Asset supervisor VanEck has filed to launch a staked solana exchange-traded fund (ETF), signaling continued curiosity in bringing blockchain-native yield-bearing belongings to conventional funding rails.

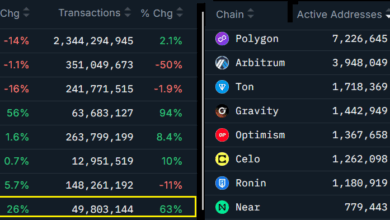

The appliance, submitted Friday as an S-1 registration with the U.S. Securities and Alternate Fee (SEC), is the primary of two filings required to listing the fund. If accredited, the ETF would maintain JitoSOL, a liquid staking token native to the Solana blockchain. JitoSOL displays possession of SOL tokens which were staked and in addition accrues the staking rewards earned by these tokens.

In contrast to conventional ETFs, this product wouldn’t simply observe the worth of SOL but additionally the revenue generated by staking — successfully baking Solana’s yield right into a publicly traded product.

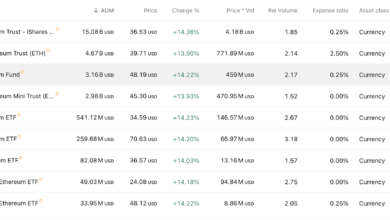

The SEC has been in ongoing discussions with ETF suppliers, together with VanEck, about whether or not staking elements could be built-in into present and proposed crypto funding funds.

Regulatory bottlenecks

Talking at an business panel in Jackson Gap earlier this week, SEC Chair Paul Atkins mentioned the Fee is seeking to clear regulatory bottlenecks that gradual innovation.

“There’s a number of spring cleansing that must be completed on the SEC,” he mentioned. “We can’t have issues so abstruse that legal professionals can’t give opinions to shoppers.”

Atkins mentioned the company’s future guidelines must be versatile and designed to evolve. He added that the SEC desires to proceed its legacy of adapting to new applied sciences, hinting at a extra open stance towards crypto asset merchandise like liquid staking ETFs.

VanEck joins quite a few asset managers seeking to launch a staked solana fund, together with Constancy, Grayscale and Franklin Templeton.