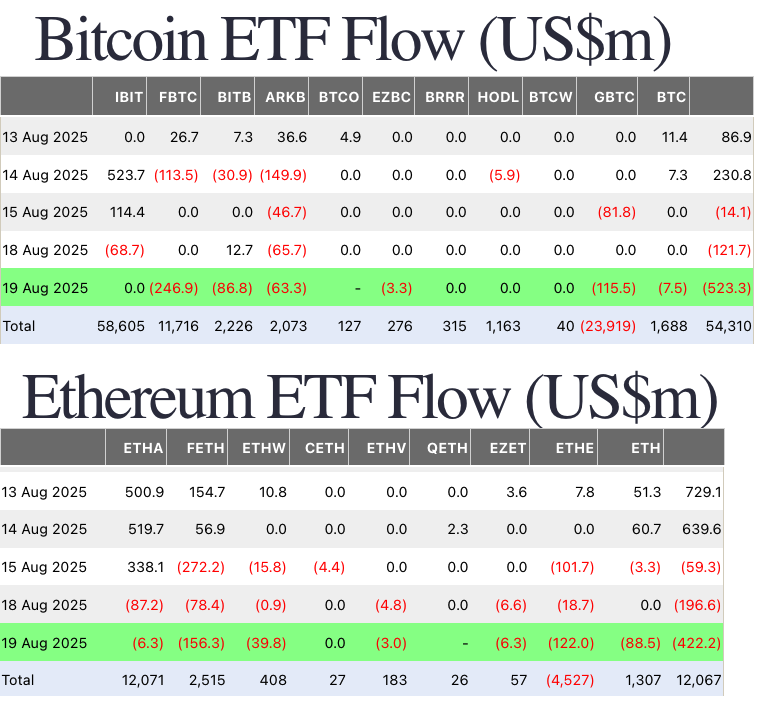

Cryptocurrency funding merchandise expanded losses on Tuesday, with Bitcoin fund outflows surging greater than 300% and Ether losses doubling, each rating because the second-largest outflows this month.

Spot Bitcoin (BTC) exchange-traded funds (ETFs) noticed $523 million in outflows on Tuesday, rising greater than fourfold from Monday’s, in line with Farside Traders knowledge.

Ether (ETH) ETFs additionally recorded main losses, with outflows doubling from round $200 million on Monday to $422 million.

Bitcoin and Ether funds have posted three consecutive days of outflows totaling $1.3 billion, coinciding with sharp value corrections of 8.3% and 10.8% since final Wednesday, in line with CoinGecko.

Constancy leads outflows with over $400 million

Constancy Investments led yesterday’s losses with outflows of $247 million from its Constancy Sensible Origin Bitcoin Fund (FBTC) and $156 million from the Constancy Ethereum Fund (FETH), totaling $403 million in day by day withdrawals.

Grayscale Investments additionally skilled substantial withdrawals, with the Grayscale Bitcoin Belief ETF (GBTC) reporting $116 million in outflows and the Grayscale Ethereum Belief (ETHE) shedding $122 million in outflows.

In distinction, BlackRock’s iShares Bitcoin Belief ETF (IBIT) skilled no outflows, and the iShares Ethereum Belief ETF (ETHA) recorded solely modest outflows of $6 million.

Worry & Greed Index slips to “Worry”

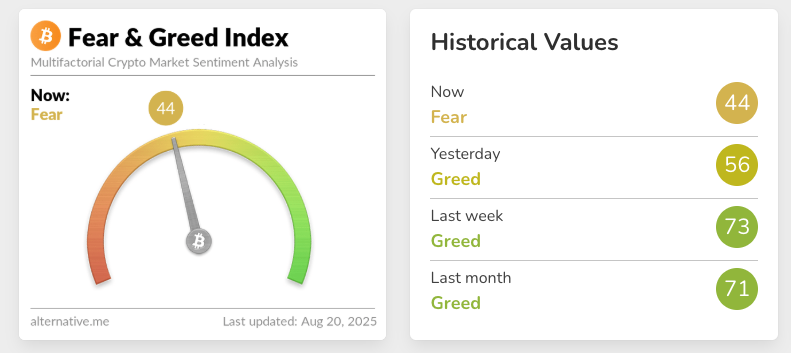

Though the three-day outflows pale compared to the record-breaking inflows for each Bitcoin and Ether funds in 2025, the losses sign a notable shift in investor sentiment amid declining costs.

On Wednesday, the Crypto Worry and Greed Index — a instrument monitoring the general sentiment of the crypto market — flipped to “Worry,” registering a rating of 44. This variation follows a chronic interval of optimism, indicating rising warning amongst buyers.

Whereas many social media commentators have raised issues concerning the latest outflows, main ETF analysts have but to touch upon the losses, suggesting it could be too early to attract conclusions.

Associated: SEC pushes again choices on Fact Social, Solana, XRP crypto ETFs

“A couple of day by day ETF outflows doesn’t imply TradFi [traditional finance] is abandoning crypto — that is simply people utilizing a easy option to hop on and off Bitcoin, displaying the market’s nonetheless buzzing and noobs are nonetheless making errors,” 21Rates adviser Ryan Park wrote in a touch upon X.

Senior Bloomberg ETF analyst Eric Balchunas took to X on Monday to spotlight that Ether ETFs turned Bitcoin into “second finest” crypto asset in July, as buyers had been more and more shifting from Bitcoin ETFs to Ether ETFs.

“I give @fundstrat [Thomas Lee] quite a lot of credit score, together with stablecoin laws, it gave Ether a very good spokesman and its killer app,” Balchunas wrote.

He particularly referred to BitMine, a newly emerged “MicroStrategy of Ether,” which appointed Fundstrat’s Thomas Lee to steer its ETH treasury technique in June.

Journal: Solana Seeker evaluation: Is the $500 crypto telephone value it?