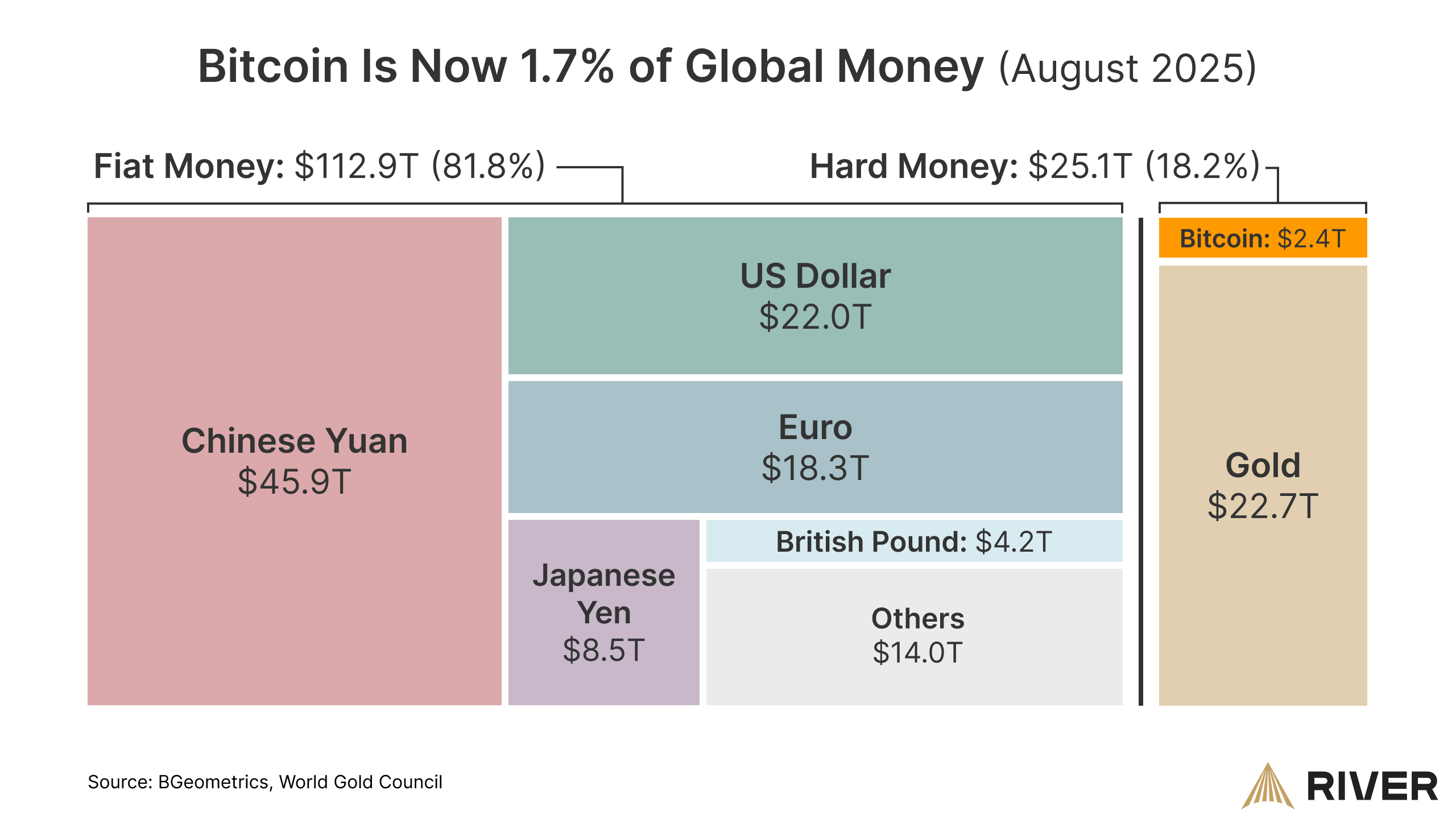

Bitcoin (BTC) grew to account for about 1.7% of world cash, a determine that features combination M2 cash provide information for all main fiat currencies, the most important minor currencies, and gold’s market cap, in keeping with River, a Bitcoin monetary providers firm.

“In 16 years, Bitcoin went as much as 1.7% of world cash,” River stated. The corporate weighed Bitcoin’s market cap towards a $112.9 trillion basket of fiat currencies and $25.1 trillion in laborious cash, which excluded silver, platinum, and unique metals like palladium.

The information assumes Bitcoin has a market capitalization of $2.4 trillion, which it topped earlier in August. Nevertheless, BTC’s present market cap is roughly $2.29 trillion, which brings its whole share of world cash all the way down to round 1.66% on the time of this writing.

Bitcoin and gold proceed to assert a larger share of the worldwide cash pie as central banks world wide inflate their fiat currencies via extreme cash printing, destroying buying energy and driving buyers to laborious cash alternate options.

Associated: Crypto sentiment returns to Greed as Bitcoin and Ether spike on Fed speech

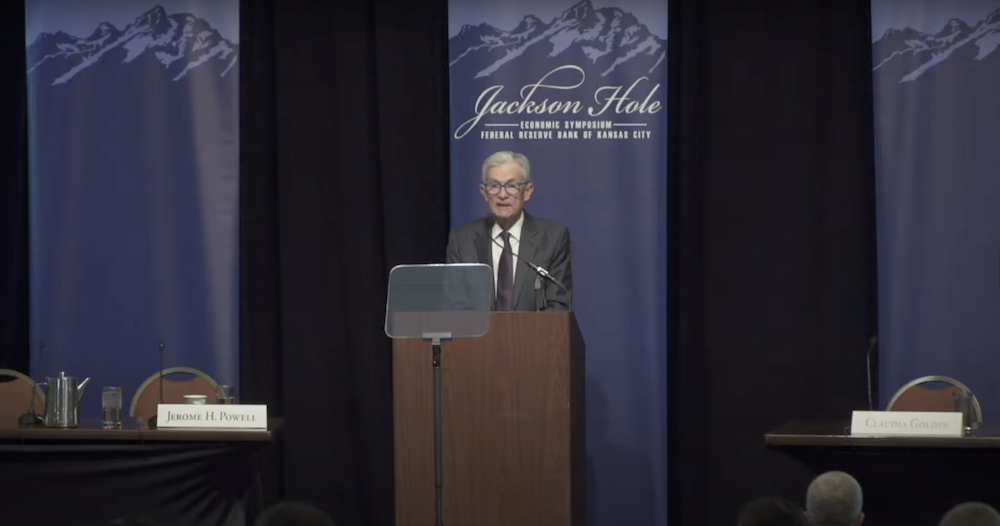

US Federal Reserve chair indicators coming fee cuts and continued financial growth

United States Federal Reserve chairman Jerome Powell delivered a keynote tackle on the Jackson Gap Financial Symposium in Wyoming on Friday, signaling impending rate of interest cuts and continued financial growth. Powell stated:

“Our coverage fee is now 100 foundation factors (BPS) nearer to impartial than it was a yr in the past, and the soundness of the unemployment fee and different labor market measures permits us to proceed fastidiously as we think about modifications to our coverage stance.”

The value of Bitcoin surged by over 2% in response to Powell’s speech, hitting a value of about $116,000 per BTC on Friday.

Bitcoin and different cryptocurrencies have a tendency to understand during times of financial growth, as the worth of digital belongings continues to correlate with international liquidity ranges.

75% of buyers now anticipate an rate of interest reduce of 25 foundation factors in September, in keeping with information from the Chicago Mercantile Change (CME) Group.

Journal: Child boomers price $79T are lastly getting on board with Bitcoin