Ethereum-focused exchange-traded funds noticed a notable reversal on Aug. 21 by recording an influx of $287 million, which ended a four-day streak of investor withdrawals.

Farside Buyers knowledge confirmed that the surge was pushed primarily by BlackRock’s iShares Ethereum Belief (ETHA), which drew the biggest share of inflows at $233.5 million. Constancy’s FETH adopted by attracting an extra $28.5 million in contemporary capital.

In the meantime, different ETFs, together with Bitwise ETHW, VanEck’s ETHV, and two Grayscale Ethereum merchandise, collectively introduced in round $25 million.

These inflows helped offset the numerous outflows of greater than $925 million recorded within the prior 4 buying and selling periods between Aug. 15 and Aug. 20.

Notably, the rebound pushed the Ethereum ETFs’ internet inflows above $12 billion and their whole property valued at roughly $27 billion.

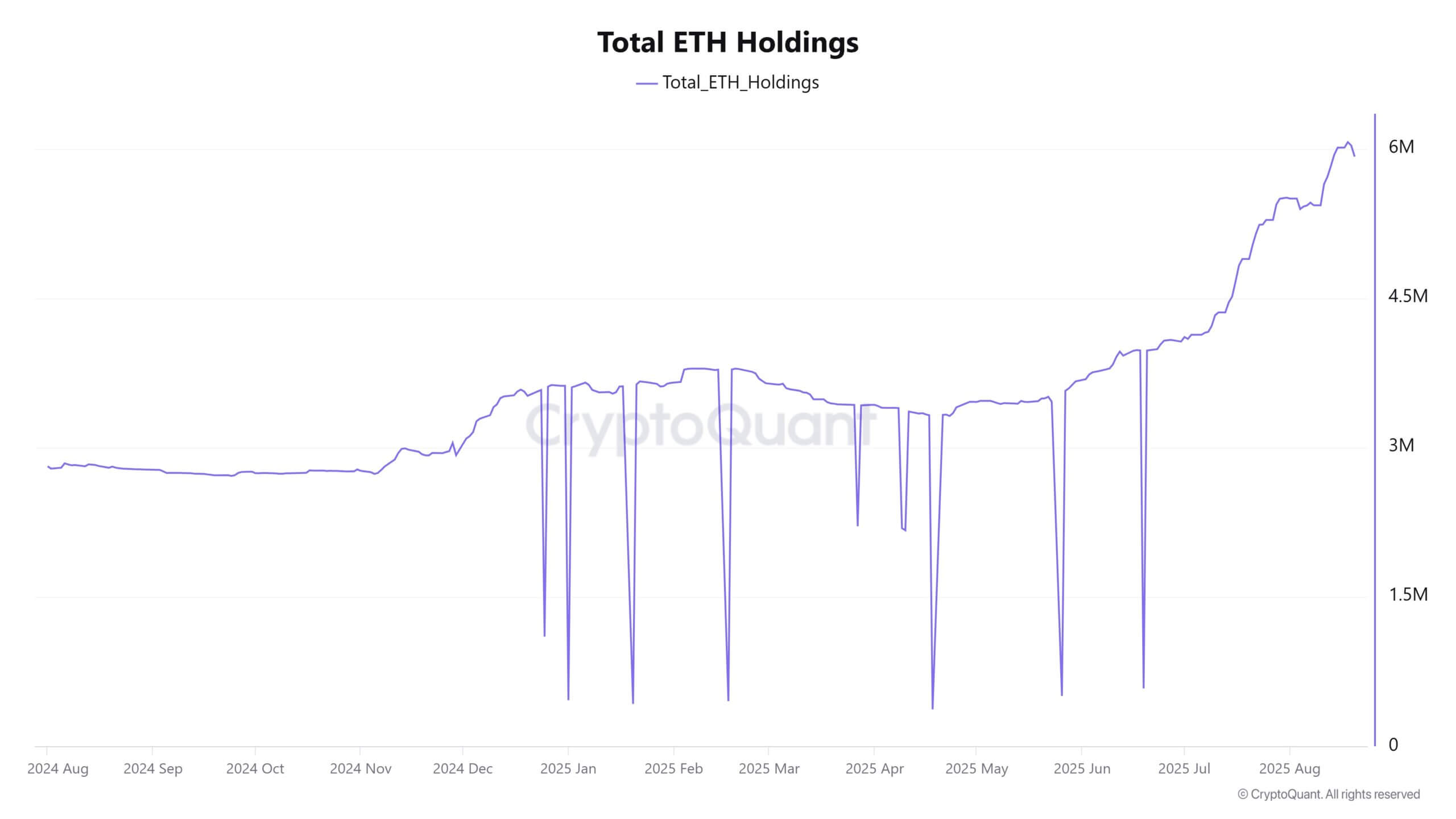

The 9 Ethereum ETF holdings reached an all-time excessive of 6.069 million ETH on Aug. 19, up from 4.15 million ETH on Jul. 8. This represents a rise of roughly 1.92 million ETH, or 46%, over six weeks.

Market analyst CryptoOnChain mentioned the surge highlights a structural shift in how Ethereum is held, with extra provide now locked in long-term funding autos.

In the meantime, the analyst additionally famous that the rising focus of ETH in ETFs has a number of market implications.

With substantial parts of Ethereum successfully faraway from every day buying and selling, spot market liquidity thins, making costs extra delicate to massive trades, together with rebalancing or redemption occasions.

The inflows create a bullish basis by sustaining demand, whereas any slowdown or reversal in ETF purchases might create promoting stress that impacts broader market pricing.