Japanese monetary conglomerate SBI has inked new blockchain partnerships with USDC issuer Circle, XRP developer Ripple and the Web3 firm Startale.

SBI Group introduced three separate partnerships on Friday, together with stablecoin-related collaborations with US firms Circle and Ripple, and a brand new tokenization mission with Singapore-based Startale.

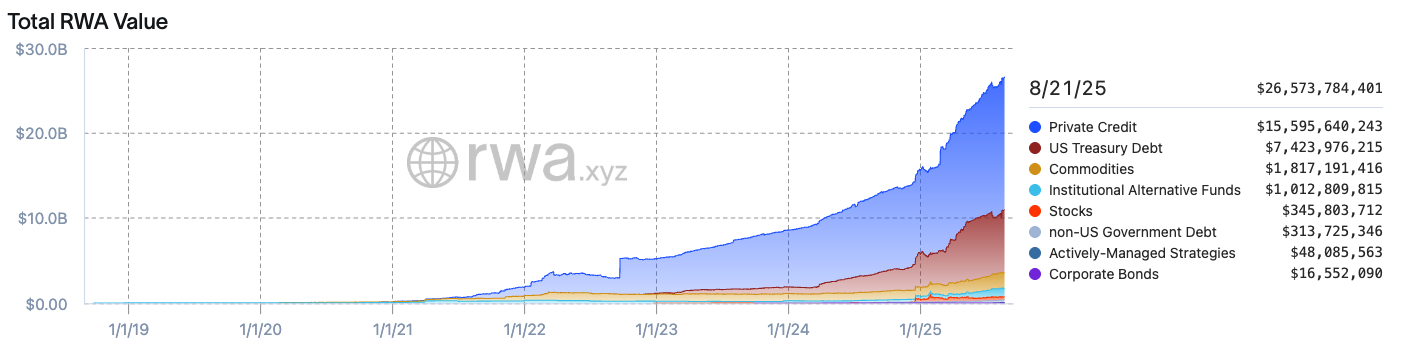

In cooperation with Startale, SBI plans to construct an onchain buying and selling platform for tokenized shares and real-world belongings (RWAs) to allow 24/7 buying and selling.

As a part of stablecoin collaborations with Ripple and Circle, SBI will discover new methods to advertise adoption of Circle’s USDC (USDC) and Ripple’s Ripple USD (RLUSD) stablecoin.

Joint Circle enterprise versus RLUSD distribution

Whereas the Circle announcement mentions the institution of a three way partnership with SBI, the partnership with Ripple goals to determine RLUSD distribution in Japan by SBI’s crypto subsidiary SBI VC Commerce.

“The institution of this three way partnership goals to advertise the usage of USDC in Japan and create new use circumstances within the Web3 and digital finance domains,” SBI mentioned.

The Ripple announcement refers to a brand new memorandum of understanding with Ripple Labs on distributing RLUSD in Japan, with SBI VC Commerce aiming to make the stablecoin accessible through the fiscal yr ending March 2026.

“The introduction of RLUSD won’t simply increase the choice of stablecoins within the Japanese market, however a significant step ahead within the reliability and comfort of stablecoins within the Japanese market,” SBI VC Commerce CEO Tomohiko Kondo mentioned.

Associated: China weighs yuan-backed stablecoins in main coverage shift: Reuters

SBI had beforehand introduced related partnerships with each Circle and Ripple, with SBI VC Commerce finishing registration to help USDC operations in March. The Japanese conglomerate has additionally maintained a long-standing partnership with Ripple, facilitating numerous XRP (XRP) providers throughout its platforms over the previous a number of years.

Startale collaboration boosts RWA development

As a part of a three way partnership with Startale, SBI has secured “milestone-based dedicated funding” to construct an upcoming onchain tokenized platform in Japan.

The event echoes many tokenization initiatives globally, with firms like Gemini, Kraken, Robinhood and introducing related 24/7 buying and selling platforms providing tokenized shares of firms like Michael Saylor’s Technique (MSTR) earlier this yr.

“As tokenized RWAs allow 24/7 real-time settlement and obtain unprecedented liquidity and capital effectivity, the convergence of conventional finance and DeFi will possible speed up,” SBI CEO Yoshitaka Kitao mentioned.

“We predict that this motion will ultimately result in the digitalization of capital markets themselves, together with exchanges,” the manager mentioned, including:

“By capturing this development and by leveraging our company ecosystem along with Startale’s blockchain know-how, we’ve got nice expectations for creating a brand new decentralized platform.”

The announcement doesn’t specify both the anticipated launch date for the platform with Startale or what blockchain community can be used as a part of the enterprise. Startale is understood for co-developing Sony’s layer-2 blockchain Soneium and Astar Community.

“We’re not able to reveal the technical structure simply but,” Startale Group CEO Sota Watanabe informed Cointelegraph.

“What issues is the three way partnership’s mission: to ship an always-on, compliant buying and selling platform for tokenized belongings,” Watanabe mentioned, including that the timeline will likely be introduced at a later date.

Associated: Scaramucci to tokenize $300M in belongings, almost doubling Avalanche’s RWA base

Cointelegraph approached SBI for remark concerning the joint tokenization mission however had not acquired a response by publication.

SBI’s transfer comes as main monetary gamers globally are experimenting with the tokenization of conventional belongings. Earlier on Friday, Bloomberg reported that Eric Trump plans to go to Tokyo in September as a part of his household’s increasing push into the cryptocurrency business.

Journal: Stablecoins in Japan and China, India mulls crypto tax adjustments: Asia Specific