Chainlink’s LINK has rallied to its highest stage in seven months, fueled by large-scale whale accumulation and a gentle stream of recent institutional partnerships.

In line with CryptoSlate’s knowledge, LINK’s worth peaked above $26 on Aug. 18 following a month-long rally of round 30% earlier than easing again to $24.71 at press time.

Notably, the crypto token posted the only real inexperienced candle among the many prime 15 cryptocurrencies by market capitalization over the last 24 hours.

What’s driving LINK’s worth?

A key driver of LINK’s rally has been heightened exercise within the derivatives market.

CoinGlass knowledge reveals that open curiosity in LINK futures has hit an all-time excessive of $1.5 billion, a virtually 60% improve for the reason that begin of 2025.

Open curiosity tracks the entire variety of lively futures contracts, and rising ranges are usually interpreted as an indication that merchants are assured within the asset’s trajectory.

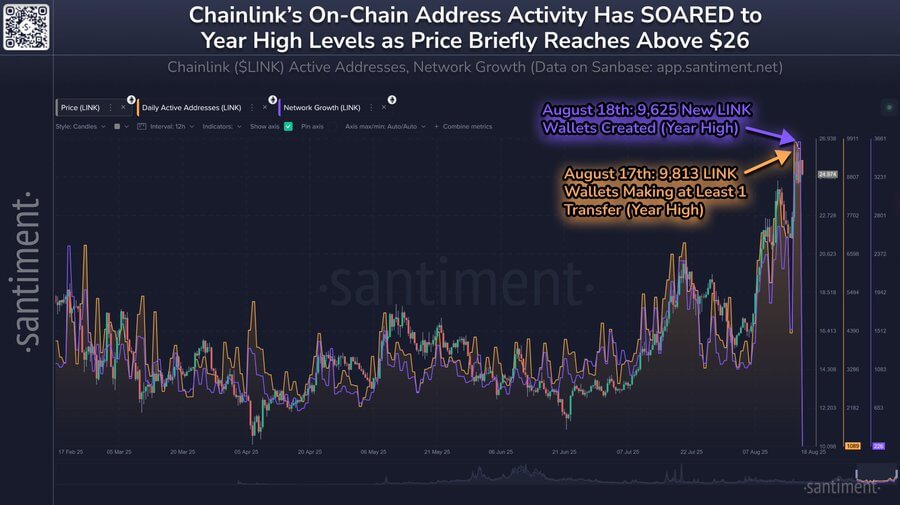

Notably, on-chain exercise on the blockchain community paints the same image of market enthusiasm.

Knowledge from Santiment exhibits that almost 9,813 addresses processed LINK transfers on Aug. 17 alone, whereas greater than 9,600 new wallets have been created the next day.

These figures symbolize the best engagement ranges of the 12 months, pointing to a broadening person base alongside worth momentum.

On the similar time, the community’s whale exercise has additionally strengthened the bullish outlook.

Blockchain evaluation platform Lookonchain reported {that a} whale pockets withdrew roughly 1.29 million LINK, value $31 million, from Binance over 4 days.

Sometimes, strikes of this measurement point out long-term holding intentions reasonably than instant promoting. This additional strengthens the market sentiment surrounding LINK and exhibits its traders are in it for the lengthy haul.

Chainlink’s institutional adoption rises

Exterior of those key metrics, Chainlink continues to broaden its attain into conventional finance via a number of high-profile collaborations.

On Aug. 18, Chainlink’s neighborhood liaison Zach Rynes highlighted greater than 30 companies testing or piloting the blockchain community’s options on their platforms.

In line with him:

“[Chainlink] is verifiably working with the most important establishments on the planet on adopting blockchains and tokenized property by way of a unified and modular platform that already powers the overwhelming majority of DeFi.”

The listing consists of monetary heavyweights like Swift, Visa, Mastercard, Citi, JPMorgan, BNY Mellon, and Constancy Worldwide, alongside main infrastructure gamers like ICE, Euroclear, and Clearstream.

Moreover, central banks and huge regional lenders in Brazil, Europe, and Asia are additionally experimenting with Chainlink-powered expertise.

These collaborations exhibit that Chainlink is positioning itself because the spine of blockchain connectivity for world markets.