Key takeaways:

-

Ether’s futures premium and derivatives stay steady, reflecting resilience regardless of the latest value downturn.

-

Onchain metrics spotlight Ethereum’s dominance in charges and TVL, supporting stronger long-term restoration potential.

Ether (ETH) seems to have discovered assist close to $4,070 on Wednesday after a pointy six-day, 15.1% drop. The transfer erased $817 million in bullish leveraged positions however did not set off a broad bearish shift. As a substitute, ETH derivatives present merchants stay unfazed by extra draw back, suggesting $4,700 stays inside attain.

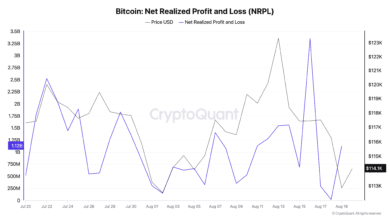

ETH’s annualized futures premium stayed above the impartial 5% threshold all through the decline, signaling confidence. Month-to-month futures sometimes commerce larger than spot markets to mirror the longer settlement interval, but the final significant bullish sign from this metric got here in January. Even the 100% ETH rally between July 1 and Aug. 13 couldn’t totally restore dealer optimism.

Financial uncertainty dents investor sentiment

A part of this hesitation stems from macroeconomic uncertainty. US inflation stays caught above the Federal Reserve’s 2% aim, whereas financial progress exhibits uneven alerts. The Nasdaq Composite fell for a second straight session on Wednesday, pressured by considerations that synthetic intelligence shares could also be excessively valued.

CNBC reported merchants trimmed positions forward of US Federal Reserve Chair Jerome Powell’s Friday remarks. “If Powell’s language is extra hawkish, that might strain tech shares even additional,” famous Carol Schleif, chief market strategist at BMO Non-public Wealth. In the meantime, retailer Goal’s weaker earnings underscored stress on profitability.

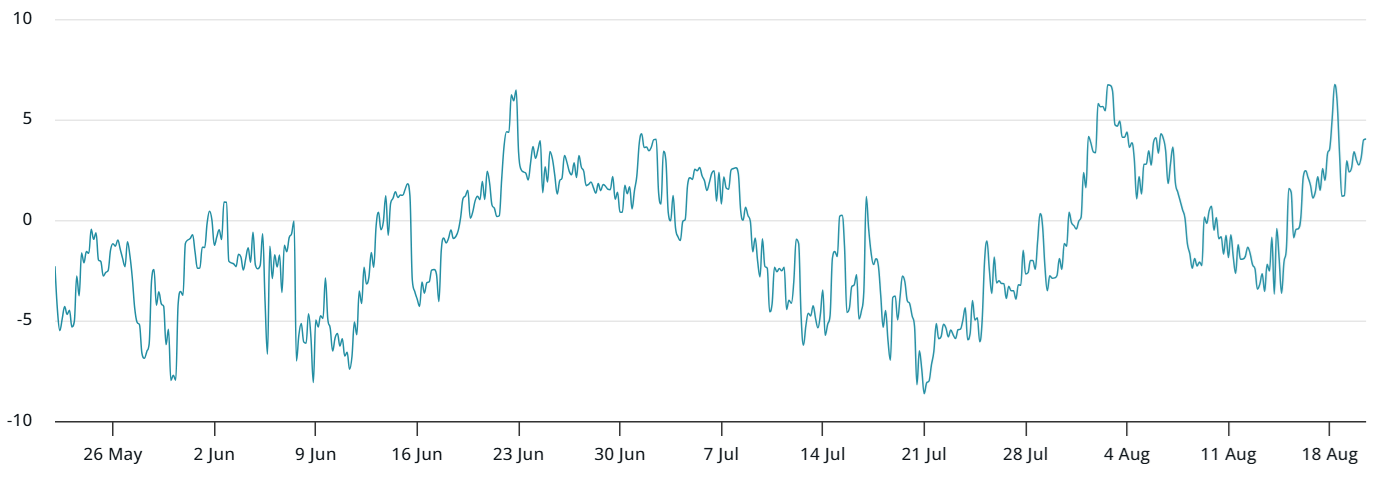

Opposite to expectations, ETH choices recommend a impartial stance, with balanced demand for each draw back and upside safety. The present 4% studying signifies an excellent cut up between put (promote) and name (purchase) curiosity. Nonetheless, the absence of stronger optimism after ETH briefly traded above $4,700 is considerably troubling, because it alerts hesitation towards calling a brand new all-time excessive.

Ethereum onchain exercise alerts larger demand for ETH

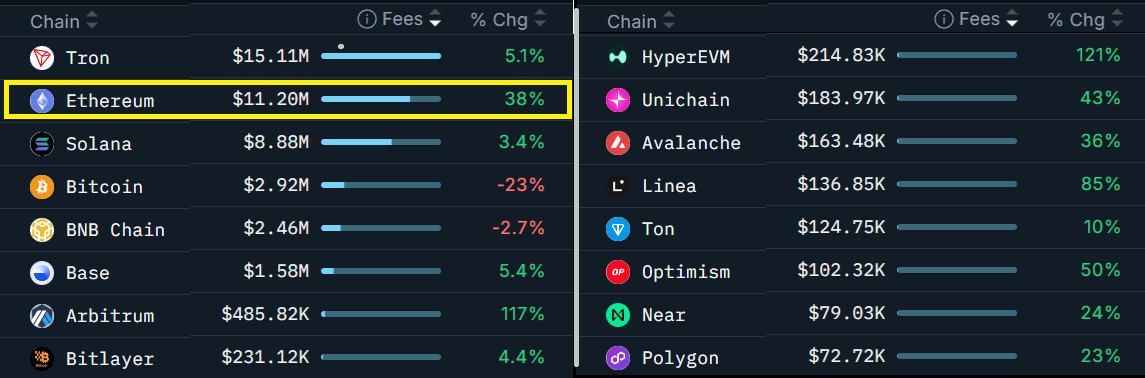

Onchain exercise paints a extra constructive image. Ethereum continues to broaden its dominance over rivals, securing roughly 60% of the market’s complete worth locked (TVL), based on DefiLlama. Much more related, community charges are climbing, reflecting stronger demand for blockspace, which helps Ether’s value restoration.

Ethereum’s 7-day charges climbed to $11.2 million on Wednesday, a 38% improve from the prior week. For comparability, Solana’s charges rose simply 3% whereas BNB Chain revenues declined by 3%. This divergence highlights Ethereum’s dominance in decentralized change volumes, which reached $129.7 billion over the previous 30 days, based on DefiLlama.

Associated: Bitcoin, Ether ETFs submit virtually $1B outflows as costs slide

Whereas Ether derivatives nonetheless recommend warning, that stance displays the broader crypto market correction slightly than Ethereum’s fundamentals. Merchants seem cautious that US import tariffs may weigh on international progress, pushing buyers towards threat aversion.

Finally, ETH’s path to reclaiming $4,700 hinges on a decline in buyers’ worry concerning the financial system. Nonetheless, derivatives knowledge point out skilled merchants stay composed, exhibiting no indicators of panic even after the $4,100 retest, supporting the case that Ether’s restoration rests on firmer floor than many initially assumed.

This text is for normal data functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don’t essentially mirror or symbolize the views and opinions of Cointelegraph.