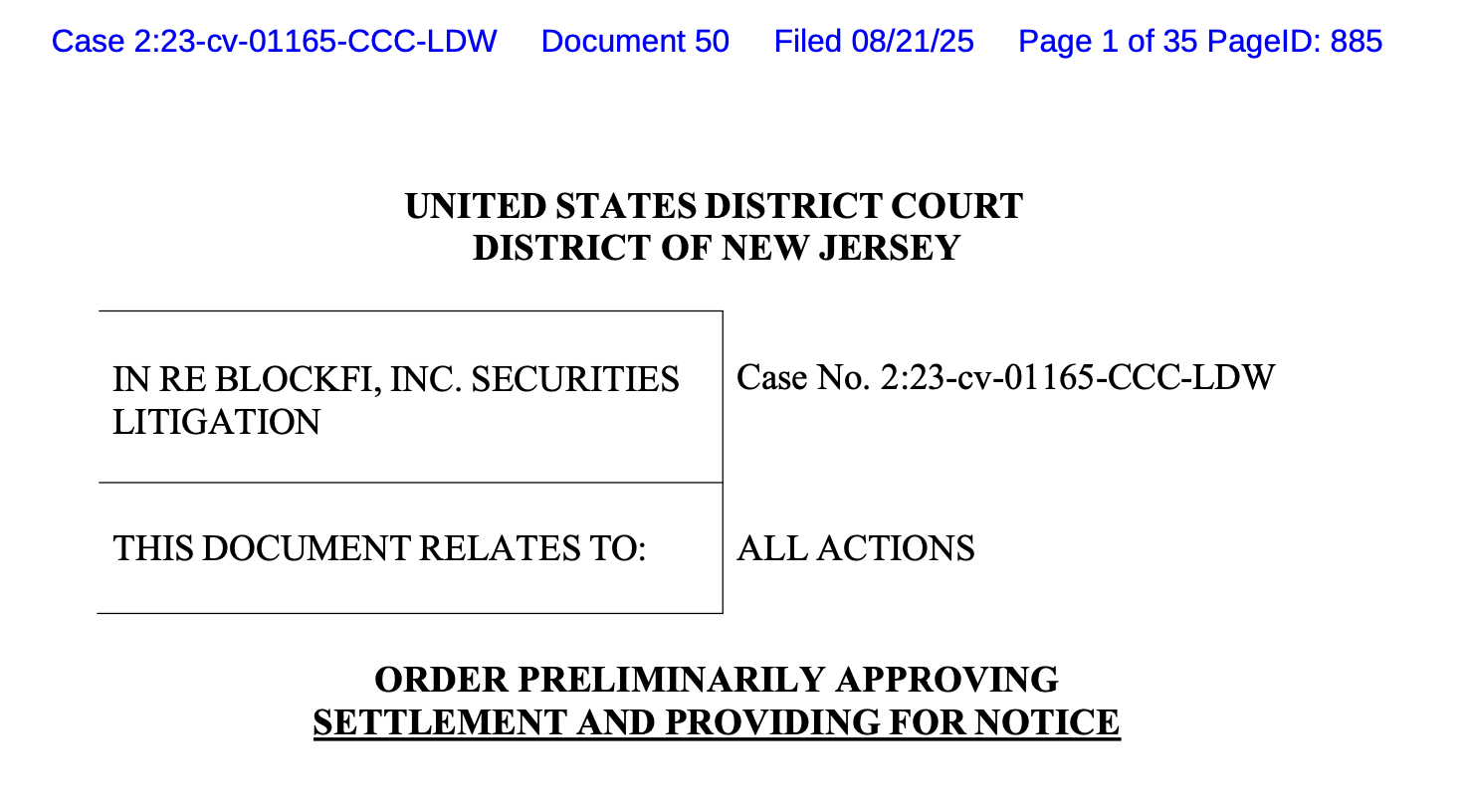

A New Jersey choose has given preliminary approval for a $13-million settlement between a bunch of buyers and cryptocurrency lending firm BlockFi after months of delays.

In a Thursday submitting within the US District Court docket for the District of New Jersey, Decide Claire Cecchi ordered BlockFi’s insurers to pay greater than $13 million to an escrow account inside 30 days as a part of a class-action lawsuit filed in 2023. The order adopted a February movement for preliminary approval, which was held up partly on account of an objection from one investor.

The choose scheduled a Dec. 11 listening to to find out remaining approval of the settlement plan and focus on any objections from events to the lawsuit. About 89,000 customers who held curiosity accounts on the firm from March 2019 till its chapter in November 2022 had been eligible for distributions underneath the settlement.

The lawsuit, filed following the chapter of BlockFi in 2022, got here amid a cryptocurrency market downturn doubtless precipitated by the collapse of the Terra ecosystem. A number of high-profile firms filed for chapter, together with FTX, Celsius Community, and Voyager Digital.

Associated: BlockFi chapter administrator and DOJ comply with dismiss $35M lawsuit

The preliminary grievance in opposition to BlockFi was filed by Trey Greene, representing a bunch of buyers. They alleged the corporate bought unregistered securities “through a gentle stream of misrepresentations and materials omissions” from then-CEO Zac Prince, chief working officer Flori Marquez, and Gemini Buying and selling.

Chapter court docket filings alleged Prince disregarded suggestions from BlockFi’s danger administration workforce over lending belongings to Alameda Analysis, doubtlessly contributing to the corporate’s collapse.

Nonetheless in chapter proceedings

Along with the class-action lawsuit, BlockFi has taken steps to return customers’ crypto holdings. A chapter court docket accepted the corporate’s Chapter 11 plan in September 2023 to repay over 10,000 collectors, and BlockFi reached an $875-million settlement with FTX and Alameda Analysis to resolve claims.

“The BlockFi Property is working to make ALL remaining distributions,” mentioned the corporate in an April 2 X publish, including: “There are nonetheless important quantities of USD and crypto that haven’t been claimed by prospects.”

Journal: Can privateness survive in US crypto coverage after Roman Storm’s conviction?