Key takeaways:

-

XRP closed under $3, however a fractal sample suggests a bullish This autumn setup, with a possible rally towards $4.35 to $4.85.

-

Whale flows stay detrimental, hinting at near-term draw back earlier than doable reaccumulation within the $2.65 to $2.33 vary.

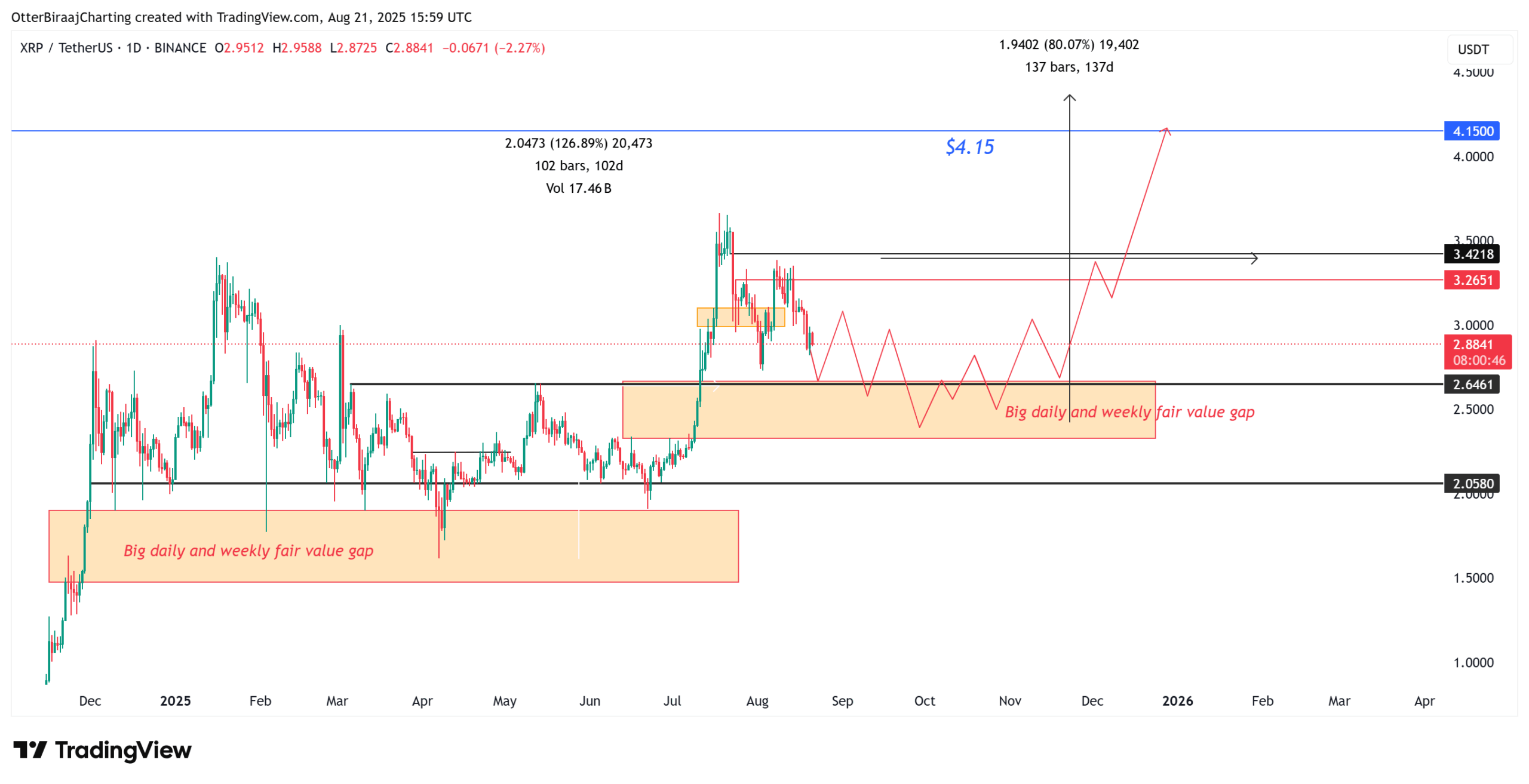

XRP (XRP) closed a every day candle under the $3 psychological stage on Aug. 19, extending its two-week correction. Whereas near-term seasonality seems bearish, the long-term outlook stays constructive, supported by a recurring market fractal sample.

A market fractal refers to a repeating worth construction noticed throughout completely different timeframes, the place related setups typically yield comparable outcomes. On XRP’s every day chart, the present construction mirrors one noticed earlier this 12 months. In January 2025, XRP rallied to $3.40 earlier than correcting steadily to $1.60 in April.

That native backside emerged after worth tapped into liquidity inside each a every day and weekly truthful worth hole (FVG). Larger-timeframe imbalances sometimes maintain extra weight, as they spotlight areas the place larger dealer bids and liquidity are concentrated.

In July, XRP rebounded sharply, forming a brand new native excessive at $3.66. At the moment, the chart outlines a comparable setup, with a recent FVG seen between $2.32 and $2.66. If this imbalance is stuffed, the chance of a renewed enlargement part will increase, probably setting the stage for a breakout rally.

Based mostly on the speed of diminishing returns, XRP might see good points of 60–85% in This autumn, with upside potential towards $4.35. The important inflection lies at $3.85, above which XRP would enter worth discovery.

Coupled with supportive macroeconomic components like potential US rate of interest cuts, XRP might maintain momentum past preliminary targets, extending the rally over a number of weeks. Whereas short-term volatility stays probably, the broader construction suggests bullish continuation into This autumn.

Associated: Value predictions 8/20: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LINK, HYPE, XLM

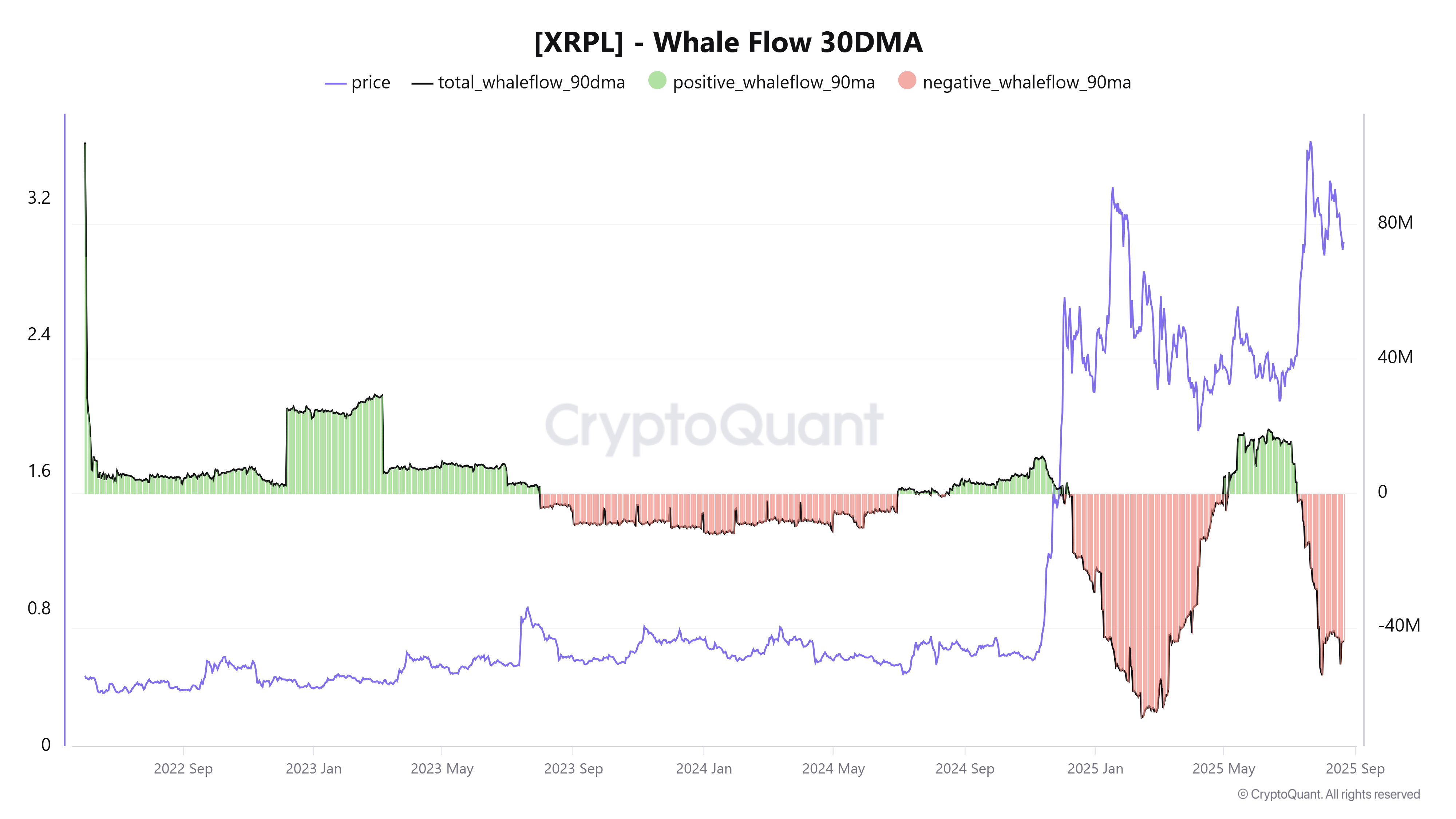

Unfavorable XRP whale flows trace at exhaustion

Latest onchain knowledge exhibits that enormous XRP holders, or “whale addresses,” have been decreasing their positions, however promoting stress is approaching exhaustion.

The same wave of promoting was noticed in Q2, coinciding with XRP’s broader correction. At the moment, the 90-day transferring common of whale netflows suggests a peak in distribution, which might flip constructive as costs development decrease.

Traditionally, whale exercise has performed a important function in shaping market course. Throughout H2 2024, vital accumulation occurred between $2.00 and $2.50, the place whales constructed sizeable positions forward of XRP’s rally. A comparable setup could also be unfolding, with accumulation zones prone to reemerge round $2.65–$2.33.

Associated: XRP’s worth downtrend might proceed: Right here’s 4 explanation why

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.