Rich households and household places of work throughout Asia are rising their cryptocurrency allocations, with some planning to allocate round 5% of their portfolios to the asset class. Reuters first reported the development, which famous a wave of demand from high-net-worth people throughout Singapore, Hong Kong and mainland China.

Wealth managers informed Reuters they’re receiving extra enquiries from purchasers, whereas cryptocurrency exchanges have reported rising buying and selling volumes and new crypto funds are drawing sturdy demand.

Jason Huang, founding father of NextGen Digital Enterprise, mentioned his firm raised over $100 million in just some months for a brand new long-short crypto fairness fund launched in Singapore in Might. His earlier fund, which wound down final 12 months, returned 375% in lower than two years.

UBS, the Swiss funding financial institution, famous that some abroad Chinese language household places of work are behind the shift, pointing to crypto allocations of round 5%. The financial institution mentioned second- and third-generation members of household places of work are starting to find out about and take part in digital belongings.

Cryptocurrency exchanges within the area have additionally reported extra exercise. Hong Kong’s HashKey Alternate mentioned its variety of registered customers rose 85% year-on-year by August 2025, whereas knowledge from CryptoQuant confirmed buying and selling volumes at South Korea’s three main exchanges had been up 17% up to now this 12 months, with common every day volumes climbing greater than 20%.

Associated: Asia’s tokenization growth is shifting capital away from the West: Skilled

Asia’s crypto growth has been retail-led till now

Till now, Asia’s crypto growth has been pushed from the underside up. Chainalysis knowledge exhibits the Central and Southern Asia and Oceania (CSAO) area noticed greater than $750 billion in inflows between mid-2023 and mid-2024, about 16.6% of worldwide quantity. The inflows had been powered primarily by retail customers making transactions beneath $10,000 for buying and selling, remittances and decentralized finance (DeFi).

Within the 2024 International Crypto Adoption Index from Chainalysis, India ranked first worldwide, with retail buyers driving exercise on centralized exchanges. Indonesia positioned third, pushed by grassroots DeFi participation and a fast-growing Web3 sector.

Vietnam ranked fifth, with adoption unfold throughout each centralized platforms and DeFi. And the Philippines got here in eighth, the place crypto is extensively used for remittances and play-to-earn gaming.

Singapore has additionally emerged as a hub for crypto funds. Chainalysis knowledge confirmed that service provider providers within the nation processed practically $1 billion price of cryptocurrency within the second quarter of 2024, with stablecoin transfers extensively used for retail-level transactions.

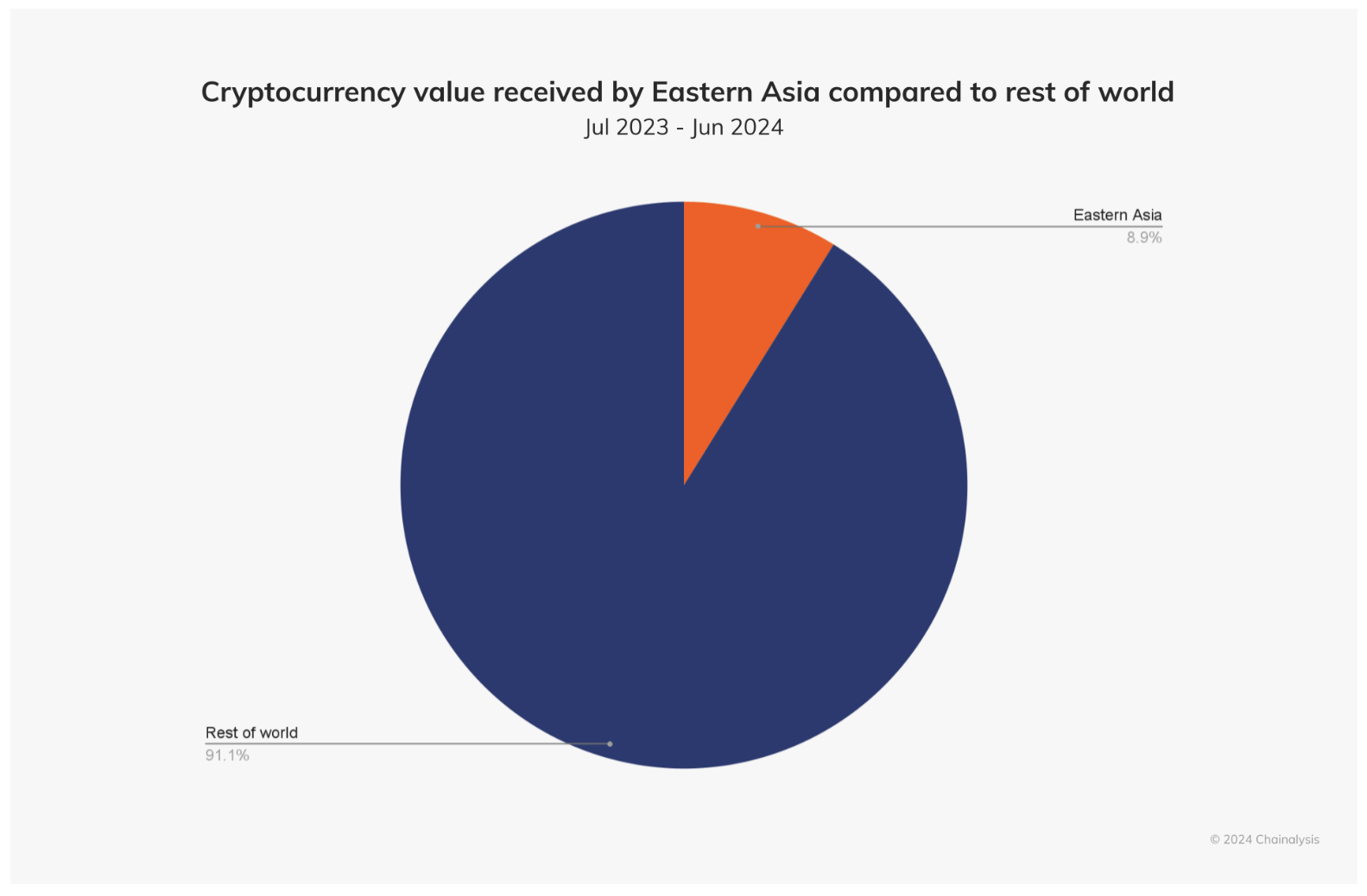

However East Asia has been telling a distinct story. The area added practically $400 billion over the identical interval, with exercise formed extra by skilled and institutional buyers, and in some circumstances, by rich residents utilizing crypto as a retailer of worth.

South Korea obtained about $130 billion in crypto, making it the area’s largest market. Skilled merchants drove a lot of this exercise by means of altcoins and stablecoins, and with arbitrage methods tied to the “kimchi premium.”

Hong Kong posted the area’s quickest development, with exercise up 85.6% year-on-year. Greater than 40% of inflows got here from stablecoins, whereas the approval of three spot Bitcoin (BTC) and three Ether (ETH) alternate traded funds (ETFs) in April 2024 spurred institutional flows and a shift towards direct BTC and ETH holdings.

In China, exercise shifted to OTC and P2P platforms after the 2021 crackdown on exchanges. Rich residents have more and more used crypto to protect belongings and transfer cash overseas, with flows rising in late 2023 because the property market weakened and inventory indexes fell.

Asia additionally accounts for 32% of lively crypto builders, in accordance with the 2024 Electrical Capital Developer Report. That’s up from simply 12% in 2015, with 41% of latest crypto builders now originating from the area.

Asia Categorical: ‘China’s MicroStrategy’ Meitu sells all its Bitcoin and Ethereum