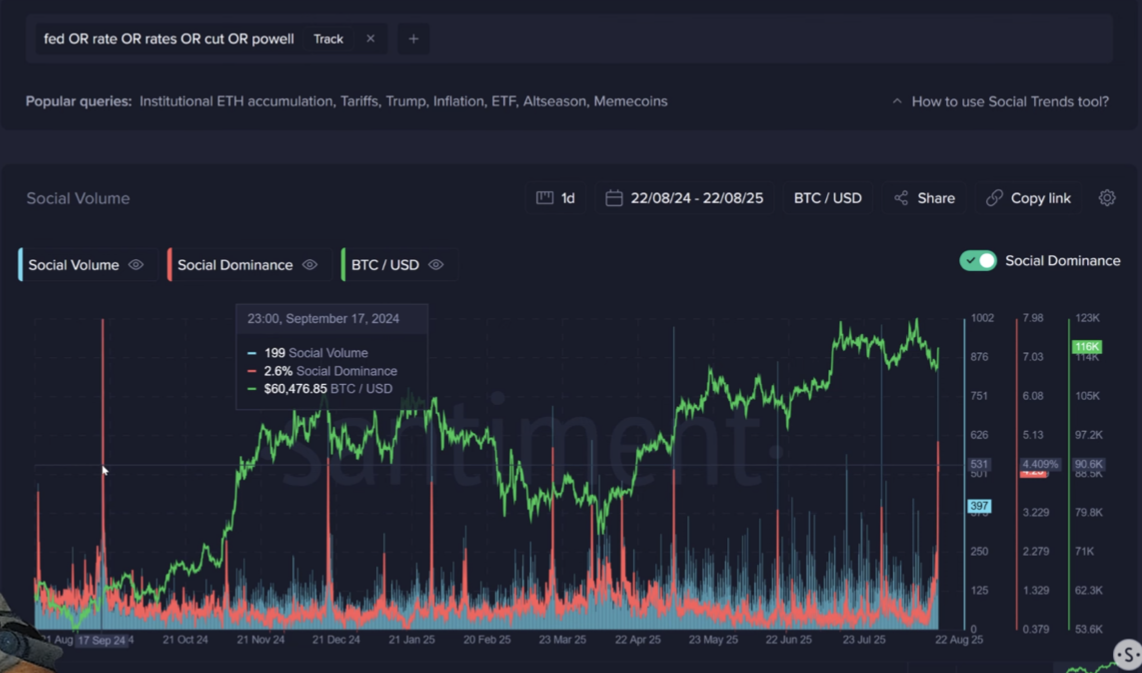

The surge in social media chatter across the extremely anticipated US Federal Reserve September rate of interest choice may very well be a warning signal for crypto, says sentiment platform Santiment.

It comes after the crypto market rallied on Friday and market sentiment returned to greed following Fed Chair Jerome Powell’s dovish remarks on the annual Jackson Gap financial symposium. He hinted that the primary price reduce of 2025 might are available September.

“Traditionally, such a large spike in dialogue round a single bullish narrative can point out that euphoria is getting too excessive and should sign a neighborhood prime,” Santiment stated in a report on Saturday. The agency stated that social media mentions of key phrases tied to the Fed and rate of interest cuts have jumped to their highest stage in 11 months.

Santiment urges warning as analysts are divided

“Whereas optimism a few price reduce is fueling the market, social information suggests warning is warranted,” Santiment stated.

Powell stated throughout his speech on Friday that present situations in inflation and the labor market “might warrant adjusting” the Fed’s financial coverage stance. In keeping with the CME FedWatch Device, 75% of market individuals anticipate a price reduce on the September assembly.

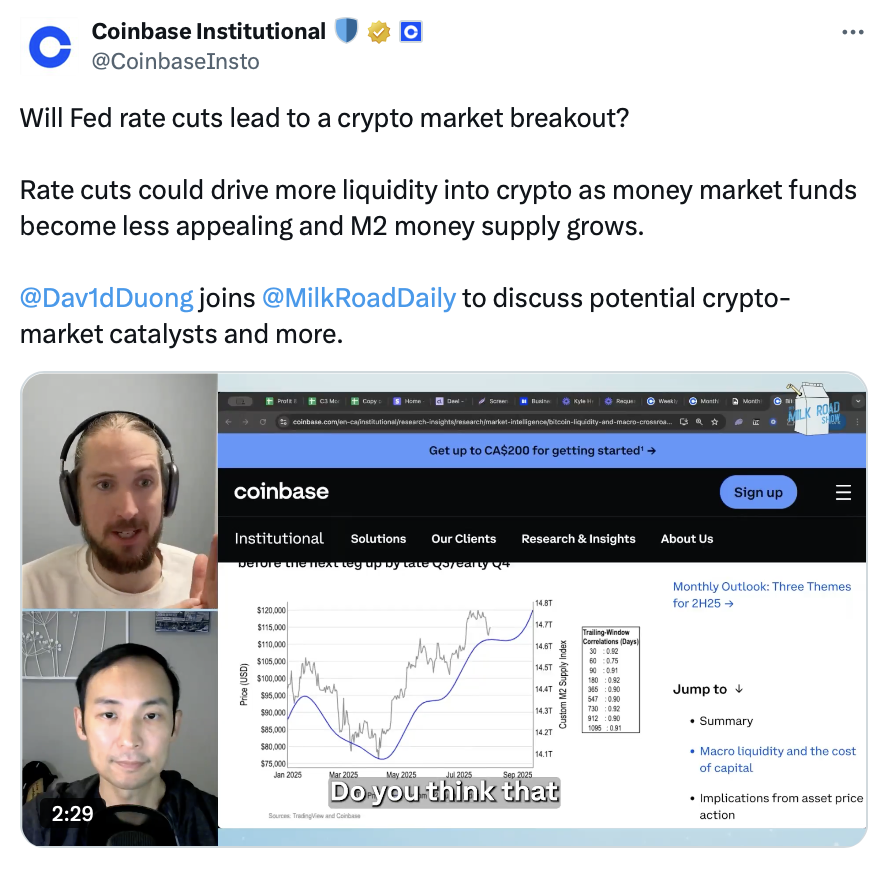

Many crypto analysts have based mostly their crypto market forecasts on the Fed’s choices all through this yr. Whereas some see a price reduce as a possible bullish catalyst, others are divided on the end result.

After Powell’s speech, crypto dealer Ash Crypto stated, “the Fed will begin the cash printers in This fall of this yr,” together with two price cuts, which implies “trillions will stream into the crypto market.”

“We’re about to enter parabolic part the place Altcoins will explode 10x -50x,” Ash Crypto stated.

Analyst warns crypto might face short-term strain

Others counsel that the crypto market might not instantly see the impression of a Fed price reduce.

On April 11, 10x Analysis head of analysis Markus Thielen stated, “Anticipating a bullish impulse is just too early.” He stated that whereas a longer-term value alternative for Bitcoin (BTC) might emerge, it could face short-term strain pushed by recession fears.

Associated: BTC climbed to 1.7% of world cash earlier than Fed chair signaled price reduce

In the meantime, some say that if the Fed takes no motion this yr, it might result in headwinds for the crypto market.

On March 9, community economist Timothy Peterson warned that if the Fed holds off on price cuts in 2025, it could trigger a broader crypto market downturn.

Journal: Can privateness survive in US crypto coverage after Roman Storm’s conviction?