- NZD/USD is up practically 0.85% on Friday after briefly touching 0.5800, its lowest stage since April 11.

- Powell balanced tariff-driven inflation dangers with labor market weak spot, signaling financial coverage recalibration.

- Markets worth in a 90% likelihood of a September fee lower, up from 70% earlier within the week.

The New Zealand Greenback (NZD) strengthens in opposition to the US Greenback (USD) on Friday, with NZD/USD rebounding from its lowest stage since April 11 as merchants reacted to Federal Reserve (Fed) Chair Jerome Powell’s cautious remarks on the Jackson Gap Financial Symposium. On the time of writing, the pair is buying and selling close to 0.5860, recovering sharply from an intraday low of 0.5800.

Powell struck a cautious stability in his keynote, noting that whereas tariff-driven inflation pressures are doable, they’re unlikely to develop into entrenched given the rising draw back dangers to the labor market. He added that the slowdown in job progress has not created a big margin of slack, which the Fed needs to keep away from, signaling that policymakers stay attentive to dangers on either side of the mandate.

From a broader perspective, Powell additionally unveiled an up to date financial coverage framework, stripping references to the “shortfalls” language on employment and reinforcing the Fed’s flexibility in addressing evolving dangers.

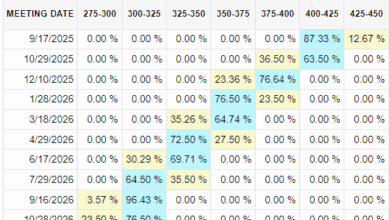

The remarks bolstered expectations that the Fed is making ready to recalibrate coverage, with markets sharply rising bets on a September fee lower. Based on the CME FedWatch Device, merchants now worth in a 90% likelihood of a 25 basis-point lower, up from round 70% earlier within the day. This repricing despatched US Treasury yields decrease and weighed closely on the US Greenback, permitting the Kiwi to stage a powerful rebound.

Danger sentiment additionally improved as Powell prevented sounding overly hawkish, triggering beneficial properties in equities and higher-beta currencies. For the New Zealand Greenback, the transfer comes after per week of heavy promoting stress tied to the Reserve Financial institution of New Zealand’s (RBNZ) dovish pivot and issues over slowing international progress.

From a technical perspective, NZD/USD is making an attempt to get well after hitting a four-month low earlier within the session. The pair now faces preliminary resistance on the 0.5900 psychological stage, adopted by the 50-day Easy Transferring Common (SMA) close to 0.5975. On the draw back, quick help is positioned at 0.5800, with a break under exposing the April 11 trough at 0.5729.

New Zealand Greenback Value As we speak

The desk under exhibits the share change of New Zealand Greenback (NZD) in opposition to listed main currencies right this moment. New Zealand Greenback was the strongest in opposition to the US Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.00% | -0.95% | -1.09% | -0.55% | -1.03% | -0.82% | -0.90% | |

| EUR | 1.00% | 0.08% | -0.12% | 0.47% | -0.08% | 0.19% | 0.11% | |

| GBP | 0.95% | -0.08% | -0.22% | 0.39% | -0.16% | 0.14% | 0.04% | |

| JPY | 1.09% | 0.12% | 0.22% | 0.55% | 0.08% | 0.23% | 0.16% | |

| CAD | 0.55% | -0.47% | -0.39% | -0.55% | -0.54% | -0.26% | -0.35% | |

| AUD | 1.03% | 0.08% | 0.16% | -0.08% | 0.54% | 0.29% | 0.20% | |

| NZD | 0.82% | -0.19% | -0.14% | -0.23% | 0.26% | -0.29% | -0.09% | |

| CHF | 0.90% | -0.11% | -0.04% | -0.16% | 0.35% | -0.20% | 0.09% |

The warmth map exhibits proportion modifications of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, in case you decide the New Zealand Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will signify NZD (base)/USD (quote).