Key takeaways:

-

ETH surged 13% on Friday after Federal Reserve Chair Jerome Powell’s dovish Jackson Gap speech hinted at an rate of interest minimize in September.

-

Onchain and technical indicators sign Ether’s potential to hit $6,000 within the brief time period.

Ether’s (ETH) worth displayed power on the Wall Avenue open on Friday, rising 13% to $4,788 following Federal Reserve Chair Jerome Powell’s Jackson Gap speech.

ETH worth rallied from $4,200 inside minutes, reclaiming $4,600, a degree that has suppressed the worth over the past seven days, per knowledge from Cointelegraph Markets Professional and TradingView.

This efficiency follows Powell’s Jackson Gap speech, the place he hinted at a possible rate of interest minimize in September, signaling a dovish stance that boosted market optimism.

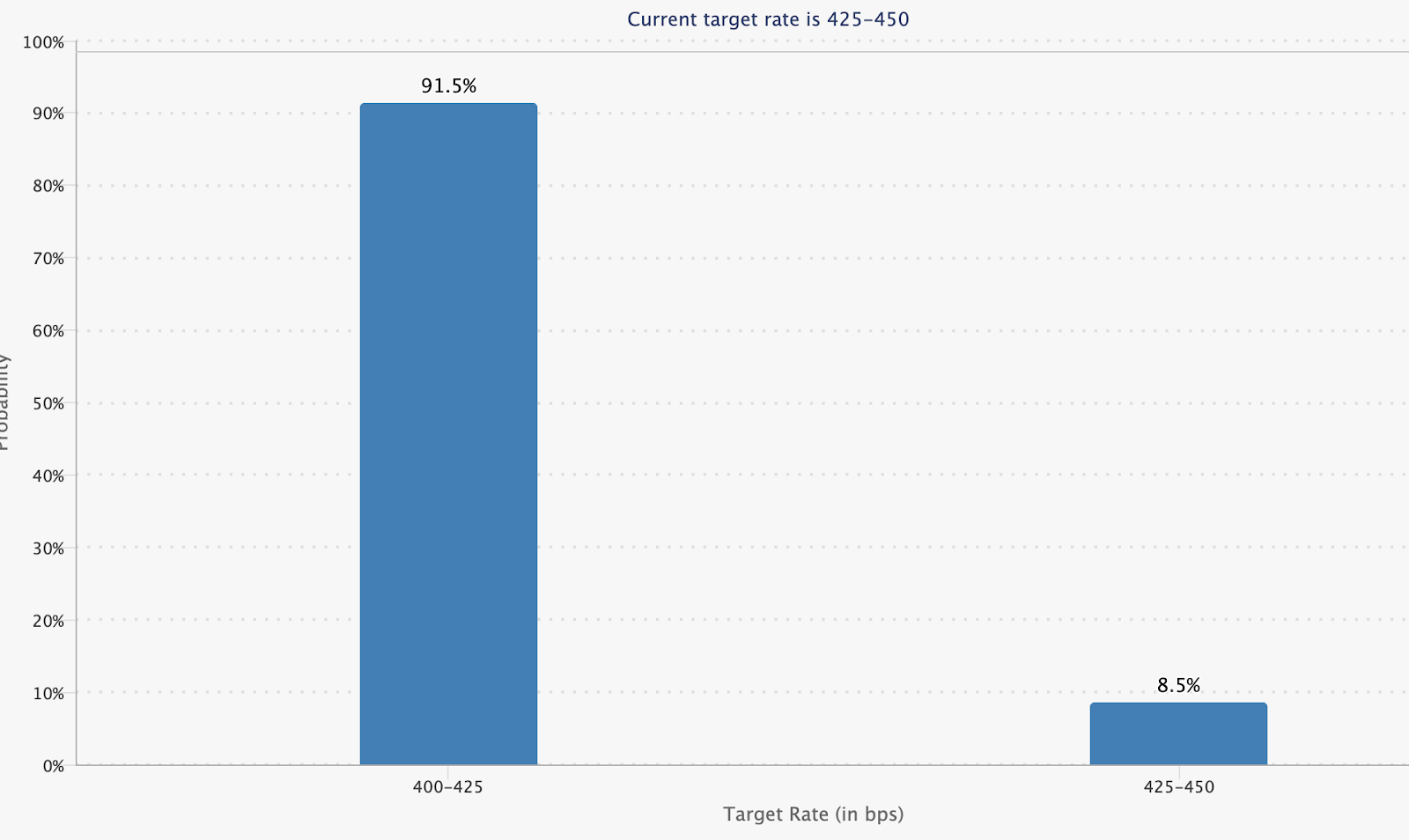

Rate of interest minimize odds for the Sept. 17 FOMC assembly have now jumped to 91.5% from 75% a day prior, in line with the CME Group Fedwatch device.

This provides to the encouraging bullish sentiment that might doubtlessly drive ETH to new highs.

ETH crosses $4,600 with a “god candle,” stated analyst Elisa in response to Ether’s response, including:

A number of bullish indicators counsel that ETH is well-positioned to interrupt out towards recent all-time highs within the following days or perhaps weeks.

Continued spot ETF inflows again ETH worth upside

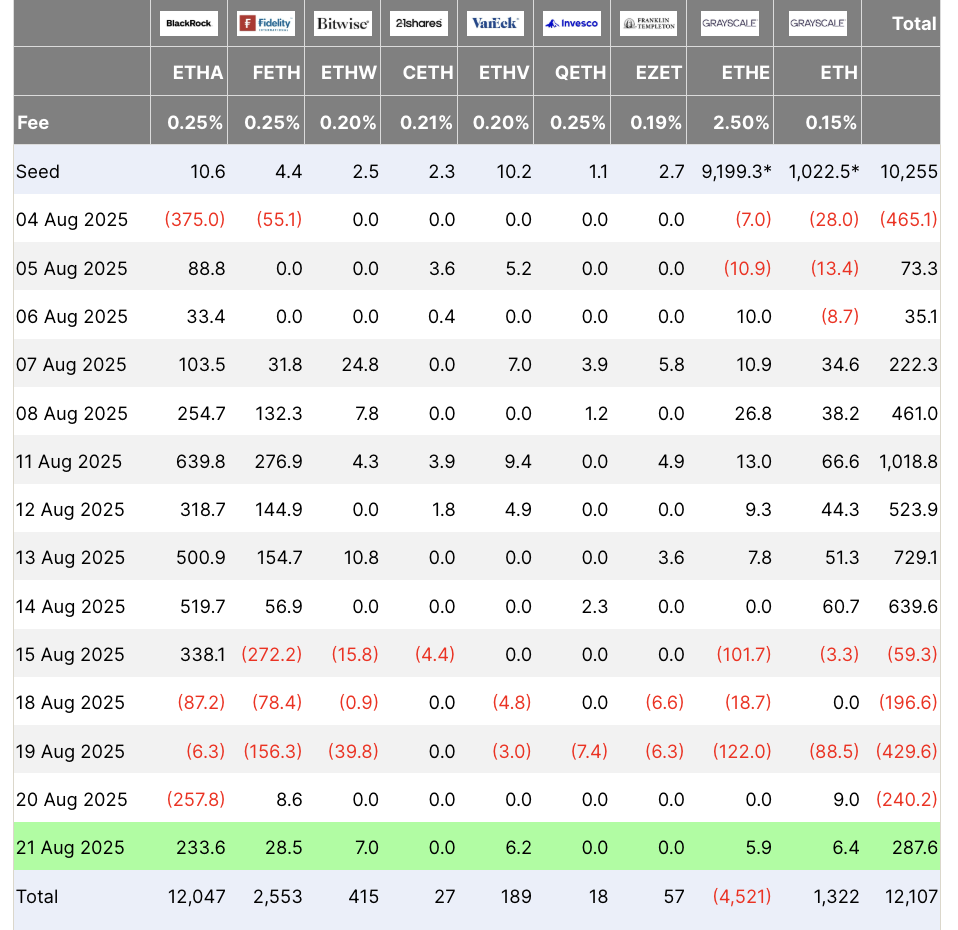

One issue supporting Ether’s bull argument is persistent institutional demand, mirrored by important inflows into spot Ethereum exchange-traded funds (ETFs).

Spot Ether ETFs noticed $287.6 million in inflows on Aug. 21, breaking a four-day outflow streak. These funding merchandise have seen web inflows totaling $2.55 billion month-to-date as per knowledge from Farside Buyers.

As Cointelegraph reported, Ether continued dominating world exchange-traded merchandise (ETPs) final week, with inflows totaling $2.9 billion, marking rising investor urge for food for the altcoin ETPs.

Associated: EU exploring Ethereum, Solana for digital euro launch: FT

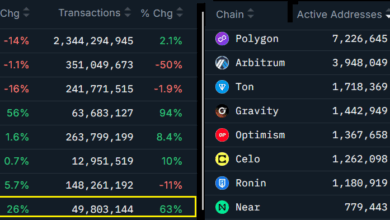

Alternate provide plummets

ETH balances on exchanges have dropped to nine-year lows, falling to 14.9 million ETH for the primary time since July 2016, Glassnode knowledge exhibits.

The full stability between inflows and outflows out and in of all recognized alternate wallets exhibits a steep decline since October 2023, when withdrawals from the buying and selling platforms started to surge. This drop accompanies a 180% rise in Ether’s worth over the identical time interval.

Decreasing Ether provide on exchanges could sign an incoming worth rally fueled by a “provide scarcity,” which happens when robust purchaser demand meets lowering accessible ETH, in line with crypto investor Crypto Virtuos.

“The quantity of $ETH held on centralized exchanges has dropped to its lowest degree in 9 years,” Crypto Virtuos stated in a Monday put up on X.

This means that extra individuals are selecting to carry and stake ETH long-term, leading to much less ETH accessible for promoting.

“Probability of a provide scarcity coming. Is ETH prepared for its subsequent huge transfer?”

Bull flag breakout locations ETH worth goal above $6,000

From a technical perspective, Ether’s worth motion has validated a bull flag sample on the every day chart.

The bull flag resolved when the worth broke above the higher trendline at $4,300. ETH might then rise by as a lot because the earlier uptrend’s top. This places the higher goal for the altcoin at $6,150 — up 43% from the present worth.

Moreover, the every day relative power index is optimistic at 66. This means that the market circumstances nonetheless favor the upside, boosting Ether’s probabilities of reaching its bull flag goal.

Standard dealer Merlijn The Dealer had a extra bold goal for Ether, saying that breaking out of a four-year downtrend coupled with a bullish cross from the MACD on the month-to-month chart units ETH up for a rally towards $10,000.

THE $ETH BREAKOUT EVERYONE WAITED FOR.

Ethereum simply shattered a 4-year downtrend.

Month-to-month MACD golden cross → confirmed.This isn’t noise.

That is liftoff.Subsequent cease: $10,000 Ethereum pic.twitter.com/Mm83ZMvCAh

— Merlijn The Dealer (@MerlijnTrader) August 19, 2025

Different analysts additionally predict that Ether might attain $10,000 and past in 2025, citing institutional demand by means of spot Ethereum ETFs and ETH treasury firms stays notably robust, suggesting bullish market sentiment.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.