Key takeaways:

-

ETH surged 13% on Friday after Federal Reserve Chair Jerome Powell’s dovish Jackson Gap speech hinted at an rate of interest reduce in September.

-

Onchain and technical indicators sign Ether’s potential to hit $6,000 within the quick time period.

Ether’s (ETH) value displayed power on the Wall Avenue open on Friday, rising 13% to $4,788 following Federal Reserve Chair Jerome Powell’s Jackson Gap speech.

ETH value rallied from $4,200 inside minutes, reclaiming $4,600, a stage that has suppressed the worth during the last seven days, per knowledge from Cointelegraph Markets Professional and TradingView.

This efficiency follows Powell’s Jackson Gap speech, the place he hinted at a possible rate of interest reduce in September, signaling a dovish stance that boosted market optimism.

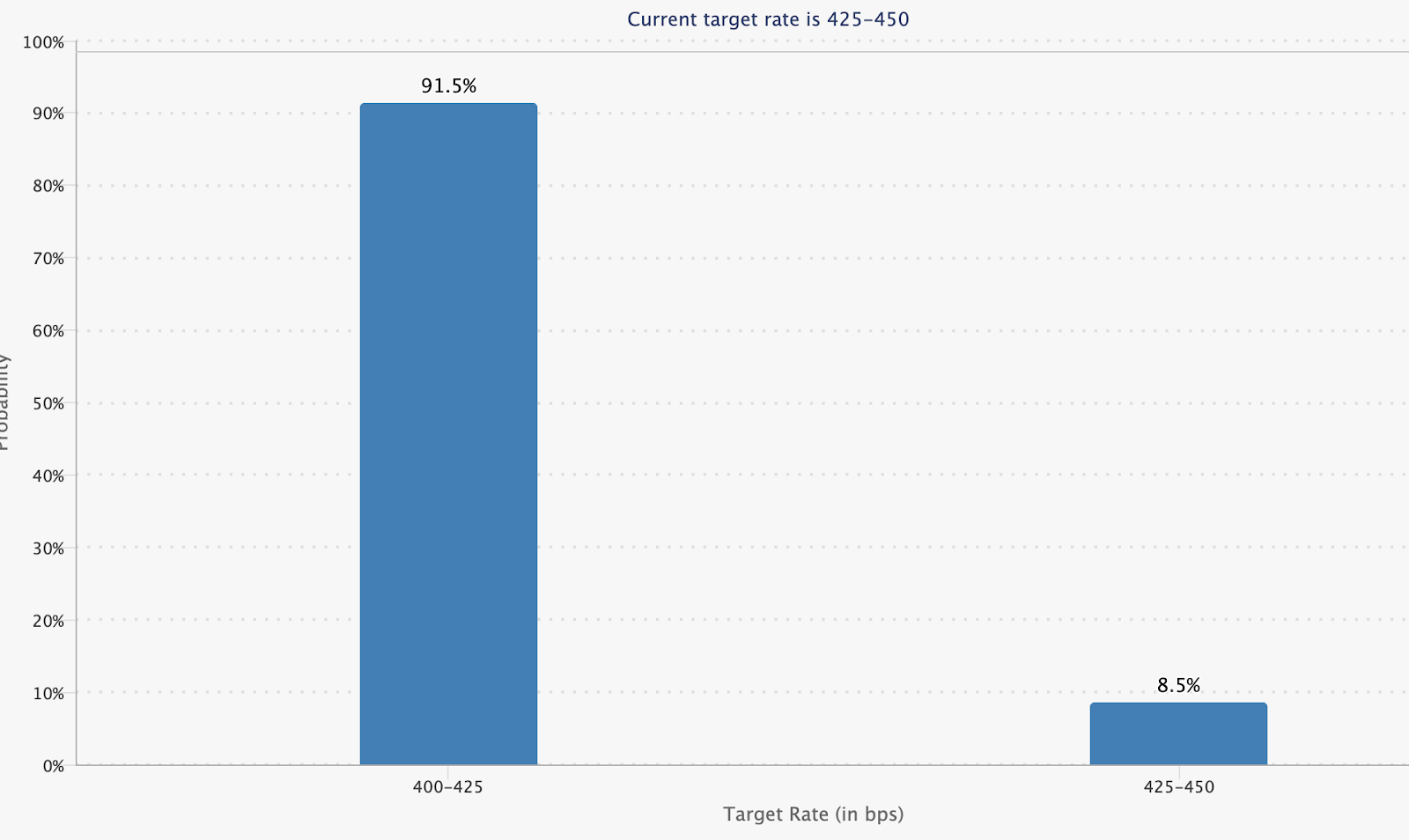

Rate of interest reduce odds for the Sept. 17 FOMC assembly have now jumped to 91.5% from 75% a day prior, in keeping with the CME Group Fedwatch software.

This provides to the encouraging bullish sentiment that would doubtlessly drive ETH to new highs.

ETH crosses $4,600 with a “god candle,” stated analyst Elisa in response to Ether’s response, including:

A number of bullish indicators counsel that ETH is well-positioned to interrupt out towards contemporary all-time highs within the following days or even weeks.

Continued spot ETF inflows again ETH value upside

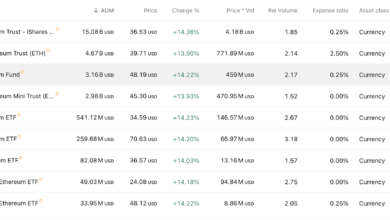

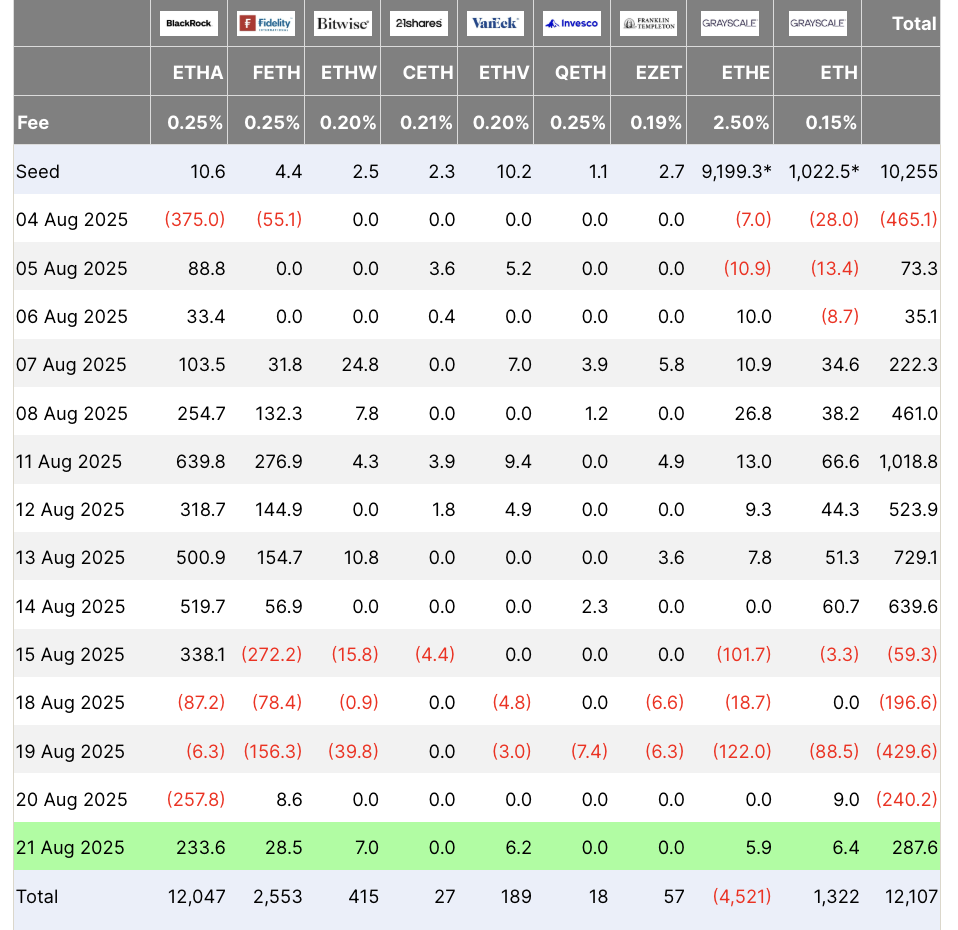

One issue supporting Ether’s bull argument is persistent institutional demand, mirrored by important inflows into spot Ethereum exchange-traded funds (ETFs).

Spot Ether ETFs noticed $287.6 million in inflows on Aug. 21, breaking a four-day outflow streak. These funding merchandise have seen web inflows totaling $2.55 billion month-to-date as per knowledge from Farside Traders.

As Cointelegraph reported, Ether continued dominating international exchange-traded merchandise (ETPs) final week, with inflows totaling $2.9 billion, marking rising investor urge for food for the altcoin ETPs.

Associated: EU exploring Ethereum, Solana for digital euro launch: FT

Change provide plummets

ETH balances on exchanges have dropped to nine-year lows, falling to 14.9 million ETH for the primary time since July 2016, Glassnode knowledge reveals.

The full steadiness between inflows and outflows out and in of all identified alternate wallets reveals a steep decline since October 2023, when withdrawals from the buying and selling platforms started to surge. This drop accompanies a 180% rise in Ether’s value over the identical time interval.

Lowering Ether provide on exchanges might sign an incoming value rally fueled by a “provide scarcity,” which happens when robust purchaser demand meets lowering obtainable ETH, in keeping with crypto investor Crypto Virtuos.

“The quantity of $ETH held on centralized exchanges has dropped to its lowest stage in 9 years,” Crypto Virtuos stated in a Monday put up on X.

This suggests that extra individuals are selecting to carry and stake ETH long-term, leading to much less ETH obtainable for promoting.

“Likelihood of a provide scarcity coming. Is ETH prepared for its subsequent massive transfer?”

Bull flag breakout locations ETH value goal above $6,000

From a technical perspective, Ether’s value motion has validated a bull flag sample on the day by day chart.

The bull flag resolved when the worth broke above the higher trendline at $4,300. ETH may then rise by as a lot because the earlier uptrend’s top. This places the higher goal for the altcoin at $6,150 — up 43% from the present value.

Moreover, the day by day relative power index is constructive at 66. This implies that the market situations nonetheless favor the upside, boosting Ether’s possibilities of reaching its bull flag goal.

Fashionable dealer Merlijn The Dealer had a extra formidable goal for Ether, saying that breaking out of a four-year downtrend coupled with a bullish cross from the MACD on the month-to-month chart units ETH up for a rally towards $10,000.

THE $ETH BREAKOUT EVERYONE WAITED FOR.

Ethereum simply shattered a 4-year downtrend.

Month-to-month MACD golden cross → confirmed.This isn’t noise.

That is liftoff.Subsequent cease: $10,000 Ethereum pic.twitter.com/Mm83ZMvCAh

— Merlijn The Dealer (@MerlijnTrader) August 19, 2025

Different analysts additionally predict that Ether may attain $10,000 and past in 2025, citing institutional demand by way of spot Ethereum ETFs and ETH treasury corporations stays notably robust, suggesting bullish market sentiment.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.