Dogecoin rallied on Tuesday after a string of regulatory and company catalysts shifted sentiment throughout the crypto sector. A $50 million Trump-linked acquisition of a DOGE mining agency, Wyoming’s launch of a state-backed stablecoin, and feedback from Federal Reserve officers signaling a softer stance on digital property all converged to set off recent institutional flows.

Information Background

• Thumzup, a Trump-affiliated entity, acquired Dogehash for $50 million, creating what executives described as the biggest DOGE mining operation. The deal alerts deep-pocketed confidence in Dogecoin infrastructure.

• Wyoming unveiled the Frontier Secure Token, the primary government-backed state stablecoin, reinforcing the U.S. regulatory pivot towards digital property.

• Fed Vice Chair Michelle Bowman warned banks about aggressive dangers from delaying digital asset adoption, signaling a extra crypto-accommodative posture.

• SoFi Applied sciences built-in Bitcoin’s Lightning Community, concentrating on the $740 billion remittance market — one other sign of conventional finance edging deeper into crypto rails.

Worth Motion Abstract

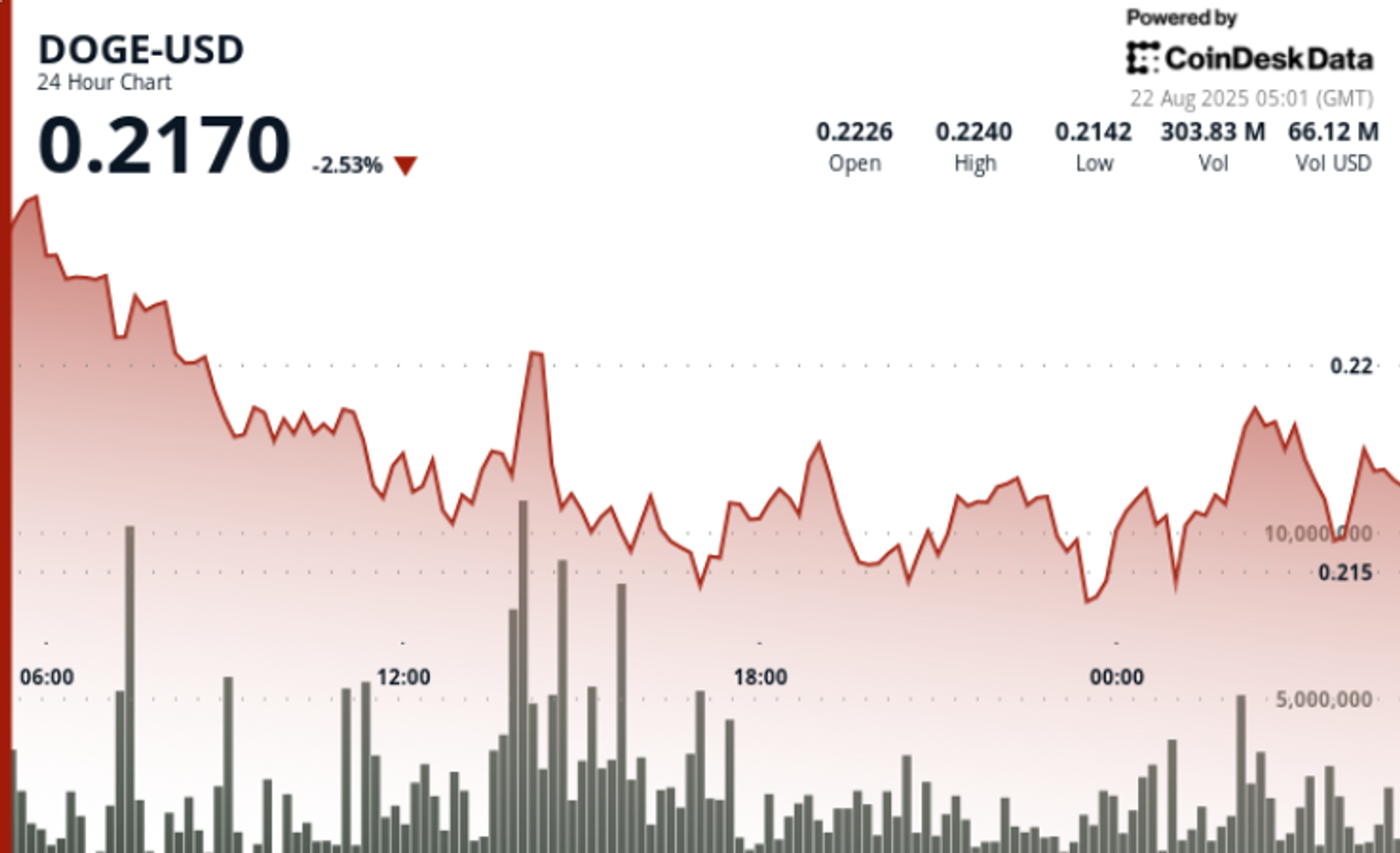

• DOGE traded in a $0.01 band from $0.21 to $0.22 between Aug. 20 15:00 and Aug. 21 14:00, marking ~4–5% intraday volatility.

• The token rallied 5% from $0.21 to $0.22 throughout the Aug. 20 night session, establishing $0.22 as near-term resistance.

• A late-session 60-minute window (Aug. 21 13:22–14:21) noticed DOGE surge 1% from $0.22 to $0.22 with quantity spikes above 61.8 million, confirming institutional exercise.

• Help constantly held within the $0.21–$0.22 zone with bounces on 320–380 million quantity throughout key testing factors.

Technical Evaluation

• Help: $0.21–$0.22 established as dependable flooring with repeated high-volume retests.

• Resistance: $0.22 key pivot cleared, however bulls want follow-through towards $0.225 to verify breakout.

• Quantity: Peak surges of 61.8 million and 378.6 million verify institutional shopping for curiosity.

• Sample: Traditional consolidation adopted by impulsive breakout; upward trajectory if assist base holds.

• Futures OI: Secure round $3 billion, reflecting sustained leveraged curiosity regardless of macro volatility.

What Merchants Are Watching

• Whether or not DOGE can maintain above the $0.22 pivot and push towards $0.225–$0.23 resistance.

• The market’s response to Fed coverage shifts and Wyoming’s stablecoin launch — potential sector-wide tailwind.

• Whale accumulation patterns, already totaling 2 billion DOGE ($500M) this week.

• Mining sector enlargement by way of Thumzup’s acquisition and its impression on DOGE’s hashpower distribution.