XRP Spiked 3% as Federal Reserve Chair Jerome Powell firmly put a September fee lower on the desk on Friday, inflicting bitcoin (BTC) and main tokens to maneuver larger.

470 million token selloff drove quantity spikes and heavy resistance at $2.92, whereas ETF delays and weak safety rankings compound bearish stress.

Information Background

• Institutional liquidations dominated buying and selling as 470 million XRP had been offloaded throughout main exchanges in the course of the Aug. 21–22 window, triggering a pointy selloff.

• On-chain settlement volumes surged 500% to 844 million tokens on Aug. 18, one of many largest spikes this yr, signaling adoption development regardless of market weak spot.

• The SEC postponed rulings on XRP ETF purposes, together with Nasdaq’s CoinShares submitting, now anticipated in October. The delay provides to regulatory uncertainty.

• A safety evaluation positioned XRPL on the lowest rating amongst 15 blockchains, elevating considerations about community robustness and including to bearish sentiment.

Value Motion Abstract

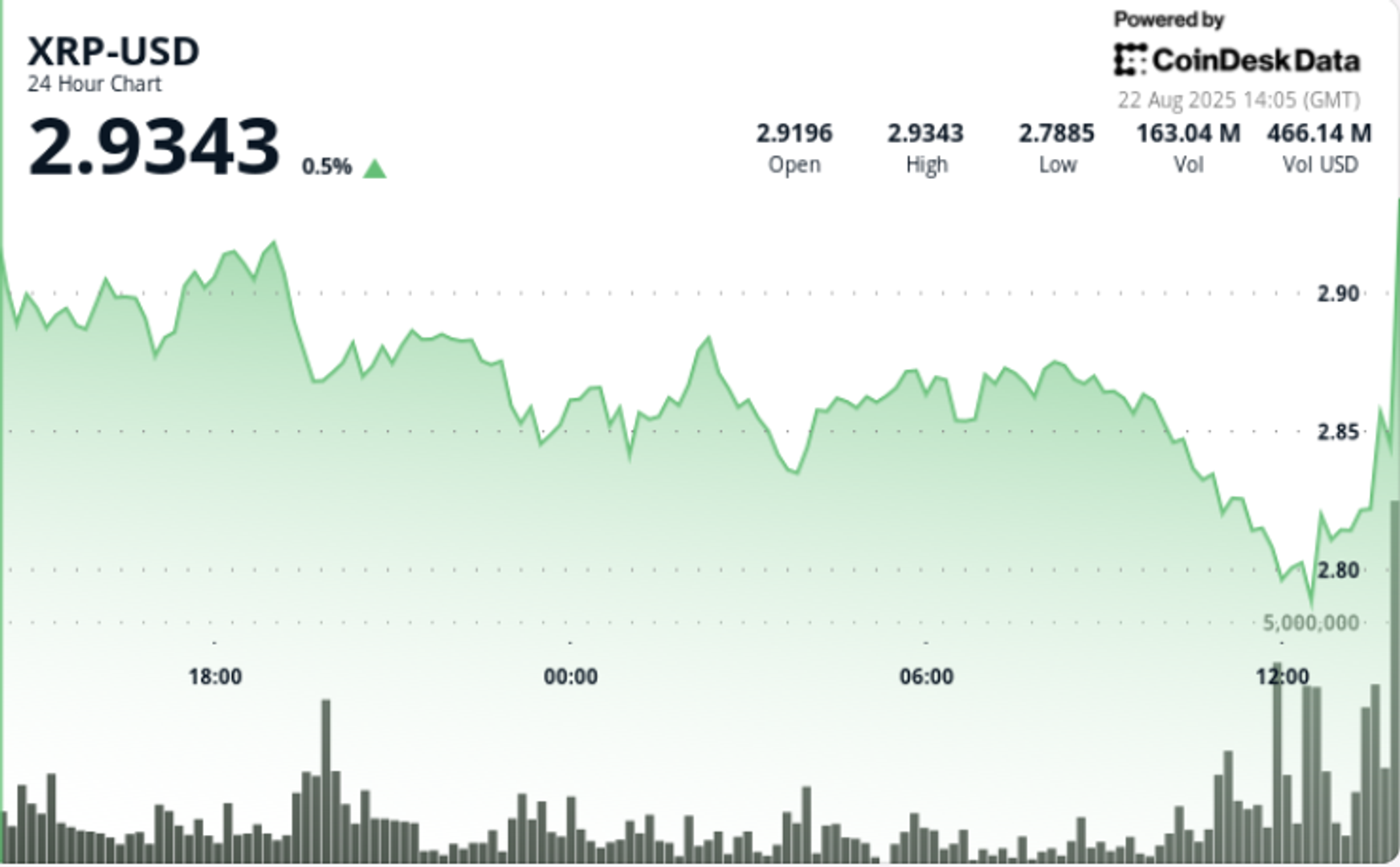

• XRP declined 3.1% within the 24-hour session from Aug. 21 13:00 to Aug. 22 12:00, falling from $2.89 to $2.80.

• The token ranged $0.12, a 4.25% volatility band, between a $2.92 peak and $2.80 trough.

• The sharpest transfer occurred at 19:00 on Aug. 21, when XRP was rejected at $2.92 on 69.1M quantity, confirming main resistance.

• Ultimate hour buying and selling (Aug. 22 11:24–12:23) noticed XRP drop 2.5% from $2.82 to $2.80 on surging quantity of seven.2M, confirming bearish continuation.

• Assist emerged close to $2.80–$2.85, however accumulation curiosity weakened with every retest.

Technical Indicators

• Resistance hardened at $2.92 on 69.1M quantity rejection.

• Assist recognized at $2.80–$2.85 zone, although weakening on repeated exams.

• Quantity spiked to 96M at 11:00 Aug. 22, confirming bearish follow-through.

• Buying and selling vary of $0.12 (4.25%) highlights volatility focus.

• Ultimate hour selloff of two.5% with 7.2M quantity validated bearish continuation.

What Merchants Are Watching

• Whether or not $2.80 can maintain as assist; a break dangers acceleration towards $2.75.

• ETF-related headlines, with October selections key to broader institutional flows.

• Whale accumulation patterns — on-chain adoption rising, however worth failing to replicate fundamentals.

• $2.92–$3.00 resistance zone as breakout set off for bullish reversal.