Cathie Wooden’s ARK Make investments doubled down on crypto-linked equities, scooping up shares of Bullish and Robinhood amid a broad sector sell-off.

In line with Tuesday’s commerce notifications, ARK Make investments’s flagship ARK Innovation ETF (ARKK) bought 356,346 shares of Bullish, valued at about $21.2 million, and 150,908 shares of Robinhood Markets, price $16.2 million.

Final week, ARK Make investments went huge on Bullish, buying 2.53 million shares, price $172 million, throughout three ETFs after the crypto trade’s debut on the New York Inventory Trade.

ARK Make investments has additionally been on a Robinhood shopping for streak, including shares for 3 consecutive classes. The agency purchased $14 million price on Monday and $9 million on Friday.

The buyback got here as ARK Make investments dumped a number of batches of Robinhood shares final yr to adjust to Rule 12d3-1, which bars ETFs from holding greater than 5% of their property in securities tied to registered brokers or advisers.

Associated: Technique buys 21K Bitcoin with 2025’s largest public providing

Crypto shares drop

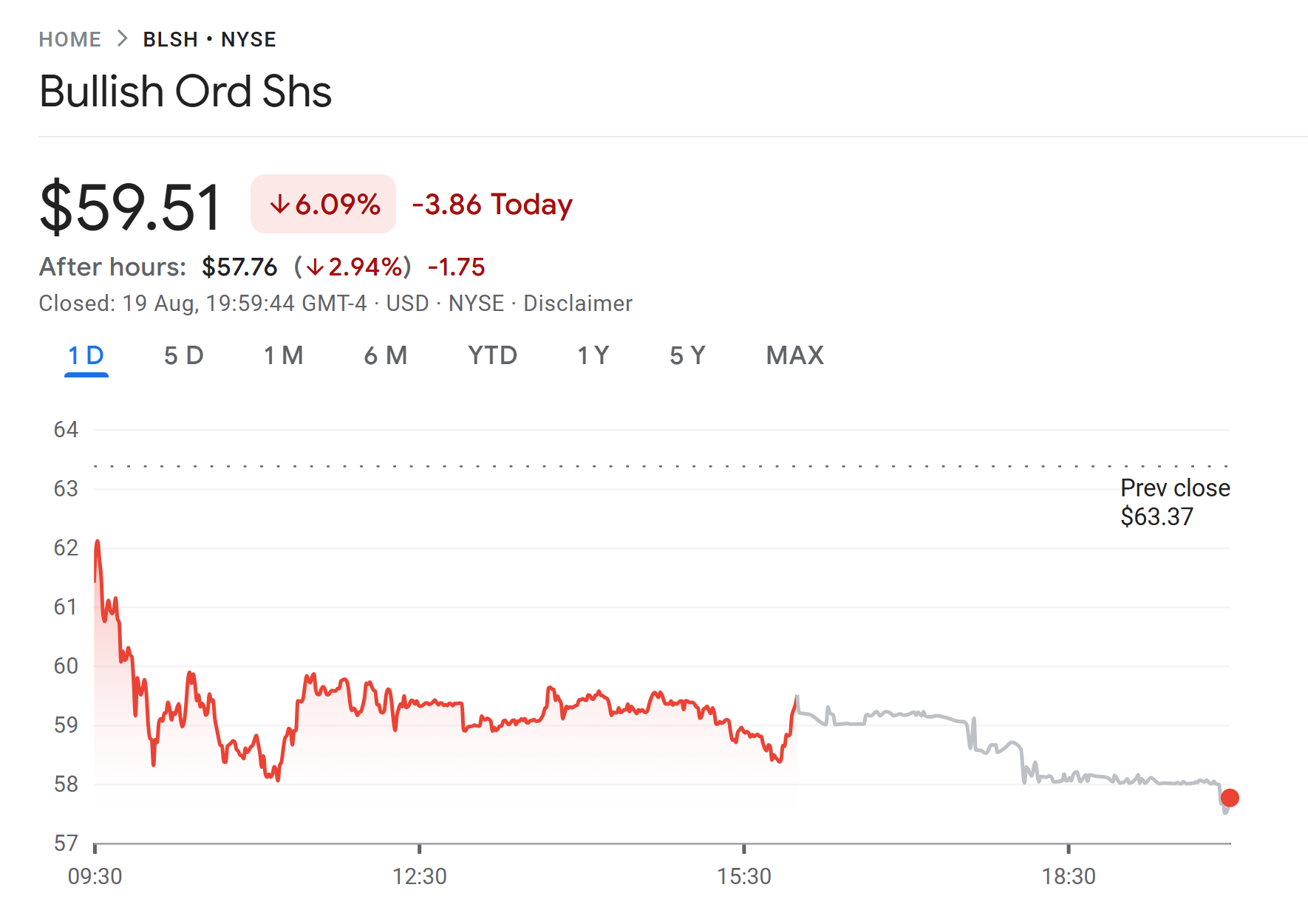

Each Bullish and Robinhood shares sank on Tuesday. Bullish closed down 6.09% at $59.51 and slid one other 3.24% in after-hours buying and selling, whereas Robinhood fell 6.54% to $107.50 and shed a further 1.23% post-market.

The sell-off wasn’t remoted. Crypto-exposed equities had been broadly within the pink, with Coinbase down 5.82%, Galaxy Digital off 10.06%, Technique dropping 7.43%, and Circle slipping 4.49%. The Nasdaq Composite additionally fell 1.46%, signaling wider market jitters.

In line with CNBC, traders pulled again from crypto shares after their increase final week amid rate-cut optimism. Consideration now shifts to the US Federal Reserve’s Jackson Gap symposium, the place hints of dovish coverage from Chair Jerome Powell might set off a rebound.

Associated: CoinDesk proprietor Bullish ups IPO aim to $1B as Wall Avenue backs crypto push

Bullish raises $1.1 billion

Final week, Bullish, which operates a cryptocurrency trade and owns CoinDesk, priced its IPO above earlier expectations of $32–$33 per share, elevating $1.1 billion by means of the sale of 30 million shares.

The Cayman Islands-based firm ended its first buying and selling session up 83.8% from its IPO value of $37. Shares jumped one other 11.2% in after-hours buying and selling. The surge got here because the inventory opened at $90 and hit an intraday excessive of $118, greater than 215% above the IPO value, earlier than falling again.

Journal: Solana Seeker evaluation: Is the $500 crypto cellphone price it?