Immediately in crypto, cryptocurrency trade Gemini acquired a Markets in Crypto-Property Regulation (MiCA) license in Malta, US Fed governor Christopher Waller has urged his friends to not worry decentralized finance (DeFi) and the blockchain, and US Senator Cynthia Lummis mentioned the digital asset market construction invoice is on monitor to reach on President Trump’s desk by the top of the yr.

Gemini receives MiCA license in Malta after Might derivatives approval

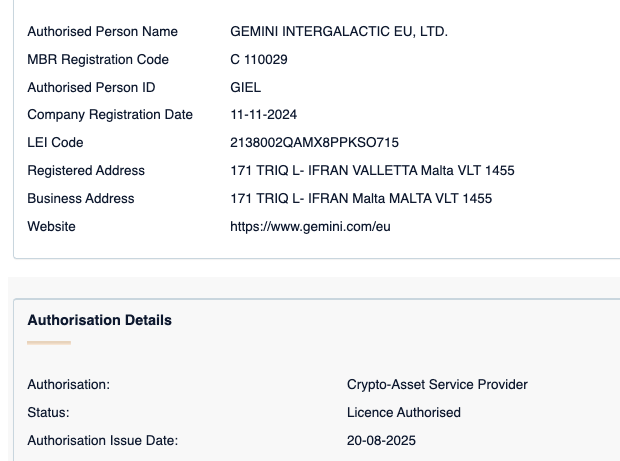

The Cameron and Tyler Winklevoss-owned Gemini trade secured a MiCA license from the Malta Monetary Companies Authority (MFSA) on Wednesday, in accordance with official MFSA information.

“Receiving this approval marks a crucial milestone in our regulated European enlargement, as it would permit us to develop our safe and dependable crypto merchandise for purchasers in over 30 European international locations and jurisdictions,” Gemini mentioned in a press release shared with Cointelegraph.

The regulatory milestone got here shortly after Gemini filed to record its Class A typical inventory on the Nasdaq World Choose Market below the ticker GEMI final Friday.

“Immediately’s announcement cements Gemini’s long-standing dedication to upholding the very best requirements of regulatory compliance as we scale within the area,” Gemini mentioned, highlighting the significance of MiCA for crypto adoption.

“We imagine that clear regulation of the trade is the muse of worldwide crypto adoption, and MiCA’s implementation has confirmed that Europe is among the most progressive and forward-thinking areas relating to this,” Gemini’s assertion added.

Gemini additionally holds a Markets in Monetary Devices Directive (MiFID II) license, acquired in Might, permitting the trade to supply derivatives within the European market.

In keeping with energetic enlargement within the EU, Gemini rolled out a tokenized shares providing on the Arbitrum blockchain in late June, focusing on European prospects.

Not like conventional inventory choices, tokenized shares permit customers to commerce tokenized shares of firms like Michael Saylor’s Technique (MSTR) with 24/7 market entry.

Fed governor tells bankers DeFi is “nothing to be afraid of”

US Federal Reserve Governor Christopher Waller informed his friends and the non-public banking sector that there’s “nothing to be afraid of” about crypto funds regardless of it working outdoors the standard banking system.

“There may be nothing scary about this simply because it happens within the decentralized finance or DeFi world — that is merely new know-how to switch objects and report transactions,” he mentioned throughout a speech on the Wyoming Blockchain Symposium 2025 on Wednesday.

Leveraging progressive tech to construct new cost providers isn’t a “new story,” Waller mentioned as he pitched policymakers and the non-public banking sector to work collectively on crypto cost infrastructure. “There may be nothing to be afraid of when eager about utilizing good contracts, tokenization, or distributed ledgers in on a regular basis transactions.”

Waller’s pro-crypto views may quickly have extra weight, as he’s thought-about a front-runner to interchange Jerome Powell as Fed chair.

Lummis gives a timeline on crypto market construction invoice

Wyoming Senator Cynthia Lummis mentioned the long-awaited US market construction invoice may attain President Trump’s desk “earlier than the top of the yr,” setting the stage for implementation in 2026.

Talking on the Wyoming Blockchain Symposium on Wednesday, Lummis pointed to Thanksgiving as a possible inflection level.

The Home authorised the Digital Asset Market Readability (CLARITY) Act in July, and Republicans at the moment are pushing to advance it by means of the Senate. Lummis and different lawmakers say their very own proposal — the Accountable Monetary Innovation Act — will “construct” on the CLARITY framework.

“We […] wish to honor as a lot of the Home’s work as we will on CLARITY as a result of that they had a strong bipartisan vote,” Lummis mentioned. “CLARITY will in all probability find yourself being what we move, however CLARITY as tweaked by the Senate.”