- USD/CAD drops 0.49% to 1.3835 after Powell’s dovish Jackson Gap speech and upbeat Canadian Retail Gross sales.

- Powell: “Dangers to inflation tilted to upside, dangers to employment to draw back — a difficult scenario.”

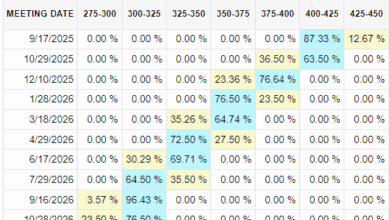

- Markets now value in 50 bps easing by year-end, with September reduce odds rising from 75% to 90%.

USD/CAD tumbles over 0.49% throughout the North American session as Fed Chair Jerome Powell leaned dovish and robust Canadian Retail Gross sales boosted the Loonie. On the time of writing, the pair trades at 1.3835 after hitting a day by day excessive of 1.3924.

Fed Chair’s remarks elevate charge reduce bets whereas sturdy Canada information boosts Loonie

On the Jackson Gap Symposium, the Fed Chair Jerome Powell acknowledged that “dangers to inflation are tilted to the upside, and dangers to the employment to the draw back—a difficult scenario.” He mentioned that tariffs might create a “one-time” impact in inflation and that it could take a while to be mirrored.

Regardless of reiterating the Fed’s dedication to the twin mandate, Powell mentioned that “draw back dangers to the labor market are rising” and that “the baseline outlook and the shifting stability of dangers might warrant adjusting our coverage stance.”

Throughout Powell’s speech, traders had totally priced in 50 foundation factors (bps) by year-end, and the possibilities of a September 25 bps reduce rose from 75% to 90%.

He added that “the soundness of the unemployment charge and different labor market measures permits us to proceed rigorously.”

In Canada, Retail Gross sales rose as anticipated in June, rebounding from a dip in Might. Gross sales elevated 1.5% MoM, up from a 1.2% MoM contraction a month in the past. Excluding autos, gross sales surged by 1.9% exceeding forecasts of 1.1%.

USD/CAD Value Forecast: Technical outlook

Regardless of retreating, the USD/CAD uptrend stays intact, until the pair dives beneath the August 7 low of 1.3721. However, to increase its losses, the pair should clear the 20-day SMA at 1.3801, adopted by the 100-day SMA at 1.3784.

Then again, if USD/CAD is about for a restoration, merchants should push the change charge above 1.3900, in order that they have an opportunity of difficult the 200-day SMA at 1.4033.

Canadian Greenback Value This week

The desk beneath reveals the share change of Canadian Greenback (CAD) towards listed main currencies this week. Canadian Greenback was the strongest towards the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.07% | 0.15% | -0.28% | 0.15% | 0.22% | 0.95% | -0.58% | |

| EUR | 0.07% | 0.20% | -0.24% | 0.21% | 0.29% | 0.99% | -0.51% | |

| GBP | -0.15% | -0.20% | -0.54% | 0.01% | 0.09% | 0.78% | -0.76% | |

| JPY | 0.28% | 0.24% | 0.54% | 0.46% | 0.54% | 1.27% | -0.29% | |

| CAD | -0.15% | -0.21% | -0.01% | -0.46% | 0.05% | 0.80% | -0.77% | |

| AUD | -0.22% | -0.29% | -0.09% | -0.54% | -0.05% | 0.69% | -0.86% | |

| NZD | -0.95% | -0.99% | -0.78% | -1.27% | -0.80% | -0.69% | -1.55% | |

| CHF | 0.58% | 0.51% | 0.76% | 0.29% | 0.77% | 0.86% | 1.55% |

The warmth map reveals share adjustments of main currencies towards one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, if you happen to choose the Canadian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will symbolize CAD (base)/USD (quote).