A US choose has unfrozen $57.6 million in USDC (USDC) stablecoins tied to the Libra token scandal in February, giving memecoin promoter Hayden Davis and former CEO of the Meteora decentralized change Ben Chow entry to the funds.

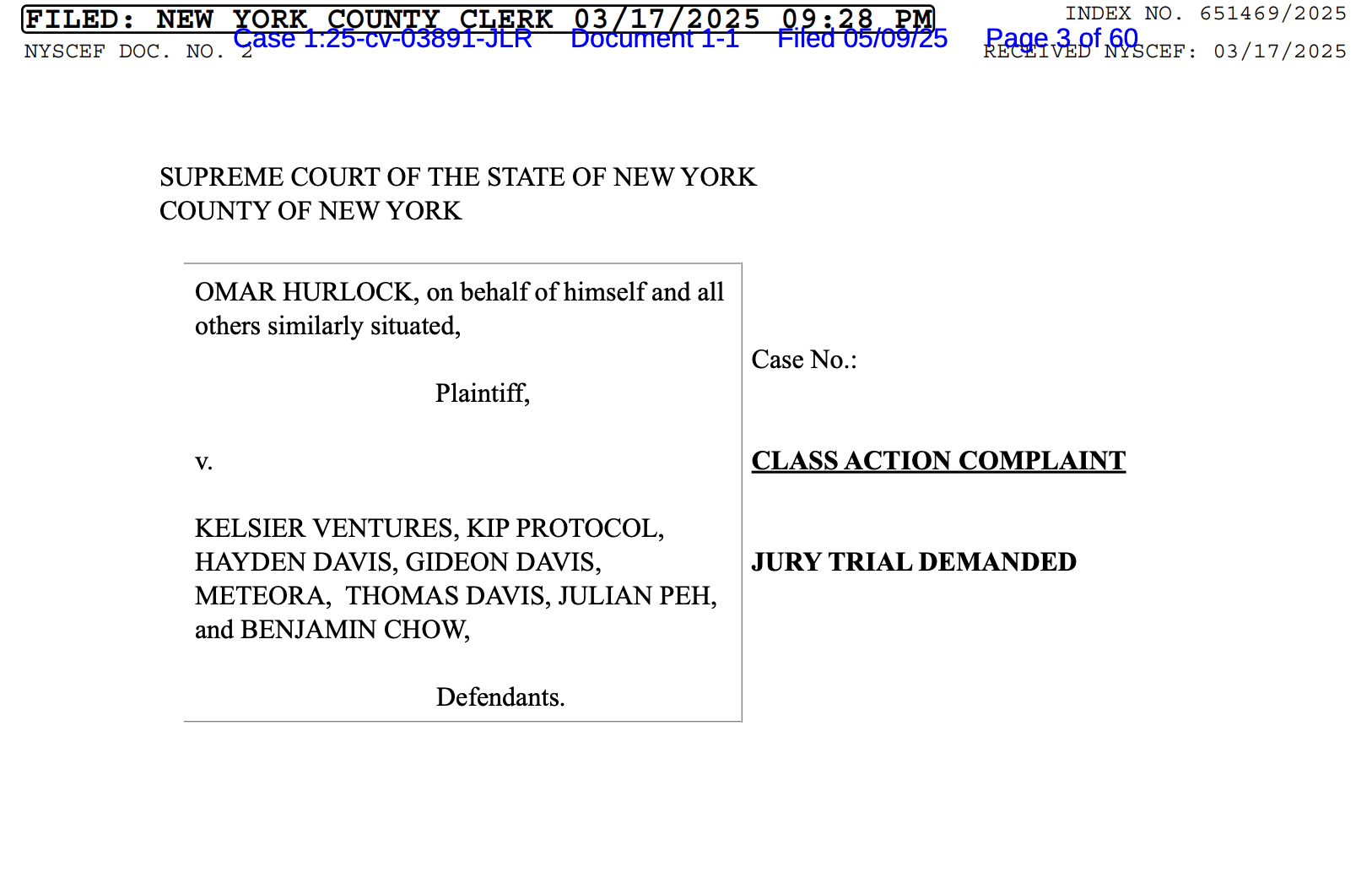

US choose Jennifer L. Rochon froze the funds in Could as a part of a listening to in a class-action lawsuit towards Davis, Chow, blockchain infrastructure firm KIP Protocol and KIP’s co-founder, Julian Peh.

The Decide stated the defendants didn’t show “irreparable” hurt as a result of the funds to reimburse victims are nonetheless out there, and the defendants have made no effort to maneuver the frozen funds, in line with Law360.

In July, Davis filed a movement to dismiss the lawsuit towards him, which was denied as “moot” by the court docket. Regardless of this, Rochon stated she was uncertain that the class-action lawsuit towards Davis, Chow and others would succeed.

The Libra token scandal is taken into account one of the vital important rug pulls in historical past, drawing in Argentine President Javier Milei, prompting an ethics investigation into the chief and class-action lawsuits from buyers.

Associated: From Coinbase to Milei and LIBRA: Crypto class-action fits pile up

The Libra token scandal and the aftermath that rocked the crypto world

The Libra token launched in February, billing itself as a mission to assist assist Argentina’s small companies, and was initially promoted by Milei on social media.

Libra crashed and burned inside hours of launching, prompting widespread backlash from buyers who have been caught up in what was characterised as a $107 million rug pull.

Milei distanced himself from the token, denying data of the mission’s fundamentals and backtracking on the preliminary promotion.

“A couple of hours in the past, I posted a tweet, like so many different numerous occasions, supporting a supposed personal enterprise with which I clearly don’t have any connection,” Milei wrote in a Feb. 14 X publish.

The assertion did little to stem a congressional probe into Milei for attainable ethics violations and calls from Argentine lawmakers to question Milei.

Nevertheless, Milei closed the investigation and disbanded the duty pressure with none costs or findings of wrongdoing towards the president’s workplace, prompting allegations of a politically motivated cover-up.

Journal: Crypto merchants ‘idiot themselves’ with worth predictions: Peter Brandt