For many of its historical past, bitcoin has been prized as digital gold: an asset to carry somewhat than use. That passivity has left trillions of {dollars}’ value of BTC sitting idle in wallets, disconnected from the yield methods and composability that outline decentralized finance (DeFi).

The rise of liquid staking tokens guarantees to alter that, positioning bitcoin not solely as a retailer of worth however as a productive asset built-in into onchain capital markets.

Liquid staking refers back to the technique of makes use of providing their crypto to assist safe a community, and obtain a liquid, tradable token in return that represents their staked belongings and can be utilized throughout DeFi whereas the unique tokens proceed incomes staking rewards.

Lombard Finance has emerged as one of many outstanding tasks in bitcoin liquid staking. Its flagship product, LBTC, is a yield-bearing token backed 1:1 by BTC.

When BTC is deposited into the Lombard protocol, the underlying cash are staked, primarily by way of Babylon, a protocol enabling trustless, self-custodial bitcoin staking. Customers obtain LBTC in return, which might be deployed throughout DeFi ecosystems whereas the unique Bitcoin earns staking rewards.

This twin performance is vital. Holders can maintain publicity to bitcoin whereas utilizing LBTC in lending, borrowing, and liquidity provision throughout protocols akin to Aave, Morpho, Pendle, and Ether.fi. Designed for interoperability, LBTC strikes throughout Ethereum, Base, BNB Chain, and different networks, stopping liquidity fragmentation and guaranteeing bitcoin can take part in a multi-chain DeFi atmosphere.

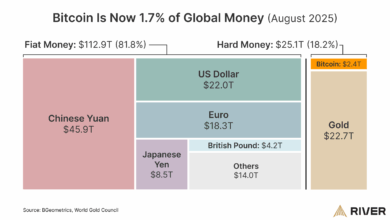

A market probably value billions

By mobilizing BTC’s dormant liquidity, Lombard and different liquid staking tasks intention to supply the infrastructure for Bitcoin DeFi, channeling the asset’s huge market cap into onchain capital markets.

This effort mirrors Ethereum’s personal transformation by way of liquid staking derivatives, however with the potential to unlock a deeper pool of worth given bitcoin’s scale.

To contextualize the distinction in scale, Ethereum’s liquid staking market, led by Lido’s stETH, boasts a market cap of roughly $38 billion. In distinction, the whole bitcoin LST sector remains to be nascent, with whole market capitalization round $2.5 billion. Lombard’s LBTC alone accounts for roughly $1.4 billion of that, or round 40% of the bitcoin LST market.

Lombard’s BARD

Constructing on that basis, Lombard this week introduced the creation of the Liquid Bitcoin Basis and its native $BARD token, alongside a $6.75 million neighborhood sale.

The Basis will act as an impartial steward of the protocol, funding analysis, grants, and schooling, whereas establishing governance frameworks to protect neutrality. $BARD will function the utility and governance token of the ecosystem, giving holders the power to stake to safe Lombard’s core infrastructure, vote on proposals, and acquire entry to new merchandise.

Jacob Phillips, Lombard’s co-founder, described the neighborhood sale as “an invite to over 260,000 LBTC holders and others within the Bitcoin ecosystem to assist form the way forward for bitcoin onchain.” Erick Zhang, founding father of Buidlpad who will host the sale, added that Lombard is “a pioneer unlocking bitcoin’s full potential as digital gold and a basis for next-gen capital markets.”