- The Dow Jones shattered value data on Friday, hitting above 45,700 for the primary time ever.

- Equities and basic threat urge for food soared after Fed Chair Powell made a dovish look.

- A September charge lower appears to be like like a positive factor, bolstering basic market sentiment.

The Dow Jones Industrial Common (DJIA) soared to new all-time highs on Friday, testing above 45,700 for the primary time for the reason that index’s inception. The Dow Jones soared over 900 factors in a single day as traders piled ferociously again into bullish bets, as a September rate of interest lower appears to be like to be within the bag.

The Dow Jones is as soon as once more testing frontier territory, exploring chart areas north of 45,500. It has been 9 months for the reason that Dow posted a file month-to-month excessive, and so long as the wheels keep on the cart, August might show to be among the finest months of 2025. The Dow Jones is up over 3.4% from August’s opening bids, and is up virtually 25% from the early April tariff plunge that landed close to 36,615.

Powell opens the door to charge cuts

Jerome Powell delivered surprisingly dovish remarks on Friday on the annual Jackson Gap financial symposium, hosted by the Federal Reserve (Fed) Financial institution of Kansas. Powell acknowledged that, regardless of the Fed’s total cautious stance on rates of interest, coverage adjustment could also be wanted as draw back dangers develop.

“With coverage in restrictive territory, the baseline outlook and the shifting stability of dangers could warrant adjusting our coverage stance.”

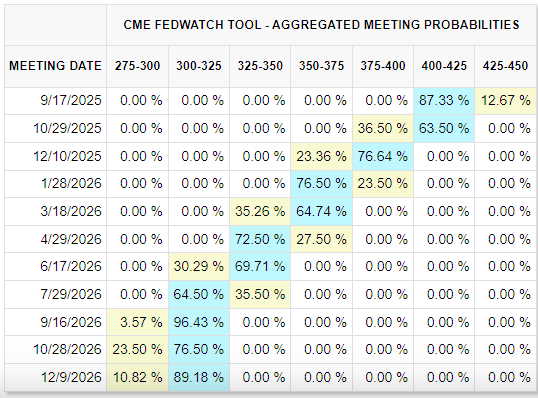

Whereas Fed Chair Powell didn’t outright say whether or not or not he endorsed fast rate of interest motion, his feedback have been sufficient to ship markets full-tilt into bets of an rate of interest lower on September 17, and equities piling into file highs. In keeping with the CME’s FedWatch Instrument, charge markets at the moment are pricing in round 90% odds of not less than a quarter-point charge trim in September, up from ~70% simply the day earlier than.

A follow-up rate of interest lower in October stays unlikely, given the final unease Fed officers seem to have towards charge cuts. Nonetheless, markets nonetheless have one other charge trim chalked in for December.

Regardless of dovish Fed tones, key information dangers stay

Some key roadblocks on the trail to charge cuts nonetheless exist, nonetheless. Regardless of a gradual unemployment charge and softening labor figures, each of which lend themselves to supporting rate of interest cuts, US inflation stays a sticky affair, and there will probably be a number of iterations of key inflation information touchdown in markets’ laps earlier than the Fed’s subsequent rate of interest resolution.

The most recent spherical of core Private Consumption Expenditure Value Index (PCE) inflation information is predicted to be launched subsequent week, one of many Fed’s key inflation metrics. Though inflation has definitely cooled from its post-pandemic highs, PCE inflation has not dipped under 2.6% since April of 2021. The higher certain of the Fed’s inflation goal sits at 2.0%, effectively under the present figures. Any contemporary sparks in inflation information might knock again the Fed’s willingness to discover rate of interest cuts subsequent month.

Dow Jones 5-minute chart

Dow Jones each day chart

Financial Indicator

Core Private Consumption Expenditures – Value Index (YoY)

The Core Private Consumption Expenditures (PCE), launched by the US Bureau of Financial Evaluation on a month-to-month foundation, measures the modifications within the costs of products and companies bought by shoppers in america (US). The PCE Value Index can be the Federal Reserve’s (Fed) most popular gauge of inflation. The YoY studying compares the costs of products within the reference month to the identical month a 12 months earlier. The core studying excludes the so-called extra unstable meals and vitality parts to offer a extra correct measurement of value pressures.” Typically, a excessive studying is bullish for the US Greenback (USD), whereas a low studying is bearish.

Learn extra.