- XAU/USD climbs 0.40%, trades above $3,350 after Powell speech.

- Powell: “Draw back dangers to the labor market are rising,” opening door to a September price lower.

- Fed Chair Powell, stated that inflation dangers stay tilted to the upside, employment dangers to the draw back.

Gold worth rises because the Fed Chair Jerome Powell opens the door for a September price lower as he stated that “draw back dangers to the labor market are rising.” On the time of writing, the XAU/USD trades volatility, surpassing the $3,350 preliminary resistance, up by 0.40%.

Fed Chair highlights rising labor market dangers, balancing inflation considerations with employment softness

In his speech, Powell stated that “the baseline outlook and the shifting steadiness of dangers could warrant adjusting our coverage stance.” He added that “the soundness of the unemployment price and different labor market measures permits us to proceed rigorously.”

He stated that dangers on the labor market seem like in steadiness and stated that they’ve seen a “affordable base case” that tariffs would create a “one-time” rise in inflation, however it might take a while to be mirrored, as stated a day in the past by Cleveland Fed President Beth Hammack.

Powell stated that “dangers to inflation are tilted to the upside, and dangers to employment to the draw back—a difficult scenario.”

Gold worth response

XAU/USD has risen, nevertheless it stays shy of cracking final week’s excessive of $3,374. A breach of the latter will expose the $3,400, adopted by the June 16 excessive of $3,452, forward of the file excessive of $3,500. On the flipside, the $3,300 determine could be the primary demand zone.

Fed FAQs

Financial coverage within the US is formed by the Federal Reserve (Fed). The Fed has two mandates: to realize worth stability and foster full employment. Its main device to realize these targets is by adjusting rates of interest.

When costs are rising too rapidly and inflation is above the Fed’s 2% goal, it raises rates of interest, growing borrowing prices all through the financial system. This ends in a stronger US Greenback (USD) because it makes the US a extra engaging place for worldwide buyers to park their cash.

When inflation falls under 2% or the Unemployment Fee is simply too excessive, the Fed could decrease rates of interest to encourage borrowing, which weighs on the Dollar.

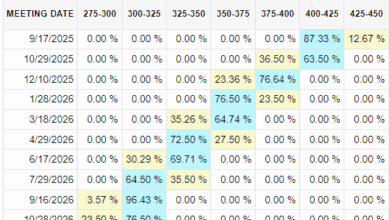

The Federal Reserve (Fed) holds eight coverage conferences a yr, the place the Federal Open Market Committee (FOMC) assesses financial situations and makes financial coverage selections.

The FOMC is attended by twelve Fed officers – the seven members of the Board of Governors, the president of the Federal Reserve Financial institution of New York, and 4 of the remaining eleven regional Reserve Financial institution presidents, who serve one-year phrases on a rotating foundation.

In excessive conditions, the Federal Reserve could resort to a coverage named Quantitative Easing (QE). QE is the method by which the Fed considerably will increase the circulate of credit score in a caught monetary system.

It’s a non-standard coverage measure used throughout crises or when inflation is extraordinarily low. It was the Fed’s weapon of alternative through the Nice Monetary Disaster in 2008. It includes the Fed printing extra {Dollars} and utilizing them to purchase excessive grade bonds from monetary establishments. QE often weakens the US Greenback.

Quantitative tightening (QT) is the reverse technique of QE, whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing, to buy new bonds. It’s often constructive for the worth of the US Greenback.