After enduring a drawdown of greater than 55% earlier this yr and lagging friends amid tariff-driven risk-off sentiment, ether (ETH) has staged a robust comeback, Wall Avenue financial institution Citi (C) mentioned in a analysis report on Tuesday.

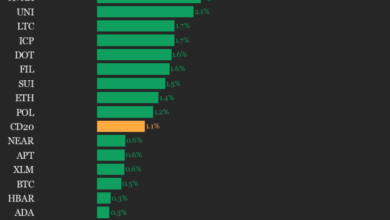

The second-largest cryptocurrency is now up almost 30% year-to-date, testing bitcoin’s (BTC) dominance in a means not seen since late final yr. This time, nevertheless, ether is taking market share relatively than ceding it, the report mentioned.

Spot ether exchange-traded funds (ETFs) have seen a surge of demand. Cumulative web inflows now high $13 billion, up from simply $2.6 billion in April, analysts Alex Saunders and Nathaniel Rupert wrote.

As ETF balances develop, flows are enjoying a extra direct position in value dynamics, the analysts mentioned.

Ether treasury companies have additionally joined the bid, with giant purchases starting in Could. Their collective holdings now hover close to $10 billion at present market values, whereas the fairness valuations of those firms have expanded alongside ether’s rally, the report famous.

Blockchain information reveals giant wallets accumulating ether whereas smaller buyers trim publicity. Ether balances on centralized exchanges proceed to say no, signaling a shift of provide again on-chain. This dynamic may very well be amplifying the newest leg greater, making a squeeze-like impact, the report added.

Whereas the rally has been sharp, the financial institution’s analysts warning it isn’t purely technical. On-chain exercise has picked up, reinforcing the transfer with stronger fundamentals. Mixed with a macro backdrop that resembles a “goldilocks” atmosphere, neither too scorching nor too chilly, ether’s resurgence may have legs, notably with supportive regulatory indicators and bullish narratives in play.

Learn extra: Ether-Led Rally Pushed Crypto Market Cap to $3.7T in July: JPMorgan