This can be a every day evaluation by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin

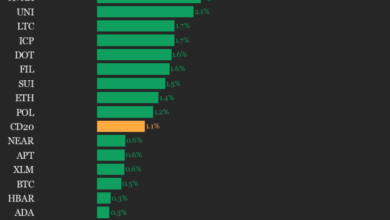

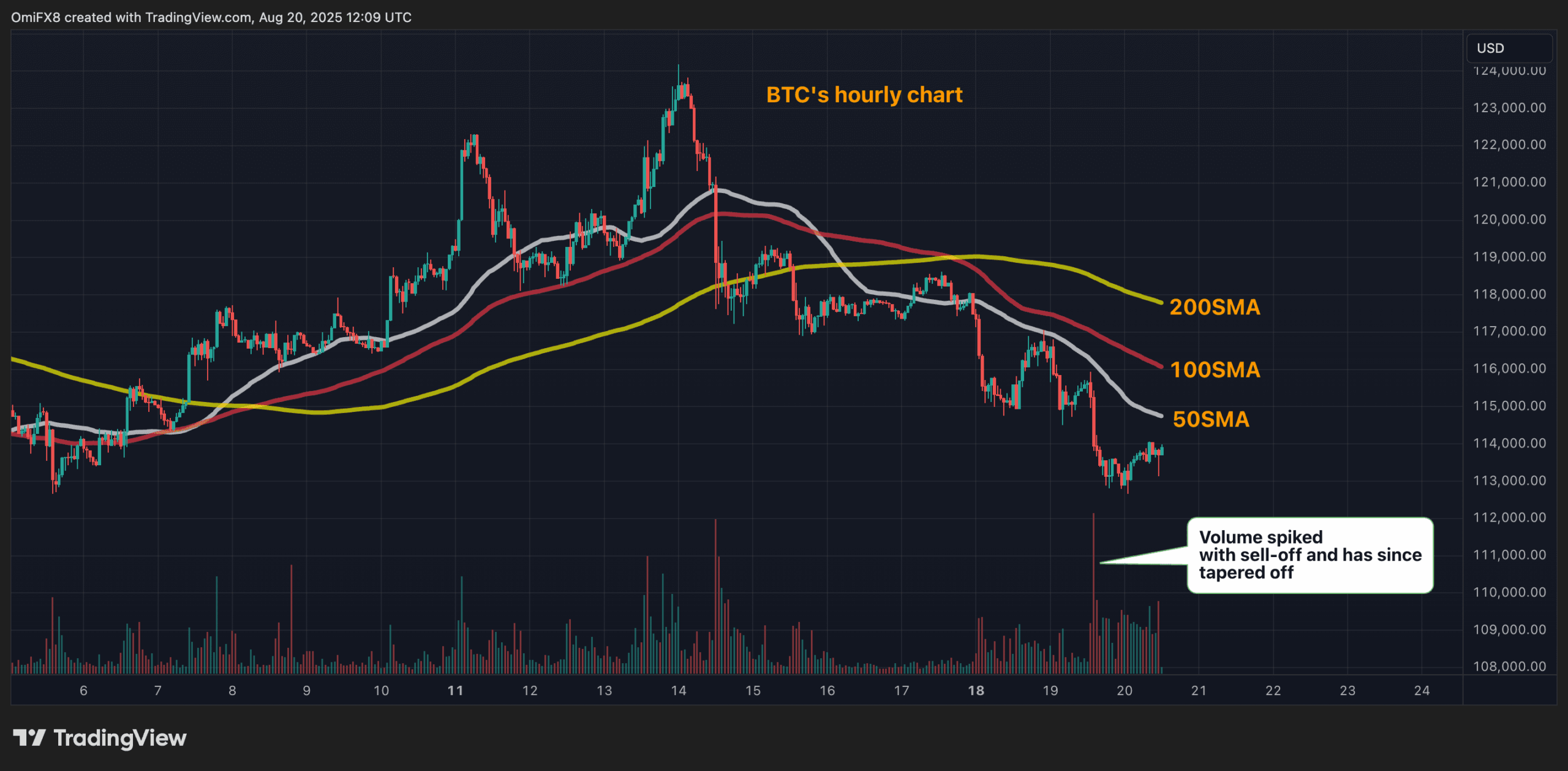

bulls try to ascertain an interim low round $113,000, however the effort seems weak by way of each value and quantity. Thus far, the bounce has been barely notable, with upside capped above $114,000. Moreover, volumes have stayed low relative to what we noticed in the course of the early Tuesday drop, as seen on the hourly chart.

The weak bounce is per bearish momentum alerts, because the 50-, 100-, and 200-hour easy transferring averages (SMAs) are aligned in descending order and trending downward.

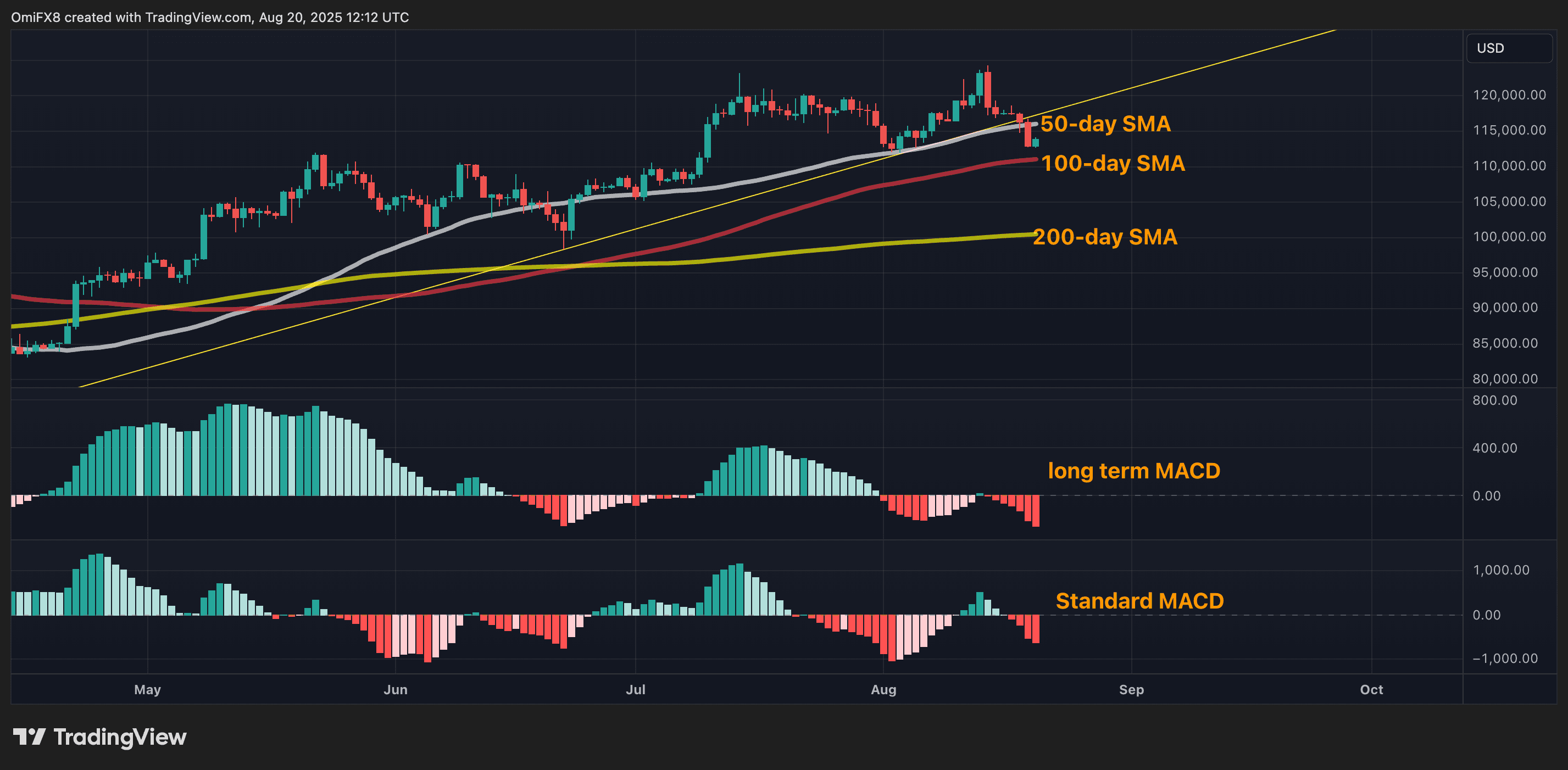

On the every day chart, costs have convincingly damaged beneath the rising trendline assist, signaling a shift from bullish to bearish momentum. Each the longer-term MACD histogram (50,100,9) and the extra generally used MACD (12,26,0) are exhibiting growing detrimental momentum, with deeper bars beneath the zero line.

Subsequently, the percentages seem like stacked in favor of a continued transfer decrease. The primary degree of assist is $11,982, from which the market turned larger on Aug. 3. The 100-day SMA is seen at $11,053. If these ranges are taken out, the main target would shift to the 200-day SMA at $100,484.

A convincing transfer above the 50-day SMA at $116,033 would negate the bearish outlook.

- Resistance: $116,033, $120,000, $122,056.

- Assist: $111,982, $110,053, $100,484.

Learn extra: Markets At present: Bitcoin, Ether Get better From Lows Earlier than FOMC Minutes