- Gold costs rallied sharply after Powell’s dovish tone highlighted employment dangers regardless of persistent upside dangers to inflation.

- Merchants priced in a 90% likelihood of a 25 basis-point Fed reduce, with key information nonetheless forward earlier than September.

- Subsequent week’s US docket contains Sturdy Items, GDP, and the Fed’s most popular inflation gauge, the Core PCE Value Index.

Gold costs proceed to development larger on Friday after the Federal Reserve (Fed) leaned dovish, as commented by the Fed Chair Jerome Powell, who stated that “draw back dangers to the labor market are rising.” XAU/USD trades at $3,371 after hitting a each day low of $3,321.

The day arrived and Powell hinted that there’s a “cheap base case” to suppose that tariffs would create a “one-time” improve in costs. Nonetheless, he acknowledged that dangers to inflation are tilted to the upside and dangers to employment to the draw back, a “difficult scenario.”

After his remarks, Bullion costs initially soared in the direction of the $3,350 space earlier than resuming to the upside, heading to a each day excessive of $3,378 earlier than retreating considerably to present value ranges.

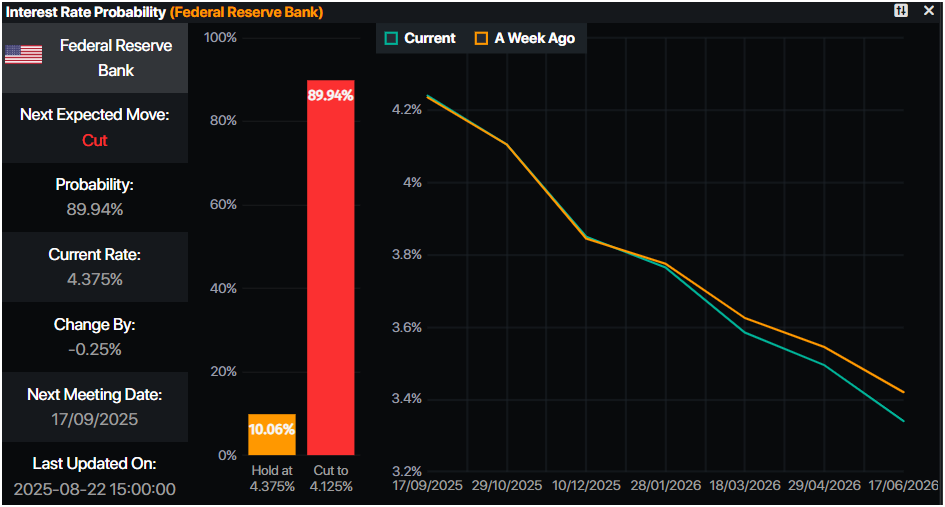

Market members had priced in a 90% likelihood that the Federal Reserve will reduce 25 foundation factors (bps) from its foremost reference fee, in response to Prime Market Terminal. Nonetheless, there are two inflation prints left and the next Nonfarm Payrolls report on September 5.

Supply: Prime Market Terminal

After Powell’s speech, Cleveland Fed President Beth Hammack stated that she heard that Powell is open-minded concerning the coverage outlook, and she or he reiterated her stance to get inflation again to focus on.

Subsequent week, the US financial docket will characteristic Fed speeches, Sturdy Items Orders, CB Shopper Confidence, GDP figures, Preliminary Jobless Claims, and the Fed’s most popular inflation gauge measure, the Core Private Consumption Expenditures (PCE) Value Index.

Day by day digest market movers: Gold boosted by hypothesis of September fee reduce

- Following Powell’s remarks, US Treasury yields tumbled, flattening the yield curve. The ten-year Treasury be aware is down almost seven foundation factors at 4.261%. US actual yields —that are calculated from the nominal yield minus inflation expectations— are down seven bps at 1.871% on the time of writing.

- The US Greenback Index (DXY), which tracks the efficiency of the USD towards a basket of six currencies, drops greater than 1% to 97.55.

- Fed Chair Powell stated, “The baseline outlook and the shifting stability of dangers might warrant adjusting our coverage stance.” He added that “the steadiness of the unemployment fee and different labor market measures permits us to proceed rigorously.”

- Cleveland’s Fed Beth Hammack added that the Fed is a small distance away from the impartial fee and that the “Fed must be cautious about any transfer to chop charges.” She expects an increase in inflation and within the unemployment fee.

Technical outlook: Gold value surges in the direction of $3,400

Gold value has risen sharply, nevertheless it stays shy of testing the $3,400 mark. Bulls emerged on Powell’s remarks however stay cautious as geopolitical danger had de-escalated following upbeat information initially of the week, relating to Russia and Ukraine.

If XAU/USD climbs previous $3,400, the subsequent resistance could be the June 16 excessive of $3,452, forward of the report excessive of $3,500. On the flipside, the $3,300 determine could be the primary demand zone.

Conversely, if Bullion retraces, it might halt its cease on the 50-day Easy Transferring Common (SMA) at round $3,350. On additional weak spot, the 20-day SMA at $3,345 is up subsequent, adopted by the 100-day SMA at $3,309.

Fed FAQs

Financial coverage within the US is formed by the Federal Reserve (Fed). The Fed has two mandates: to realize value stability and foster full employment. Its major instrument to realize these objectives is by adjusting rates of interest.

When costs are rising too rapidly and inflation is above the Fed’s 2% goal, it raises rates of interest, growing borrowing prices all through the economic system. This ends in a stronger US Greenback (USD) because it makes the US a extra enticing place for worldwide buyers to park their cash.

When inflation falls beneath 2% or the Unemployment Fee is simply too excessive, the Fed might decrease rates of interest to encourage borrowing, which weighs on the Buck.

The Federal Reserve (Fed) holds eight coverage conferences a yr, the place the Federal Open Market Committee (FOMC) assesses financial circumstances and makes financial coverage choices.

The FOMC is attended by twelve Fed officers – the seven members of the Board of Governors, the president of the Federal Reserve Financial institution of New York, and 4 of the remaining eleven regional Reserve Financial institution presidents, who serve one-year phrases on a rotating foundation.

In excessive conditions, the Federal Reserve might resort to a coverage named Quantitative Easing (QE). QE is the method by which the Fed considerably will increase the move of credit score in a caught monetary system.

It’s a non-standard coverage measure used throughout crises or when inflation is extraordinarily low. It was the Fed’s weapon of selection in the course of the Nice Monetary Disaster in 2008. It entails the Fed printing extra {Dollars} and utilizing them to purchase excessive grade bonds from monetary establishments. QE normally weakens the US Greenback.

Quantitative tightening (QT) is the reverse technique of QE, whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing, to buy new bonds. It’s normally optimistic for the worth of the US Greenback.