Australia’s markets regulator is ready to develop its crackdown on on-line scams after taking down 14,000 on-line scams since July 2023, with over 3,000 purporting to contain crypto.

The net scams embrace funding scams, phishing web sites and are present in on-line commercials. ASIC Deputy Chair Sarah Courtroom stated in an announcement that ASIC’s funding rip-off enforcement efforts will now be expanded to incorporate social media adverts.

“The takedown functionality is one instance of how we’re monitoring the most recent traits and performing to guard Australians from those that attempt to steal from them.”

Worldwide losses from crypto hacks, scams, and exploits hit $2.47 billion within the first half of 2025, representing a virtually 3% improve in comparison with the $2.4 billion stolen in 2024.

Crypto a bigger portion of scams this yr

ASIC launched its rip-off disruption operation in July 2023, when it began utilizing its new takedown powers, which contain referring suspicious web sites to a third-party firm specializing in cybercrime detection for investigation and removing.

ASIC’s rip-off replace launched in August final yr revealed that roughly 8% of the scams it took down have been crypto-related and it averaged round 140 takedowns every week in 2024.

This yr, the typical quantity has fallen barely to 130 weekly takedowns.

ASIC stated among the most typical schemes included fraudsters pretending to make use of synthetic intelligence-powered buying and selling bots to generate returns, faux web sites impersonating legit ones and hoax information articles with fraudulent AI-generated movie star endorsements.

Final yr, ASIC flagged deepfakes and different AI-generated photos as a rising concern as a result of they made it harder for the typical individual to detect fraud.

Funding scams lead losses however traits downward

Funding scams stay the main kind of rip-off impacting Australians, with over $73 million in losses reported this yr thus far, in line with the nation’s Nationwide Anti-Rip-off Centre.

Nonetheless, losses seem to have decreased since no less than 2023, with $192 million stolen from victims in 2024 in comparison with $291 million throughout 2023.

Courtroom stated scammers are continually evolving ways, typically adopting the most recent expertise to dupe victims.

“Whereas the most recent knowledge reveals the coordinated work of the Nationwide Anti-Rip-off Centre is making progress within the battle in opposition to scams, there’s nonetheless extra work to do, and we urge Australians to remain vigilant,” she added.

Associated: Australia bans monetary adviser for 10 years for $9.6M crypto rip-off

In the meantime, ASIC reiterated that there needs to be a wholesome quantity of skepticism utilized to all testimonials, movie star endorsements, guarantees of AI-generated returns and investments supplied by way of WhatsApp, Telegram and different direct messaging packages.

Crypto ATMS are within the firing line as nicely

Australian regulators have additionally focused crypto ATMs this yr, which they think are linked to on-line scams in some instances.

Australia’s monetary intelligence company, AUSTRAC, and the Australian Federal Police (AFP) led a nationwide crackdown on felony use of crypto ATMs, together with pig butchering victims and suspected offenders, earlier this yr.

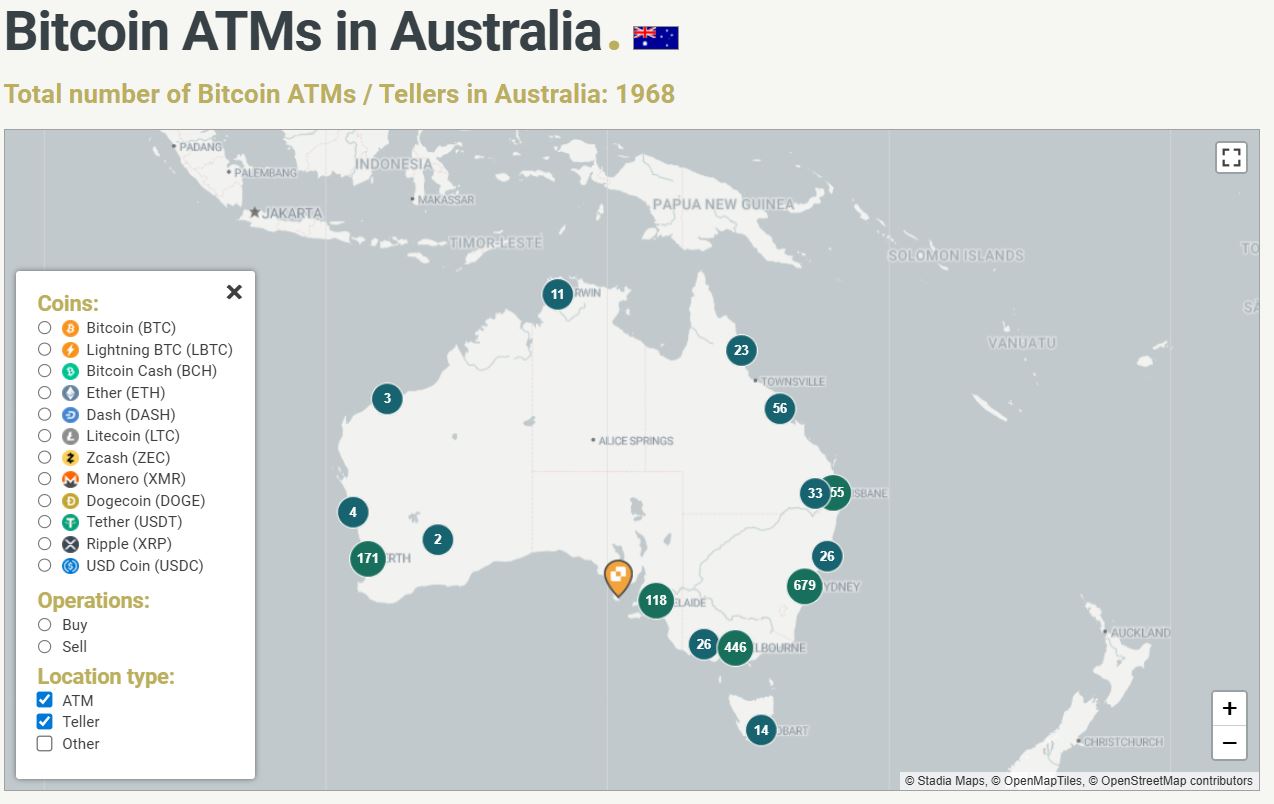

Australia has the world’s third-largest variety of crypto ATMs, with 1,968 and rising ultimately depend.

In June, AUSTRAC rolled out new working guidelines and transaction limits for crypto ATM operators to fight scams. Final December, the company additionally flagged crypto as a precedence for 2025.

Australia’s on-line cybercrime reporting system, ReportCyber, obtained 150 distinctive stories of scams involving crypto ATMs between January 2024 and January 2025, in line with the AFP, with losses exceeding $2 million ($3.1 million Australian {dollars}).

Journal: Can privateness survive in US crypto coverage after Roman Storm’s conviction?