Trish Turner has resigned as head of america Inner Income Service’s (IRS) digital property division after roughly three months within the position.

“After greater than 20 years with the IRS, I’ve closed a rare chapter of my profession with deep appreciation for individuals who formed my journey and made the work so significant,” Turner stated in a LinkedIn submit on Friday.

“Collectively, we navigated advanced challenges, constructed lasting packages, and laid the groundwork for the IRS’s digital asset technique because it shifted from area of interest to mainstream,” Turner added.

Turner is reportedly transferring to the personal sector

Turner didn’t say in her submit the place she is going to go subsequent, however defined she appears “ahead to persevering with this mission from a brand new vantage level and to constructing bridges between trade and regulators.”

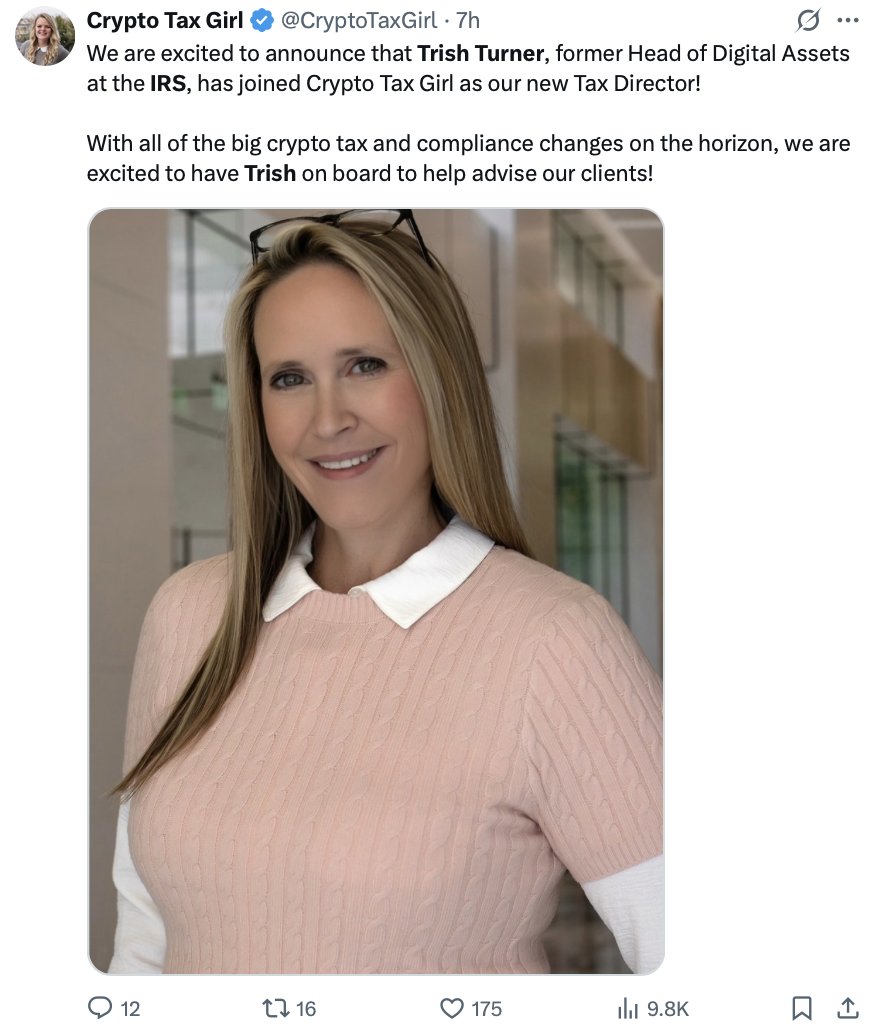

Bloomberg Tax reported on Friday that Turner advised the publication throughout an interview that she is going to turn into the tax director on the crypto tax agency Crypto Tax Woman. On the identical day, Crypto Tax Woman founder Laura Walter stated in a LinkedIn submit that Turner will be a part of the agency.

“With all the massive crypto tax and compliance modifications on the horizon, we’re excited to have Trish on board to assist advise our purchasers,” Walter stated.

Turner’s resignation comes simply over three months after she was tapped to steer the digital asset’s division in Could, after Sulolit “Raj” Mukherjee and Seth Wilks, two private-sector consultants introduced in to steer the IRS’s crypto unit, exited after roughly a 12 months of their roles.

Economist Timothy Peterson commented on the announcement, saying, “Trish Turner left the Darkish Aspect to turn into a Crypto Jedi Knight.”

Crypto tax has turn into a key focus within the US

It follows the Division of Authorities Effectivity (DOGE) proposal in March to chop the IRS workforce by 20% and a number of other latest developments round US crypto taxation.

Associated: 5 nations the place crypto is (surprisingly) tax-free in 2025

On July 11, Cointelegraph reported that the Home Committee on Methods and Means and Oversight Subcommittee management stated that they had scheduled a July listening to to deal with “affirmative steps wanted to put a tax coverage framework on digital property.”

Simply days earlier than, on July 4, the US Treasury Inspector Basic for Tax Administration really helpful reforms to the IRS legal investigation division’s dealing with of digital property, citing repeated failures to observe established protocols.

In the meantime, on April 11, US President Donald Trump signed a joint congressional decision overturning a Biden administration-era rule that will have required decentralized finance (DeFi) protocols to report transactions to the IRS.

Cointelegraph reached out to Trish Turner for remark however didn’t obtain a response by the point of publication.

Journal: Bitcoin’s long-term safety funds drawback: Impending disaster or FUD?