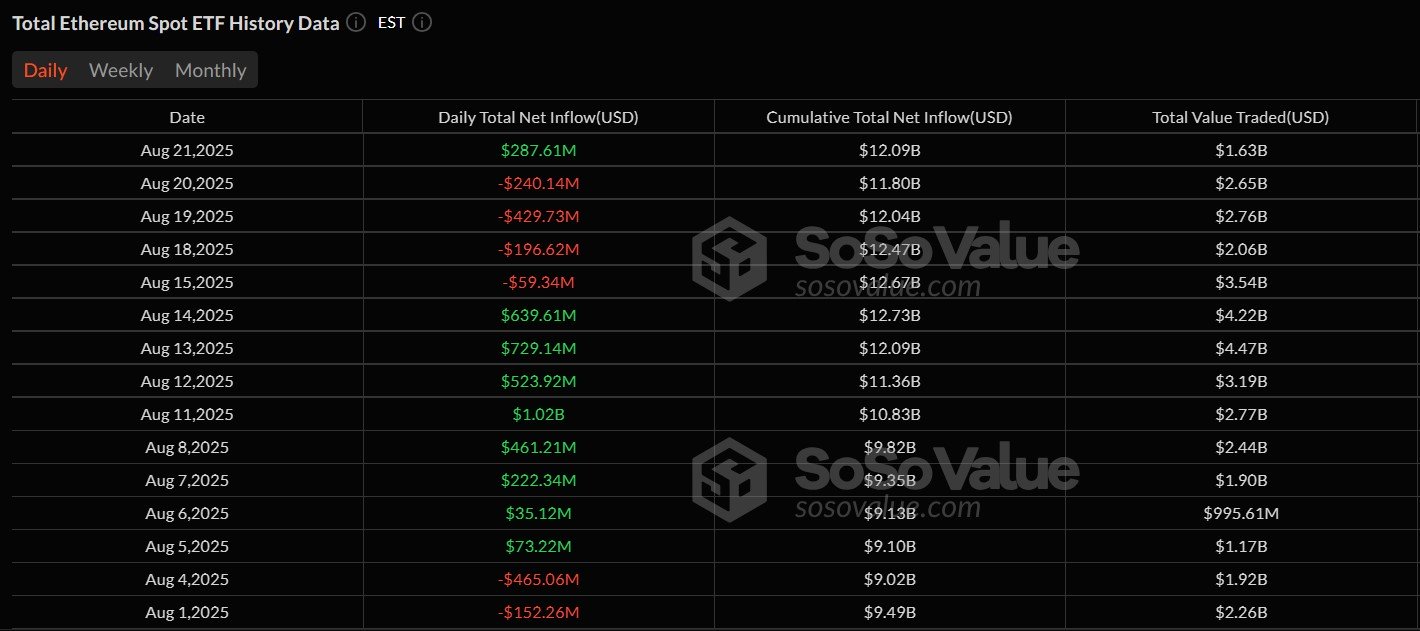

United States’ spot Ether exchange-traded funds (ETFs) funds drew $287.6 million in internet inflows on Thursday, snapping a four-day streak of outflows, in accordance with knowledge from crypto ETF tracker SoSoValue.

The rebound follows a interval of sustained outflows, with funds shedding over $924 million between final Friday and Thursday. The biggest withdrawal got here on Tuesday, when spot Ether (ETH) ETFs noticed $429 million exit — the second-largest each day internet outflow seen this month, following the $465 million that left the market on Aug. 4.

Asset supervisor BlackRock’s iShares Ethereum Belief (ETHA) led the day with $233.5 million in inflows, whereas the Constancy Ethereum Fund (FETH) adopted with $28.5 million. Different ETFs averaged round $6 million in internet inflows for the day.

The contemporary inflows lifted cumulative internet inflows above $12 billion, signaling renewed investor demand after per week of withdrawals.

Complete ETF reserves hit $27.66 billion

In line with the ETH reserve tracker Strategic ETH Reserve (SER), spot Ether ETFs at present maintain a mixed 6.42 million ETH valued at $27.66 billion. The funding merchandise recorded a each day internet influx of 66,350 ETH, lifting their whole reserve holdings to five.31% of Ether’s circulating provide.

Past ETFs, company treasury reserves and long-term holdings unfold throughout main establishments have hit 4.10 million ETH, which is price $17.66 billion. In line with SER knowledge, the holdings signify 3.39% of Ether’s provide.

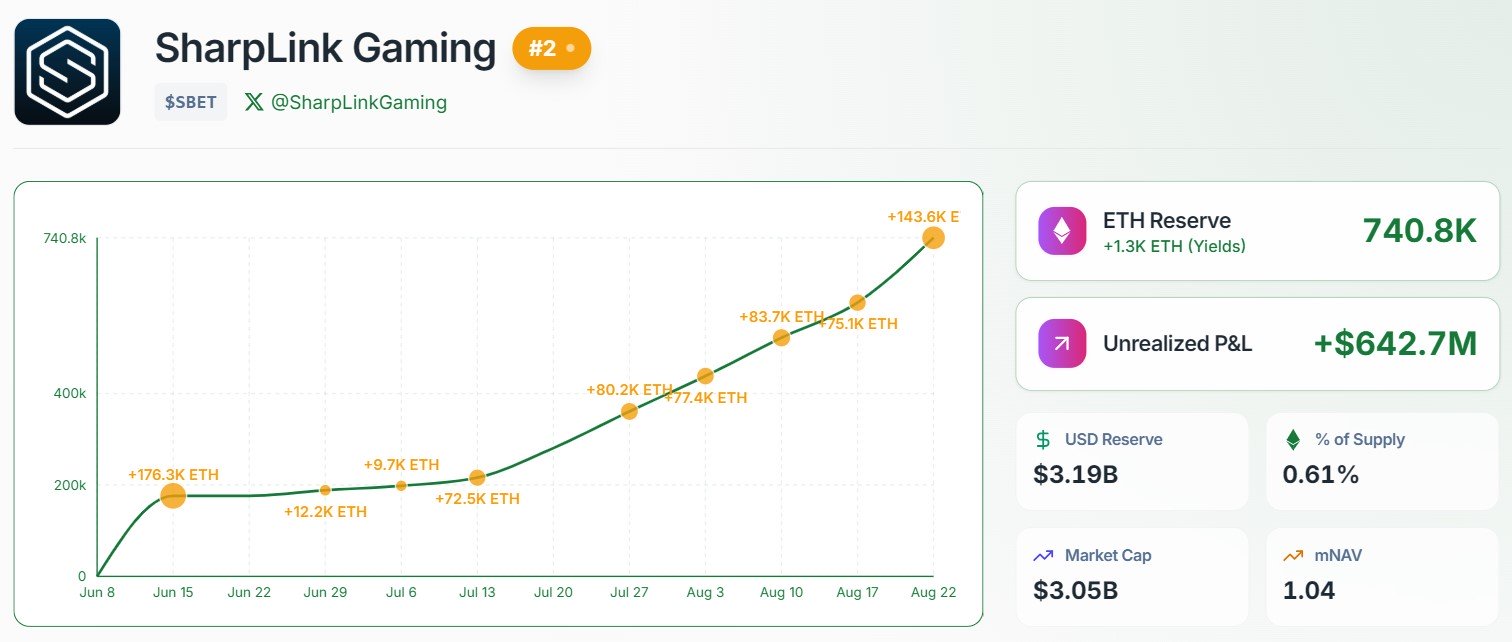

Corporations like SharpLink Gaming have maintained momentum with main ETH purchases. On Tuesday, the corporate purchased $667 million in Ether at near-record highs. This lifted its total holdings to over 740,00 ETH valued at $3.2 billion.

SharpLink is at present the second-largest ETH treasury holder subsequent to Bitmine Immersion Tech, which has 1.5 million ETH.

Associated: ETH charts predict $3.9K retest, then a 100% rally to new highs

Redditors debate whether or not company ETH purchases add actual worth

The focus of ETH in main establishments sparked an internet dialogue amongst group members, with some questioning whether or not company ETH purchases add actual worth to the ecosystem.

On Wednesday, a Redditor began a dialogue asking how ETH “hoarding” by treasury firms provides worth to Ethereum, which they perceived because the spine of decentralized finance (DeFi).

A group member mentioned that the optimistic results lie within the worth impression, decreasing the circulating provide. As well as, Redditor mentioned that the ETH bought by establishments may additionally be staked, which might again the community.

Nevertheless, one other group member disagreed, saying that there are already “greater than sufficient” stakers within the community and that including extra doesn’t assist.

The group member argued that having extra stakers from central entities additionally reduces decentralization, which is touted as one of many core values of the community.

One other Redditor mentioned the ETH group must see this as a win, saying that it brings consideration to ETH, making the asset extra precious. With ETH being up, the consumer claimed that DeFi utility will increase as properly as a result of ETH features as a base asset in lots of protocols.

Journal: How Ethereum treasury firms may spark ‘DeFi Summer time 2.0’