Regardless of this week’s market downturn, some analysts predict that the inclusion of digital belongings in US 401(ok) retirement plans might unlock billions of {dollars} in new inflows by the autumn, probably driving Bitcoin to file highs.

This “bullish” growth might push Bitcoin (BTC) above $200,000 earlier than the tip of the 12 months, signaling one other $122 billion value of recent capital whereas assuming a modest 1% portfolio allocation, André Dragosch, head of European analysis at crypto asset supervisor Bitwise, instructed Cointelegraph.

Company Bitcoin treasury acquisitions proceed to draw new entrants, such because the Nasdaq-listed healthcare service supplier and Bitcoin treasury agency KindlyMD, which made its first Bitcoin funding of $679 million on Tuesday.

Different large buyers are turning from Bitcoin to guess on Ether (ETH) value appreciation. On Thursday, a Bitcoin whale despatched $189 million value of BTC to the Hyperliquid decentralized trade and transformed most of it right into a $295 million perpetual future lengthy place and a subsequent $240 million spot ETH place.

Crypto in US 401(ok) retirement plans might drive Bitcoin to $200,000 in 2025

The inclusion of cryptocurrency in US retirement plans might mark a milestone for Bitcoin adoption and unlock billions of {dollars} in new capital, probably pushing the asset above $200,000 by the tip of 2025, in accordance with André Dragosch, head of European analysis at crypto asset supervisor Bitwise.

President Donald Trump paved the best way for cryptocurrency inclusion in US 401(ok) retirement plans by signing an govt order on Aug. 7, granting People entry to digital belongings by their retirement plans.

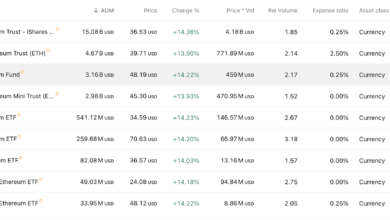

The inclusion of crypto in 401(ok) plans could also be much more important for the Bitcoin (BTC) value than the approval of US spot Bitcoin exchange-traded funds (ETFs) in January 2024, Dragosch mentioned.

This “bullish” growth could also be “greater than the US Bitcoin ETF approval itself,” signaling one other $122 billion value of recent capital whereas assuming a modest 1% portfolio allocation, Dragosch instructed Cointelegraph throughout the Chain Response each day X areas present on Monday, throwing in a value prediction for good measure:

“The official prediction stays $200,000 by the tip of the 12 months.”

“If you happen to have a look at 401(Ok) and defined-contribution retirement plans within the US, they’re large,” mentioned Dragosch, including that 1% was a “comparatively conservative” allocation estimate for the $12.2 trillion business.

Together with digital belongings in retirement plans will allow 401(ok) portfolio managers to put money into Bitcoin ETFs, which can push Bitcoin’s value to new all-time highs, flashing one other optimistic sign for Bitwise’s $200,000 Bitcoin value goal for the tip of 2025.

Proceed studying

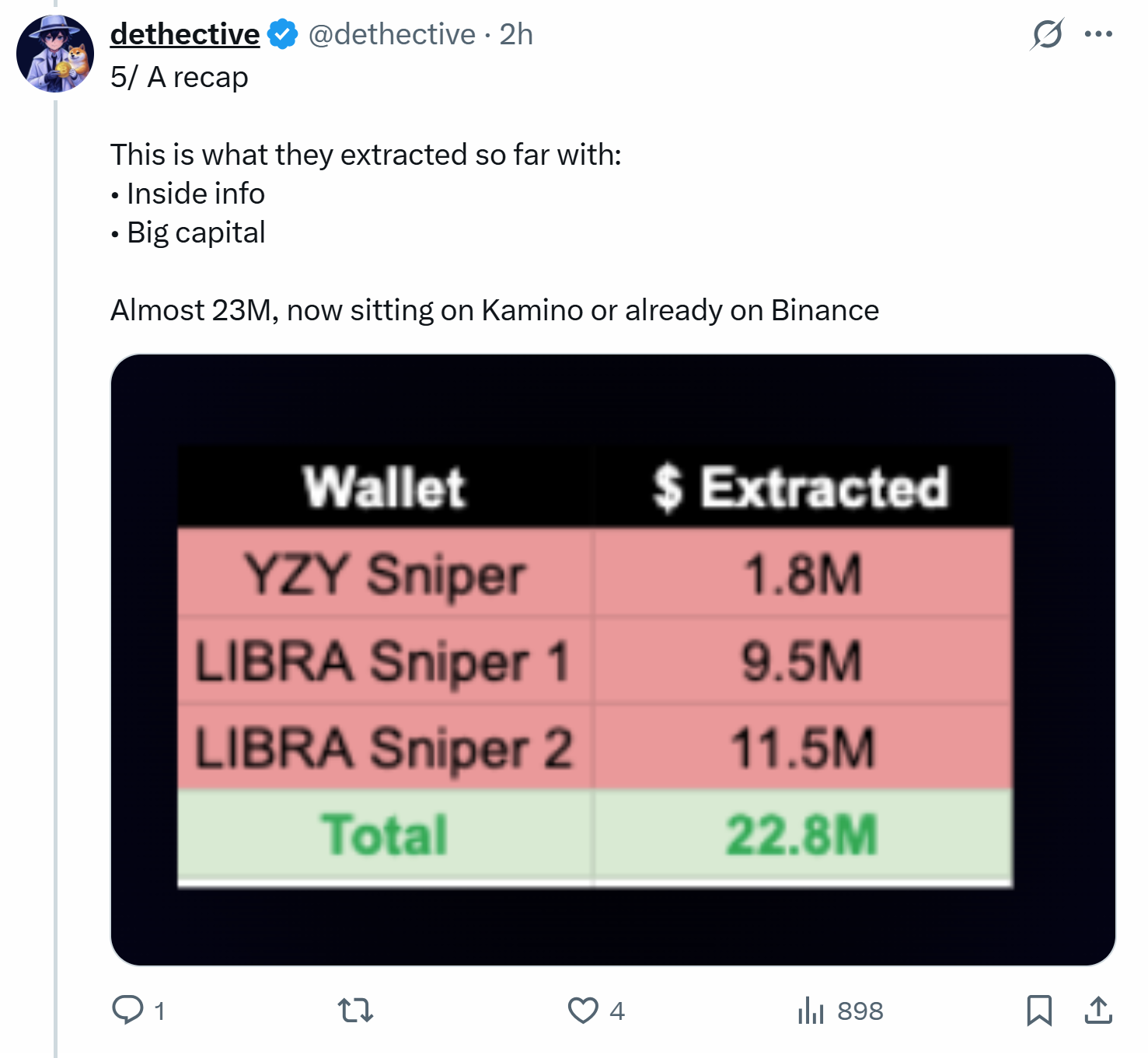

Kanye West YZY sniper pockets linked to $21 million LIBRA extraction scheme: Analysts

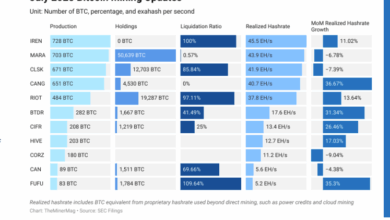

An onchain investigation by pseudonymous analyst Dethective linked a pockets that sniped the Kanye West-themed token YZY to a different set of wallets behind the LIBRA token, suggesting that the identical operator extracted tens of hundreds of thousands of {dollars} utilizing insider information.

In a collection of X posts on Thursday, Dethective revealed {that a} YZY sniper pockets managed to purchase $250,000 value of tokens at simply $0.20, far beneath the worth most merchants paid. Inside minutes, the pockets secured over $1 million in revenue, which was later funneled right into a treasury pockets.

The identical treasury pockets had additionally obtained massive sums from wallets tied to LIBRA’s launch six months in the past. Two “Libra sniper” wallets extracted a mixed $21 million. In whole, practically $23 million was pulled throughout the YZY and LIBRA launches, with funds later moved to Kamino or Binance.

“We may be positive that is somebody with clear inside information,” Dethective wrote. “The proof is that he didn’t snipe any coin in addition to $YZY and $LIBRA and he was ready with large dimension,” they added.

Proceed studying

Bitcoin bull and billionaire information for $250 million SPAC focusing on DeFi, AI

Early Bitcoin investor and billionaire Chamath Palihapitiya filed to lift $250 million in blank-check firm “American Exceptionalism Acquisition Corp A,” focusing on the decentralized finance, AI, power and protection sectors.

The particular goal acquisition firm (SPAC) could be led by Social Capital managing associate Steven Trieu as CEO and Palihapitiya as chairman, in accordance with the registration assertion filed with the US Securities and Trade Fee on Monday.

The $250 million elevate seeks to supply 25 million shares at $10 every below the ticker AEXA on the New York Inventory Trade.

Palihapitiya and Trieu are betting on decentralized finance, not Bitcoin, to steer the following wave of monetary innovation, specializing in options that bridge conventional markets with blockchain expertise:

“Whereas Mr. Palihapitiya has lengthy been a proponent of Bitcoin as an inflation hedge and different to fiat currencies, we imagine that the following stage of growth is the elevated integration between conventional finance and decentralized finance.”

Proceed studying

Ex-White Home crypto director Bo Hines takes Tether advisory position

Stablecoin big Tether employed former White Home Crypto Council Govt Director Bo Hines as its new strategic adviser for digital belongings and US technique, signaling a push to broaden on this planet’s greatest financial system.

Tether, the issuer of the USDt (USDT) stablecoin, appointed Hines to instantly interact and coordinate the corporate’s US technique and growth as a part of its core focus with rapid impact, in accordance with a Tuesday announcement shared with Cointelegraph.

Hines beforehand served in President Donald Trump’s administration, the place he labored on initiatives to foster digital asset innovation, set guardrails for stablecoin issuers and develop collaboration between authorities and the blockchain business.

In his new position, Hines will work with Tether’s management workforce to execute its US market entry and domesticate “constructive relationships” with policymakers and business stakeholders.

Hines’ “deep understanding of the legislative course of, mixed together with his ardour for sensible blockchain adoption, makes him a useful asset as Tether enters the largest market on this planet,” mentioned Paolo Ardoino, CEO of Tether, including:

“Bo’s appointment demonstrates our dedication to constructing a robust U.S.-based presence that spans throughout a number of sectors, beginning with digital belongings and increasing to new alternatives, together with a deep give attention to potential additional investments in home infrastructure.”

Tether Investments has already reinvested virtually $5 billion within the US financial system. Hines’ addition goals to “reinforce” this dedication and alignment to the US market, the announcement mentioned.

Proceed studying

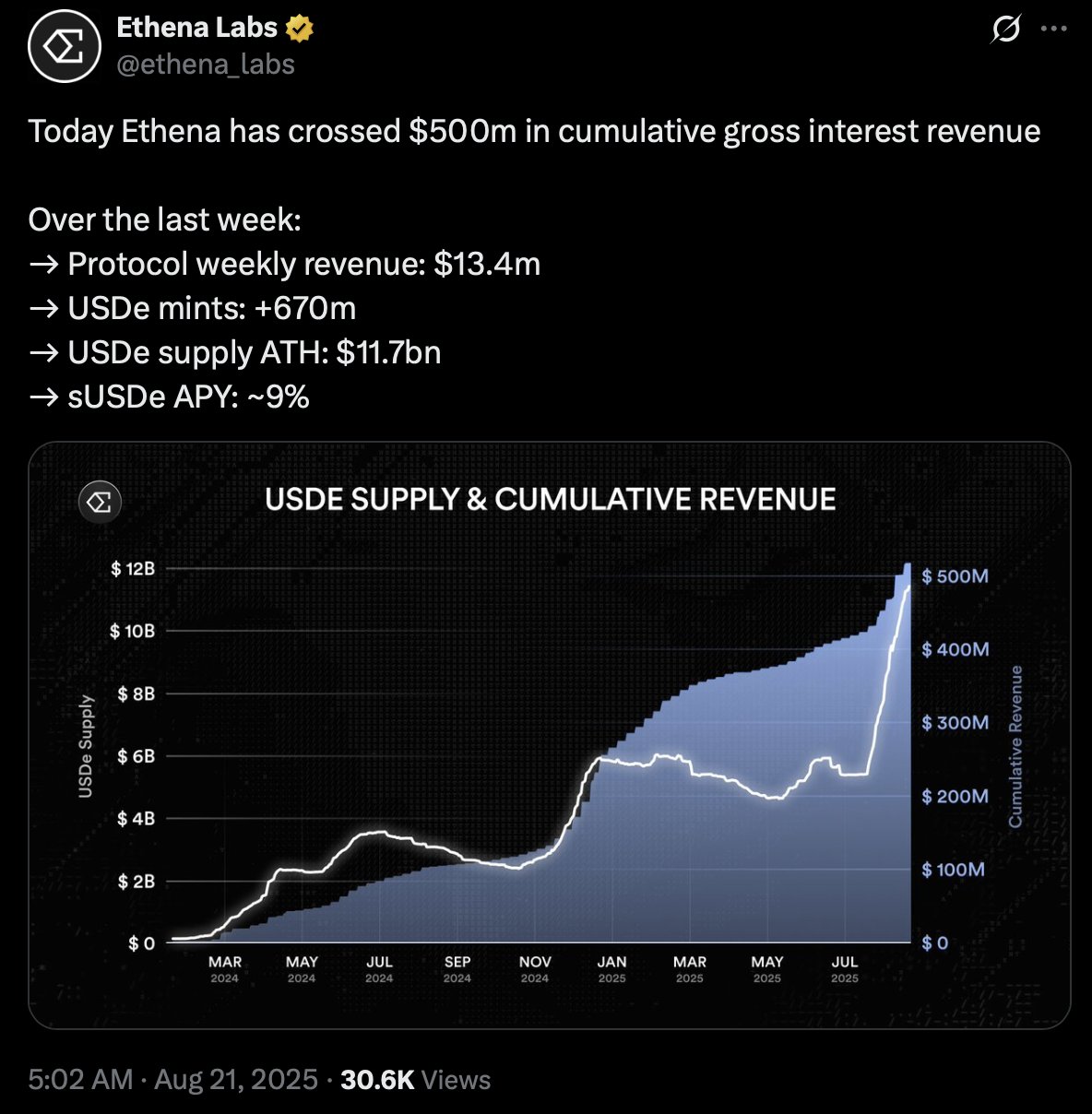

Ethena crosses $500 million in cumulative income as artificial stablecoins acquire floor

Ethena Labs on Thursday mentioned its Ethena protocol has generated greater than $500 million in cumulative income. Progress in each income and the circulating provide of its artificial stablecoin, Ethena USDe (USDe), has accelerated since July as artificial stablecoins acquire market share.

Ethena Labs shared the information by way of a submit on X, saying that previously week, protocol income hit $13.4 million and USDe provide hit an all-time excessive of $11.7 billion.

“Ethena’s income has been pushed by robust inflows into USDe and favorable market circumstances which have amplified returns from its delta-neutral hedging reserve mannequin,” an Ethena Labs spokesperson instructed Cointelegraph. “The protocol’s momentum displays rising demand for and confidence in USDe as a retailer of worth.”

Based on decentralized finance analytics platform DefiLlama, Ethena USDe had the third-largest market capitalization of all stablecoins on the time of writing. It additionally had the highest market capitalization amongst artificial stablecoins. Prior to now month, the market cap of Ethena USDe has risen 86.6%.

Together with Ethena USDe, different artificial stablecoins are gaining momentum and market share. Sky Greenback (USDS), which powers the Sky ecosystem and is an upgraded model of DAI (DAI), has seen a 14% improve in market cap. Falcon USD (USDf), an artificial greenback created by Falcon Finance, has seen its market cap soar 89.4%.

Artificial stablecoins have advantages in addition to dangers. As a result of they aren’t collateralized by bodily belongings, they could have decrease transaction prices. There’s additionally a threat of instability and depegging, which can lead to important investor losses.

Proceed studying

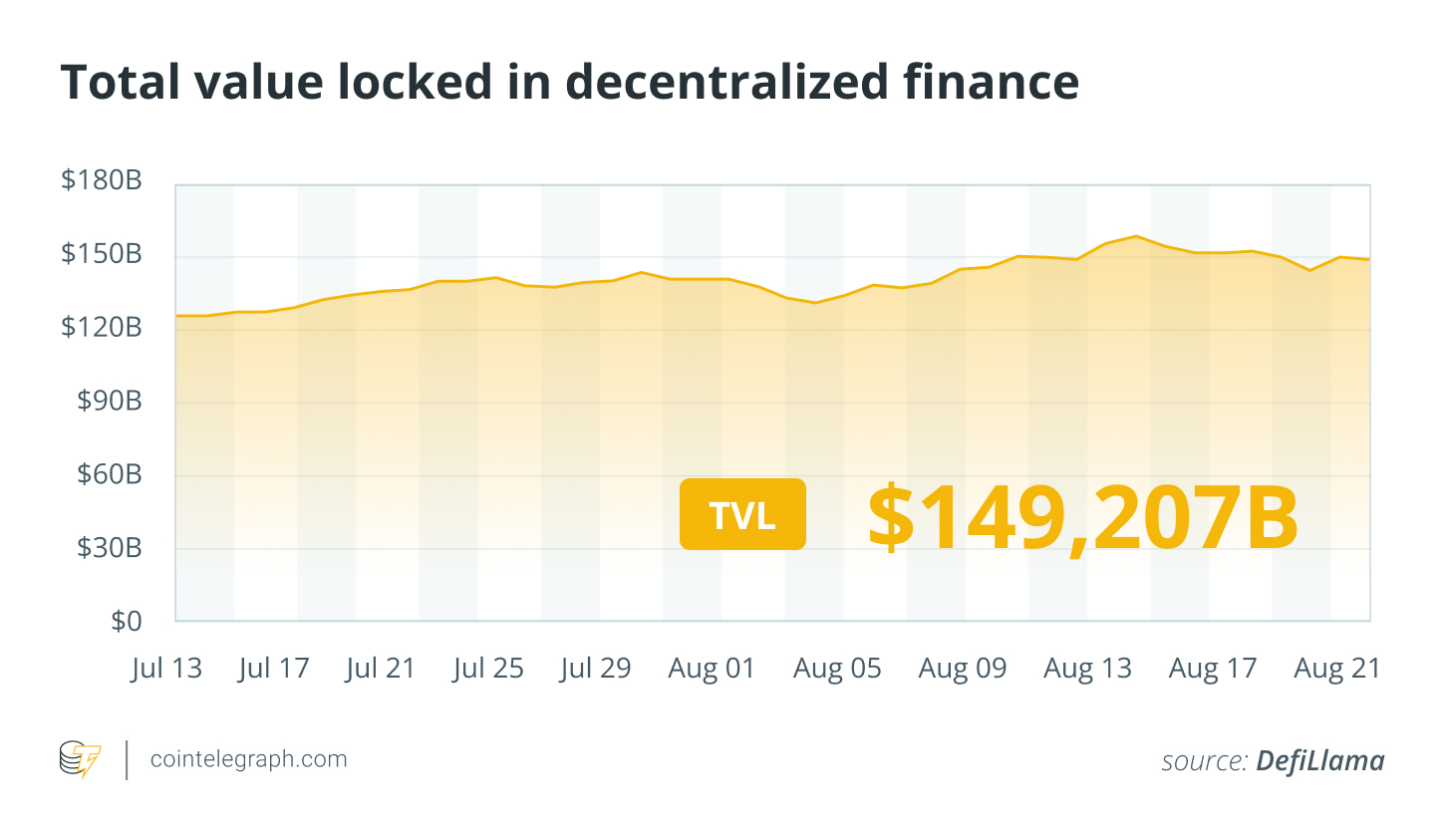

DeFi market overview

Based on knowledge from Cointelegraph Markets Professional and TradingView, a lot of the 100 largest cryptocurrencies by market capitalization ended the week within the purple.

Memecoin launch platform Pump.enjoyable’s (PUMP) token fell over 22% marking the week’s greatest decline, adopted by the SPX6900 (SPX) token, down over 18% over the previous week.

Thanks for studying our abstract of this week’s most impactful DeFi developments. Be a part of us subsequent Friday for extra tales, insights and training relating to this dynamically advancing area.