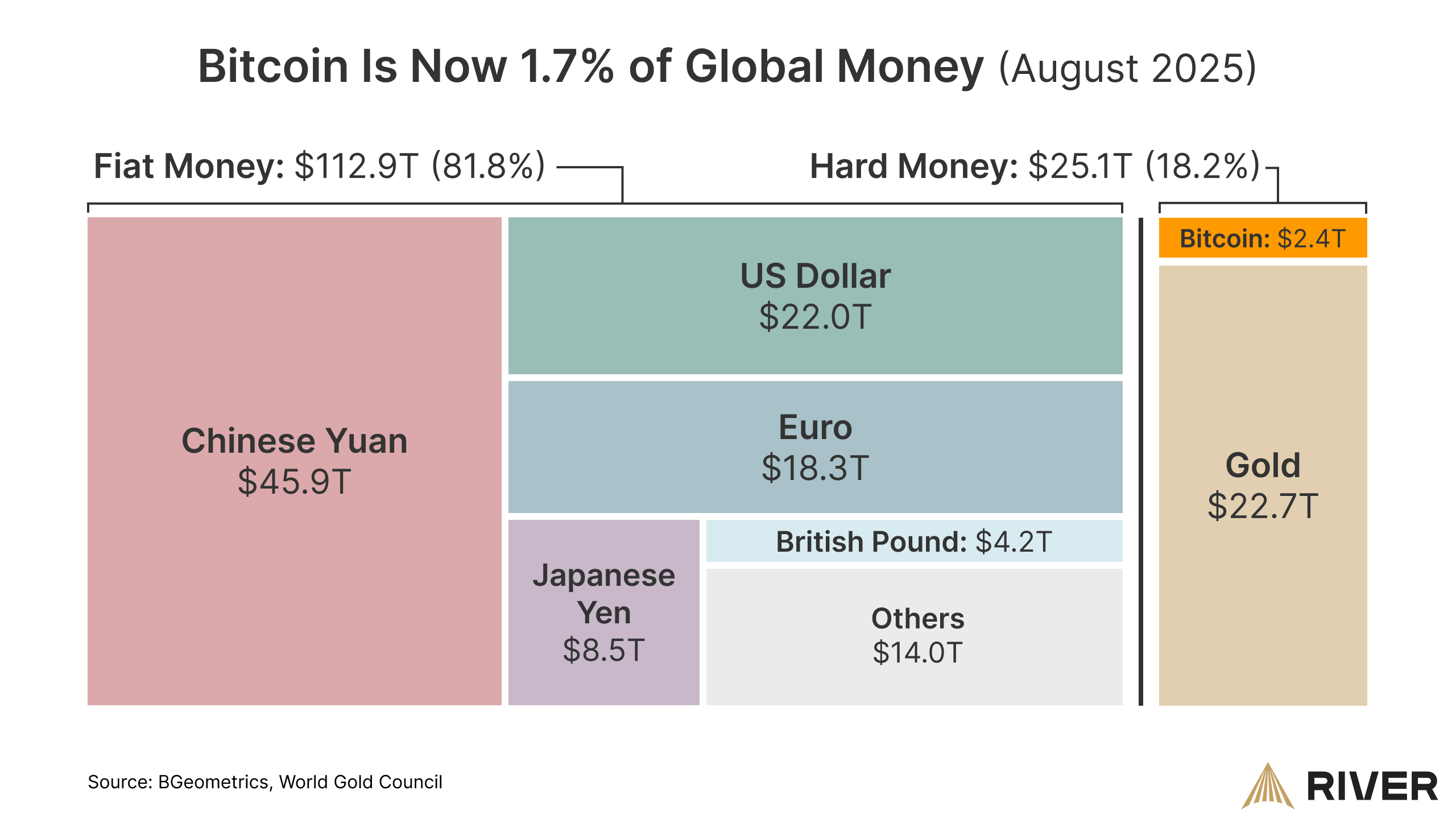

Bitcoin (BTC) grew to account for about 1.7% of worldwide cash, a determine that features mixture M2 cash provide information for all main fiat currencies, the biggest minor currencies, and gold’s market cap, in accordance with River, a Bitcoin monetary companies firm.

“In 16 years, Bitcoin went as much as 1.7% of worldwide cash,” River mentioned. The corporate weighed Bitcoin’s market cap in opposition to a $112.9 trillion basket of fiat currencies and $25.1 trillion in onerous cash, which excluded silver, platinum, and unique metals like palladium.

The info assumes Bitcoin has a market capitalization of $2.4 trillion, which it topped earlier in August. Nonetheless, BTC’s present market cap is roughly $2.29 trillion, which brings its whole share of worldwide cash right down to round 1.66% on the time of this writing.

Bitcoin and gold proceed to assert a larger share of the worldwide cash pie as central banks world wide inflate their fiat currencies via extreme cash printing, destroying buying energy and driving traders to onerous cash options.

Associated: Crypto sentiment returns to Greed as Bitcoin and Ether spike on Fed speech

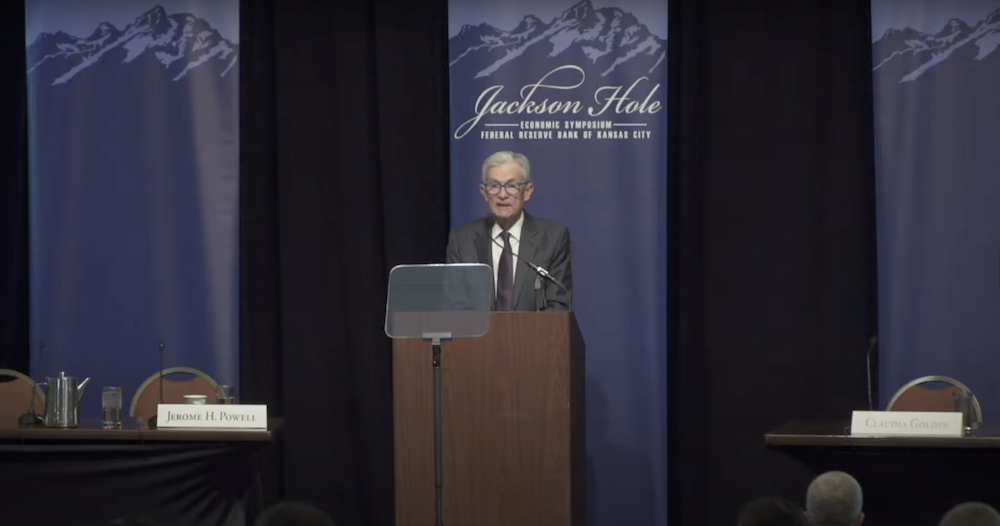

US Federal Reserve chair alerts coming charge cuts and continued financial growth

United States Federal Reserve chairman Jerome Powell delivered a keynote handle on the Jackson Gap Financial Symposium in Wyoming on Friday, signaling impending rate of interest cuts and continued financial growth. Powell mentioned:

“Our coverage charge is now 100 foundation factors (BPS) nearer to impartial than it was a yr in the past, and the soundness of the unemployment charge and different labor market measures permits us to proceed rigorously as we contemplate adjustments to our coverage stance.”

The worth of Bitcoin surged by over 2% in response to Powell’s speech, hitting a worth of about $116,000 per BTC on Friday.

Bitcoin and different cryptocurrencies have a tendency to understand during times of financial growth, as the value of digital property continues to correlate with world liquidity ranges.

75% of traders now anticipate an rate of interest reduce of 25 foundation factors in September, in accordance with information from the Chicago Mercantile Change (CME) Group.

Journal: Child boomers value $79T are lastly getting on board with Bitcoin