Trish Turner has resigned as head of america Inner Income Service’s (IRS) digital property division after roughly three months within the position.

“After greater than 20 years with the IRS, I’ve closed a rare chapter of my profession with deep appreciation for many who formed my journey and made the work so significant,” Turner stated in a LinkedIn publish on Friday.

“Collectively, we navigated complicated challenges, constructed lasting applications, and laid the groundwork for the IRS’s digital asset technique because it shifted from area of interest to mainstream,” Turner added.

Turner is reportedly transferring to the personal sector

Turner didn’t say in her publish the place she’s going to go subsequent, however defined she seems to be “ahead to persevering with this mission from a brand new vantage level and to constructing bridges between business and regulators.”

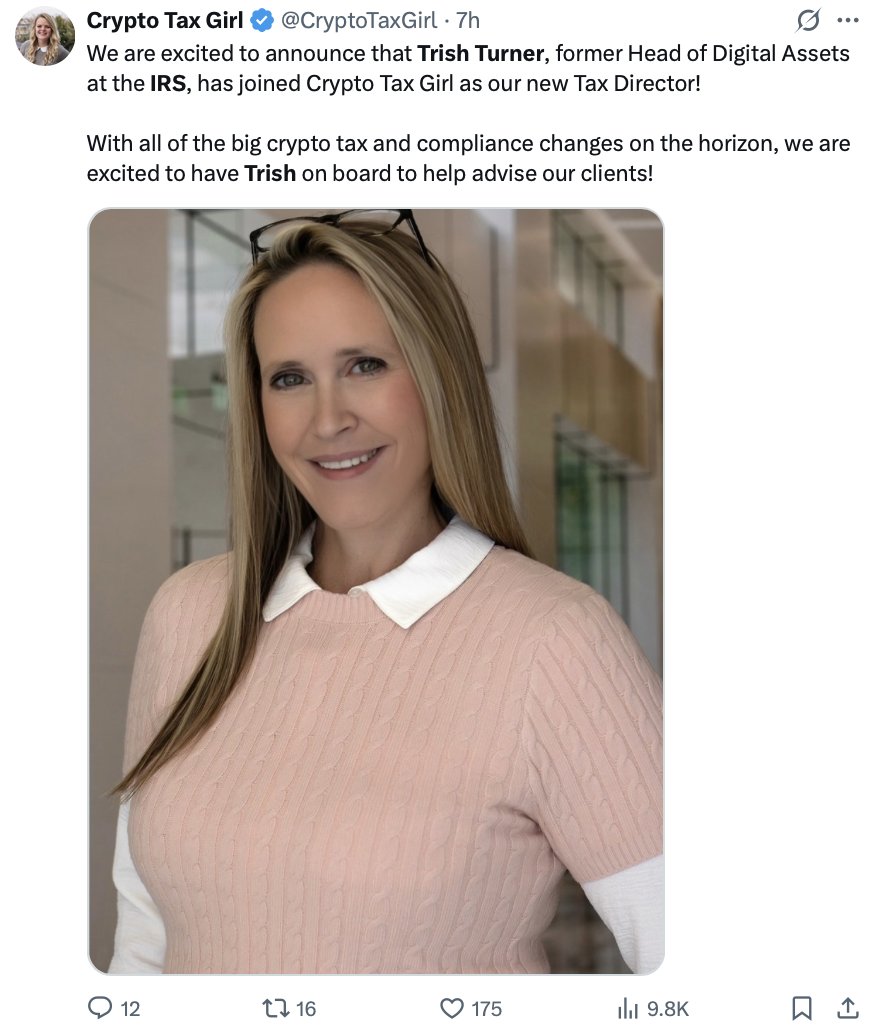

Bloomberg Tax reported on Friday that Turner informed the publication throughout an interview that she’s going to turn into the tax director on the crypto tax agency Crypto Tax Lady. On the identical day, Crypto Tax Lady founder Laura Walter stated in a LinkedIn publish that Turner will be part of the agency.

“With the entire large crypto tax and compliance adjustments on the horizon, we’re excited to have Trish on board to assist advise our purchasers,” Walter stated.

Turner’s resignation comes simply over three months after she was tapped to guide the digital asset’s division in Might, after Sulolit “Raj” Mukherjee and Seth Wilks, two private-sector specialists introduced in to guide the IRS’s crypto unit, exited after roughly a yr of their roles.

Economist Timothy Peterson commented on the announcement, saying, “Trish Turner left the Darkish Aspect to turn into a Crypto Jedi Knight.”

Crypto tax has turn into a key focus within the US

It follows the Division of Authorities Effectivity (DOGE) proposal in March to chop the IRS workforce by 20% and several other latest developments round US crypto taxation.

Associated: 5 nations the place crypto is (surprisingly) tax-free in 2025

On July 11, Cointelegraph reported that the Home Committee on Methods and Means and Oversight Subcommittee management stated they’d scheduled a July listening to to deal with “affirmative steps wanted to position a tax coverage framework on digital property.”

Simply days earlier than, on July 4, the US Treasury Inspector Normal for Tax Administration really helpful reforms to the IRS legal investigation division’s dealing with of digital property, citing repeated failures to comply with established protocols.

In the meantime, on April 11, US President Donald Trump signed a joint congressional decision overturning a Biden administration-era rule that might have required decentralized finance (DeFi) protocols to report transactions to the IRS.

Cointelegraph reached out to Trish Turner for remark however didn’t obtain a response by the point of publication.

Journal: Bitcoin’s long-term safety price range downside: Impending disaster or FUD?