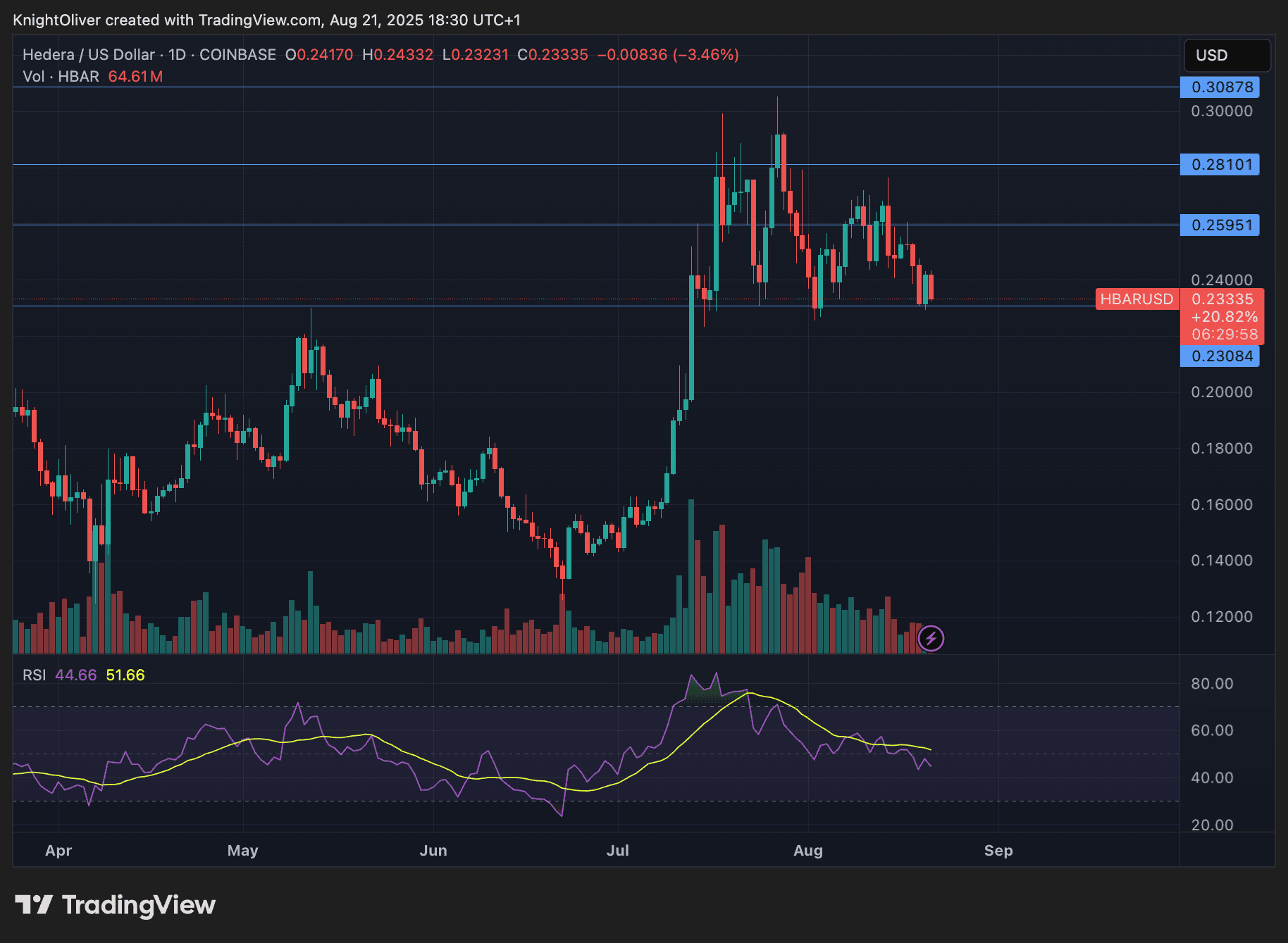

HBAR traded in a slim however energetic 4% vary from Aug. 20–21, climbing to $0.24 within the night earlier than correcting to $0.23 early the subsequent day. By session’s finish, the token had regained $0.24, reinforcing the $0.23–$0.24 band as a zone of help and accumulation.

The rebound comes as broader macro situations favor digital belongings. The Federal Reserve has stored charges under 2%, with markets more and more pricing in cuts that might present short-term momentum for crypto.

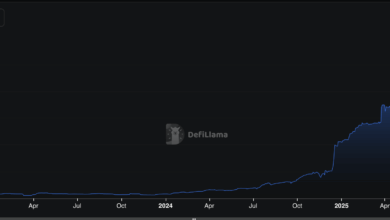

Institutional developments are additionally strengthening sentiment. International funds community SWIFT launched dwell blockchain trials that includes Hedera, whereas asset supervisor Grayscale filed a Delaware belief for HBAR — a transfer seen by some as laying groundwork for a future ETF.

Collectively, these elements spotlight rising institutional curiosity in enterprise blockchain infrastructure. As central banks and monetary establishments speed up testing of tokenized settlement programs, Hedera’s positioning inside world funds is gaining consideration. HBAR’s newest restoration might sign greater than intraday volatility — it displays rising confidence in Hedera’s position in digital finance.

Technical Indicators

- Worth demonstrated explosive volatility throughout 60-minute interval from 21 August 13:22 to 14:21, surging from $0.24 to peak of $0.24 representing 1% breakthrough.

- Closing quarter-hour demonstrated unprecedented bullish momentum as value rocketed from $0.24 to shut at $0.24 amid vital quantity spikes.

- Session showcased traditional help formation round $0.24 degree with a number of profitable retests.

- Resistance at $0.24 was decisively examined in closing section, suggesting robust institutional accumulation.

- Buying and selling volumes exceeded 2.8 million throughout breakout intervals indicating important market curiosity.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.