Key takeaways:

-

Ethereum community exercise surged by 63% in 30 days, strengthening the case for an imminent breakout to $5,000.

-

Ether futures open curiosity jumped to $69 billion, highlighting sturdy demand for leveraged publicity.

Ether (ETH) rallied to its highest stage in almost 4 years on Friday, sparking $351 million in liquidations from leveraged bearish bets. The surge got here after traders priced in a much less restrictive financial coverage in the USA, following remarks from US Federal Reserve Chair Jerome Powell. Will this momentum lastly push ETH past the $5,000 barrier?

Nasdaq rally indicators renewed urge for food for ETH and threat property

The tech-heavy Nasdaq Index climbed 1.8%, suggesting traders are shedding threat aversion and reallocating away from fixed-income positions. Ether has already gained 33% over the previous 30 days, and three indicators now level to additional power, doubtlessly solidifying the continued bull run. With ETH buying and selling above $4,800, a breakout to new all-time highs could possibly be minutes or days away.

Powell’s feedback on the Jackson Gap Financial Symposium amplified expectations of a number of price cuts: “The baseline outlook and the shifting steadiness of dangers could warrant adjusting our coverage stance.” In keeping with the CME FedWatch device, bond markets are pricing in a forty five% likelihood of charges falling to three.5% or under by March 2026, up from 37% the earlier week. Decrease borrowing prices ease monetary pressures on firms, broadly lowering systemic dangers.

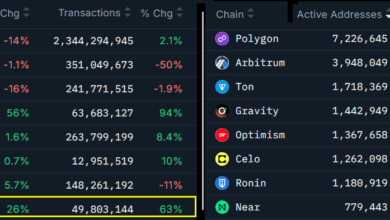

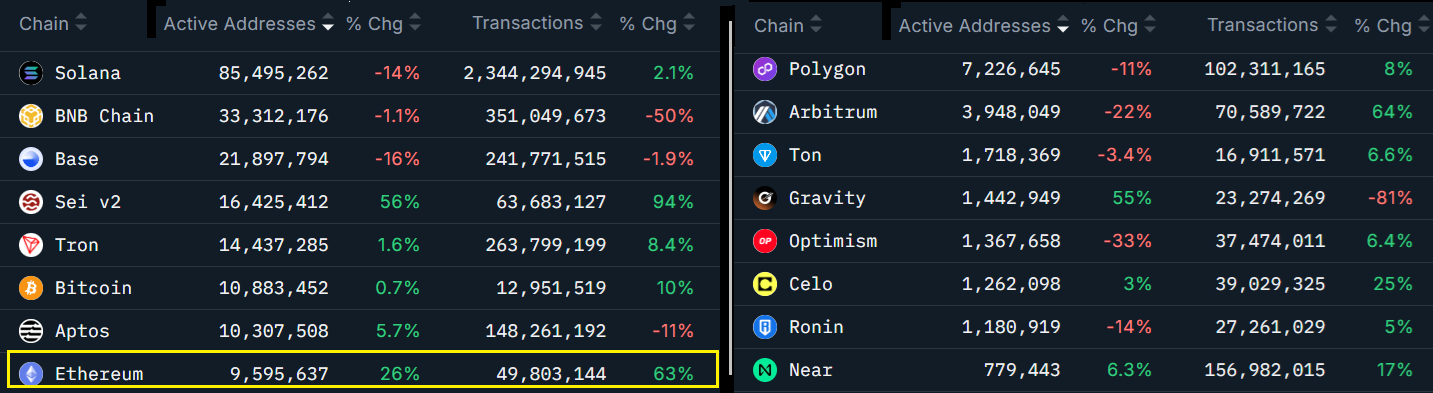

Ether can be drawing power from surging onchain exercise. Transactions on the Ethereum community jumped 63% prior to now 30 days, whereas lively addresses rose 26%. For comparability, Solana managed only a 2% enhance in transactions, with lively addresses declining by 14%, in line with Nansen information. In the meantime, BNB Chain posted a steep 50% drop in transaction depend.

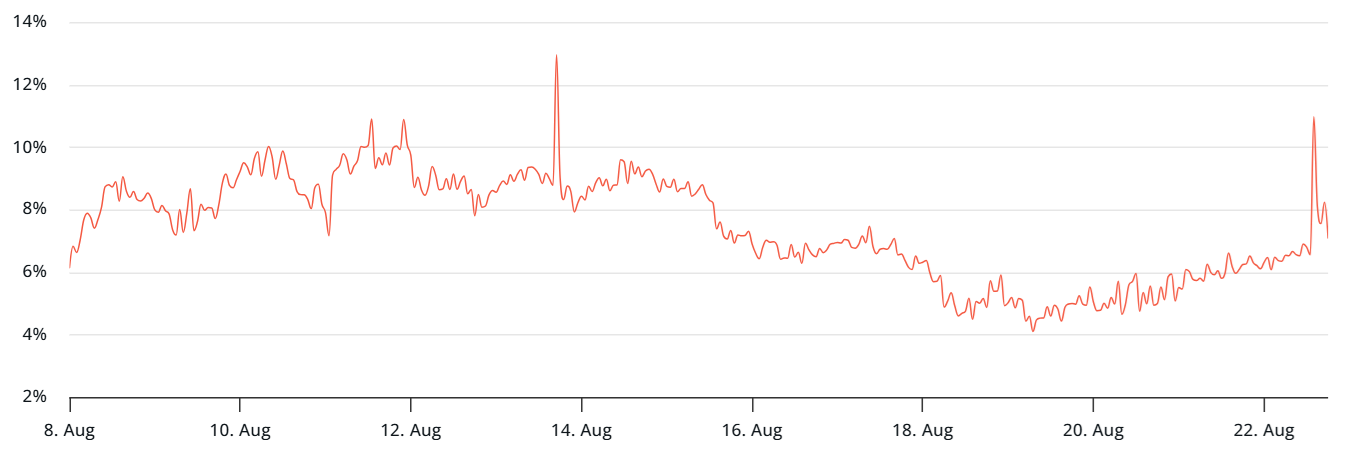

Whereas onchain metrics spotlight rising exercise, futures markets reveal a extra cautious stance. ETH futures contracts sometimes commerce at a 5% to 10% annualized premium over spot costs to account for settlement delays. At current, the month-to-month futures premium stands at 7%, up from a bearish 4% earlier within the week.

A part of this hesitation stems from comparisons with opponents. Each BNB (BNB) and Tron (TRX) are buying and selling nicely above their November 2021 all-time highs, whereas ETH continues to wrestle under its $4,868 peak. This hole underscores why some merchants stay much less enthusiastic, even amid robust community fundamentals.

Associated: BlackRock leads $287M spot Ether ETF inflows after 4-day outflow streak

Wholesome ETH futures metrics reinforce the rally

In keeping with X person JA_Maartun, futures patrons haven’t proven this stage of aggressiveness in additional than a month. Analytics agency CryptoQuant tracks these dynamics by measuring the amount of purchase orders crammed towards sellers with pending provides, a sign of rising conviction.

Regardless of latest liquidations of bearish positions, mixture open curiosity on Ether futures stays sturdy at 14.4 million ETH, unchanged from the prior week. In greenback phrases, leveraged ETH bets stand at a powerful $69 billion, reflecting regular demand for publicity.

This mixture of elevated futures premiums, resilient open curiosity, and booming onchain exercise strengthens the case for a breakout, suggesting the $5,000 milestone might arrive before many merchants anticipate.

This text is for basic info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.