Bitcoin Information At present: Ether (ETH) More likely to High $5K, BTC Eyes File Excessive as Powell Sparks Rally; Look ahead to DAT Deal Dangers: Asset Managers

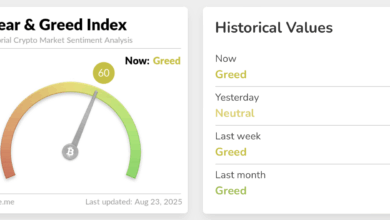

Cryptocurrencies surged late Friday after Federal Reserve President Jerome Powell struck a dovish tone on the Jackson Gap financial symposium, defying market expectations for a extra hawkish stance. That has prompted asset managers to name for brand new all-time highs for bitcoin , ether (ETH) and choose altcoins.

What Powell mentioned?

In one in every of his most essential speeches, Powell steered that the labor market may gain advantage from decrease borrowing prices, having held the benchmark rate of interest regular at 4.25% for eight months.

“Draw back dangers to employment are rising,” Powell mentioned in ready remarks for his keynote speech on the Jackson Gap Symposium, including that the potential of President Donald Trump’s tariffs having solely a short-lived impact on inflation is “affordable.”

“With coverage in restrictive territory, the baseline outlook and the shifting steadiness of dangers might warrant adjusting our coverage stance,” he famous.

Cryptocurrencies and shares soared, and the chance of the September Fed charge minimize jumped to 90% following the speech. Most analysts count on the momentum to proceed within the days forward.

Analysts see new highs for BTC and ETH above $5K

Analysts at Monarq Asset Administration anticipate that ether’s worth will rise above $5,000 within the coming days.

“We keep our general bullish stance. Market internals stay constructive, with few indicators of overheating and, as you level out, a transparent path to new all-time highs in each BTC and ETH,” Sam Gaer, chief funding officer of Monarq Asset Administration’s Directional Fund, informed CoinDesk.

“Our home view is that Powell’s dovish pivot has cleared the best way for $5,000+ within the close to time period (additionally not the toughest name to make). Demand from treasury automobiles ought to improve into the autumn as lots of the offers introduced this summer season shut or de-SPAC, along with ongoing institutional and retail inflows,” Gaer added.

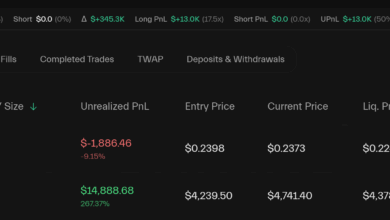

Ethereum’s native token ether has already gained practically 10% in 24 hours, hitting report highs above $4,800. As of writing, it modified palms at $4,700, based on CoinDesk information. In the meantime, market chief bitcoin traded close to $115,600, barely down from the in a single day excessive of $117,400.

Knowledge from Deribit-listed choices exhibits that ether’s rally has sparked renewed demand for upside bets, or name choices. At press time, danger reversals had been constructive throughout all tenors, implying relative richness of calls. The sentiment wasn’t so bullish in BTC choices.

Gaer said that over-the-counter desks and market makers are experiencing stronger demand for ETH in comparison with BTC, suggesting that ether might outperform forward.

That mentioned, BTC appeared robust by itself too. “The BTC pullback from ATH was ~9.6%—far lower than earlier drawdowns this 12 months—indicating robust demand, as evidenced by whale pockets accumulation across the $113k stage,” Gaer mentioned.

Spencer Yang, managing associate at BlockSpaceForce, a crypto treasury advisory agency, mentioned extra charge cuts might occur after September, guaranteeing the momentum extends effectively into the year-end.

“We’re now totally anticipating charge cuts to occur in September. It will likely be the primary minimize since Trump grew to become President this 12 months. That is vital, and plenty of extra will come,” Yang mentioned, calling new highs within the crypto market.

“The most important 5 that we take note of: BTC, ETH, BNB, SOL, LINK. These will do effectively given the assorted components of the crypto business they influence,” Yang added.

Give attention to ETF flows

Steve Lee, co-founder and managing associate at Neoclassic Capital and investor in BlockTower Capital, referred to as Powell’s dovish flip a short-term constructive growth for cryptocurrencies whereas stressing the significance of continued inflows into bitcoin and ether spot ETFs.

“I see this as constructive within the brief time period, and it could assist reverse this week’s sell-off. The important thing query is whether or not this momentum holds past the low-liquidity weekend. Since BTC and ETH worth motion is more and more institutionally pushed, spot ETF flows at this time and Monday might be a robust indicator of whether or not we’re set for an additional leg greater,” Lee informed CoinDesk.

Lee highlighted Base, Monad, Story, and SUI as key initiatives of curiosity that he’s carefully monitoring in his capability as an early-stage enterprise capitalist.

Gaer, in the meantime, favored Solana and the SOL ecosystem, together with high-beta SOL tokens corresponding to JITO and JUP. Raydium and PUMP on each a “basic and forward-demand foundation.”

Potential headwinds

Whereas Powell’s dovish stance has set the stage for a rally, merchants ought to stay cautious about potential pitfalls from company treasury cryptocurrency adoption and volatility in fairness markets.

“Digital asset treasuries (DAT) are an revolutionary automobile for public market buyers to realize publicity to the digital asset house. Nonetheless, we’ve got began to see the standard of DAT offers – from banking relationships, compliance, administration crew, and deal construction views — dropping, which exhibits early indicators of a ‘bubble,” Lee mentioned.

Naqsdaq-listed Technique began this pattern of company BTC adoption in 2020. Since then, greater than 100 publicly-listed companies have amassed a complete of 984,971 BTC, based on information supply Bitcoin Treasuries.

“The pattern might proceed, however it’s apparent that the dangers related to this aren’t ignorable,” Lee added.

Gaer referred to as for carefully monitoring dangers from an overheated fairness market and “potential for macro or geopolitical shocks.”