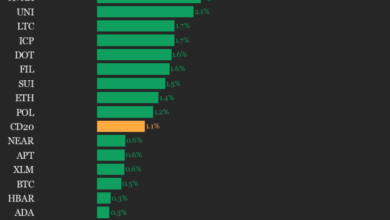

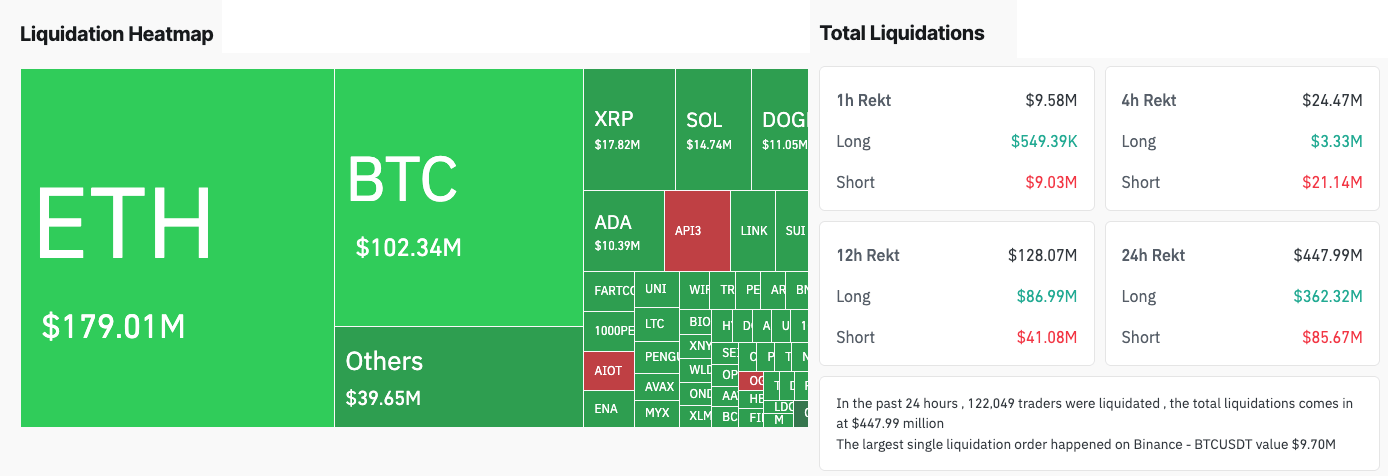

The crypto market noticed heavy liquidations totaling $449.11 million, with the overwhelming majority coming from longs. Out of this determine, $362.34 million got here from longs and simply $87 million from shorts, exhibiting that almost all merchants have been positioned for the upside.

Bybit and Binance dominated exercise, accounting for $166.53 million and $140.36 million in liquidations, respectively, whereas OKX and Gate adopted at a distance.

Ethereum was on the heart of this transfer, recording $179 million in pressured closures, the most important amongst all property. Bitcoin adopted with $102.34 million.

The focus of liquidations in ETH displays its sharper worth drop: Ethereum fell practically 6% over the interval, closing close to $4,073, whereas Bitcoin misplaced about 2.78% to $112,604. The size of ETH’s decline relative to BTC made leveraged longs significantly susceptible, which explains why ETH outweighed BTC regardless of Bitcoin’s bigger market measurement.

The hourly breakdown reveals that many of the wipeouts got here in clusters, with $128.49 million liquidated in simply 12 hours. The only largest liquidation order, valued at $9.7 million, occurred on Binance within the BTCUSDT pair.

Throughout exchanges, liquidation ratios additionally confirmed how skewed merchants have been. On HTX and CoinEx, greater than 86% of liquidations got here from longs, whereas Bitfinex recorded an excessive 99.9% on the lengthy facet.

Even on exchanges with extra balanced exercise, reminiscent of OKX and Hyperliquid, liquidations leaned closely in opposition to longs. This sample tells us that the liquidation cascade was not the results of a broad two-way flush however somewhat a concentrated squeeze on lengthy positions.