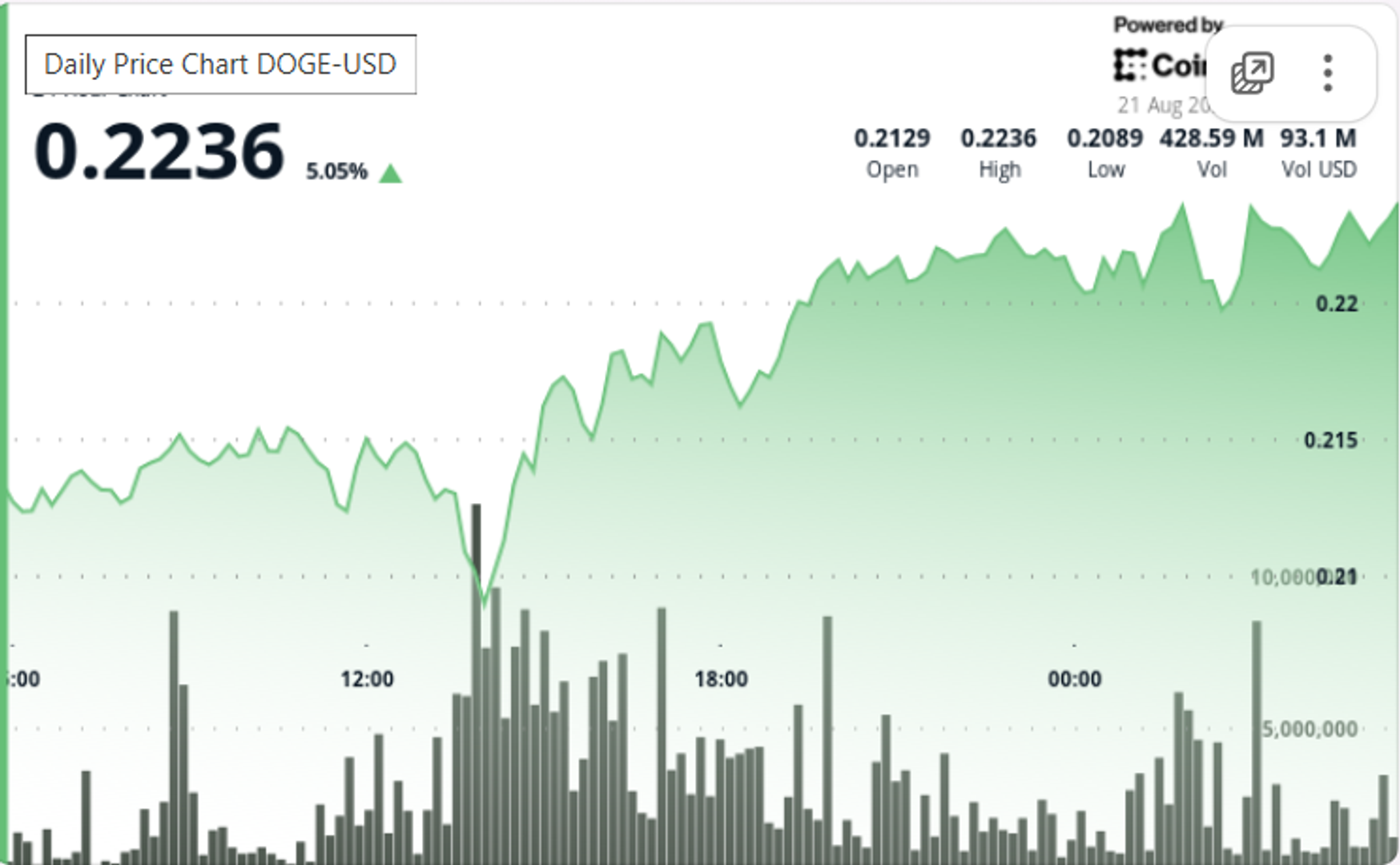

Dogecoin rebounded sharply from $0.21 lows, closing at $0.22 after a late-session surge in quantity and aggressive whale accumulation, at the same time as safety dangers from Qubic’s assault risk linger.

Information Background

- DOGE has confronted strain this month after experiences tied to Qubic’s potential 51% assault spooked retail merchants and drove promoting.

- Regardless of these dangers, on-chain knowledge reveals whale cohorts collected greater than 680 million DOGE in August, offsetting retail outflows.

- Broader market sentiment has been blended, with Bitcoin and Ethereum consolidating close to highs, leaving memecoins buying and selling with outsized volatility.

Value Motion Abstract

- DOGE superior 5% within the 24 hours ending Aug. 21, 04:00, recovering from an intraday backside of $0.21 to shut at $0.22.

- The token hit its session low round 13:00 UTC on Aug. 20 earlier than reversing course in a V-shaped restoration.

- Buying and selling quantity spiked to 9.29 million within the closing hour, including 0.45% within the final stretch and confirming institutional-sized flows.

- Whales collected 680 million DOGE via August, positioning regardless of ongoing considerations round Qubic’s potential 51% assault.

Technical Evaluation

- Key assist held at $0.21, examined at mid-session earlier than high-volume reversal.

- Resistance emerged at $0.22, setting a $0.01 buying and selling vary for the session.

- A breakout was triggered at 04:31 UTC with the 9.29 million quantity spike marking the session pivot.

- Sustained turnover at 6.8 million per minute throughout the closing hour factors to bigger consumers driving momentum.

What Merchants Are Watching

- Whether or not $0.22 can flip from resistance into assist, opening path towards $0.23–$0.24.

- Continued whale positioning developments towards the backdrop of Qubic safety considerations.

- Power of follow-through shopping for after the late-session quantity burst, which is able to affirm if the V-shaped restoration has legs.