The value of the Aave (AAVE) token tumbled by over 8% on Saturday, following rumors that the decentralized finance (DeFi) protocol would obtain a special token allocation from World Liberty Monetary (WLFI), a DeFi platform backed by members of US president Donald Trump’s household.

“The WLFI crew advised WuBlockchain that the declare that ‘Aave will obtain 7% of the overall WLFI token provide’ is fake and faux information,” blockchain reporter Colin Wu mentioned, sparking a debate in regards to the rumor and the token association on social media.

Wu was referencing a WLFI group proposal from October 2024, outlining an association through which the Aave decentralized autonomous group (DAO), answerable for governing the protocol, would obtain 7% of the WLFI governance token’s circulating provide and 20% of protocol revenues generated by the WLFI deployment on Aave v3.

Aave founder Stani Kulechov referred to as the proposal “the artwork of the deal” on Saturday, and, in a separate put up, signaled the phrases of the proposal had been nonetheless legitimate. Following the rumors, Aave’s token fell from about $385 to a low of $339 earlier than rebounding to about $352.

Cointelegraph reached out to World Liberty Monetary and Aave spokespeople however didn’t obtain a response by the point of publication.

Rumors relating to the association between Aave and World Liberty come amid a renewed curiosity in DeFi and rising institutional involvement within the crypto area of interest.

Associated: $70B DeFi protocol Aave goes reside on Aptos in ecosystem growth

DeFi sector is on the rise as establishments take discover

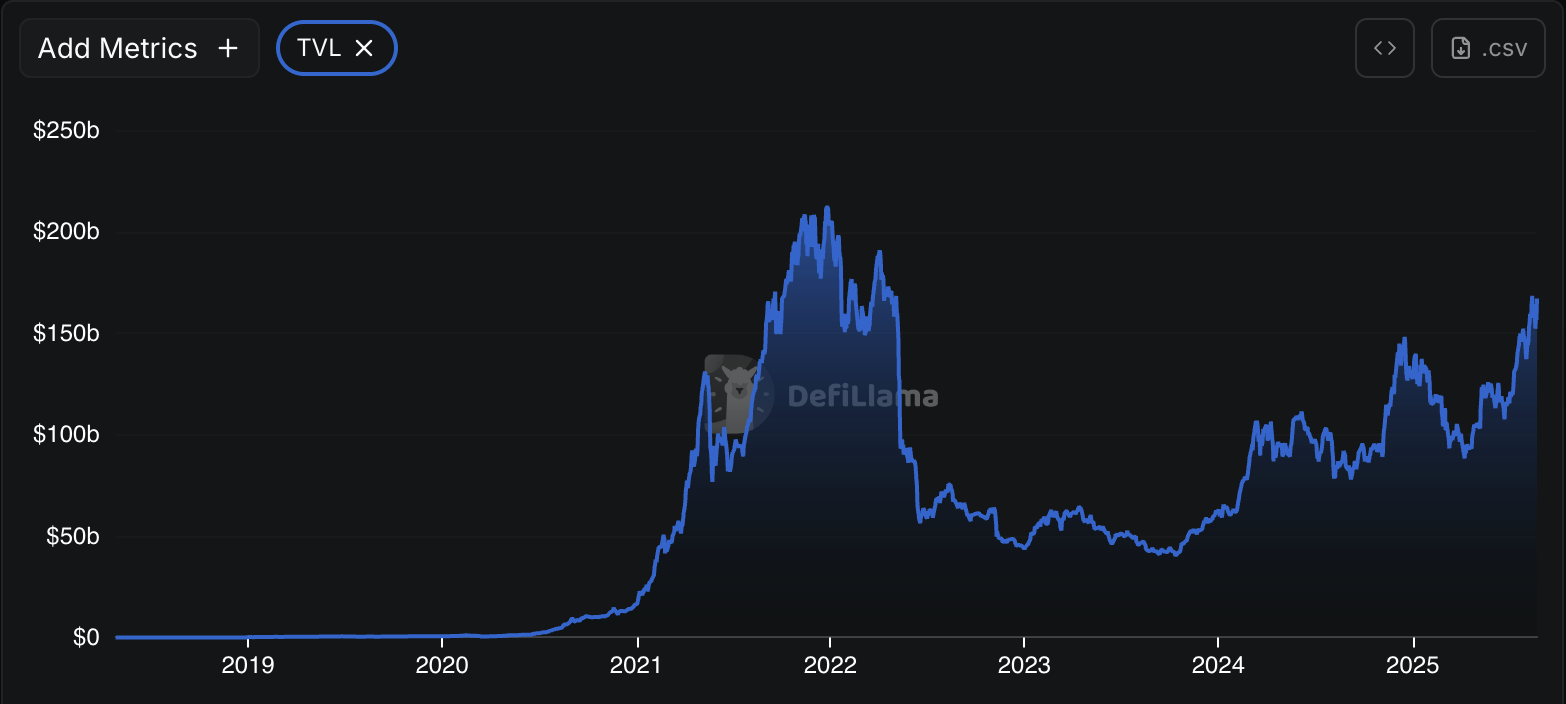

The full worth locked (TVL) in DeFi protocols is presently over $167 billion, based on DeFiLlama, and is approaching the all-time excessive of over $212 billion from December 2021.

DeFi TVL rose sharply following the outcomes of the 2024 US elections in anticipation of a friendlier regulatory local weather for cryptocurrencies within the nation.

Institutional buyers, together with banks, asset managers, firms, and monetary companies corporations, have change into more and more concerned in crypto and DeFi, shaping most of the narratives through the present market cycle.

This involvement has fueled a debate among the many crypto group about encroaching authorities rules on permissionless protocols and the potential seize of DeFi by conventional monetary establishments.

Journal: How Ethereum treasury corporations might spark ‘DeFi Summer time 2.0’