Why are some buyers selecting Bitcoin over authorities bonds?

Traditionally, sovereign bonds just like the US Treasurys, Japanese authorities bonds and German Bunds have been go-to property for risk-averse buyers. They’re normally perceived to be minimal-risk property providing regular returns. Nevertheless, for the reason that emergence of Bitcoin 13 years in the past, the narrative of Bitcoin as an alternative choice to bonds has been steadily rising within the minds of buyers.

The interaction between the Federal Reserve’s stability sheet and the M1 and M2 cash provide can be a big consideration to assist perceive why some buyers are shifting to Bitcoin (BTC).

- The M1 cash provide is a measure of the entire amount of cash available in an economic system. It contains essentially the most liquid property: money, demand deposits (checking accounts) and different related checkable deposits.

- The M2 cash provide is a wider measure of cash provide than M1. It contains the entire M1 property, mixed with financial savings deposits, retail cash market funds (MMFs) and small-time deposits.

The US Federal Reserve’s actions on increasing and shrinking its $6.69-trillion stability sheet straight affect the M1 and M2 provide, which in flip have an effect on inflation, bond yields and investor confidence in fiat property. When the Fed provides or removes cash, it modifications how a lot money (M1) and financial savings (M2) can be found. These modifications have an effect on inflation, how a lot curiosity bonds pay and the way a lot folks belief conventional (fiat) cash.

Up to now few years, the Fed has saved the federal funds charge in a excessive vary between 4% and 5% and has additionally signaled that charge cuts may not be essentially imminent. On Might 26, 2025, Moody’s downgraded the US debt score from AAA to AA1, citing fiscal instability and political dysfunction.

Moreover, the Japanese bond disaster of 2024-2025 exemplified how a shift within the relationship between bond demand and yields, amplified by US tariff insurance policies, can impression investor sentiment and the protected haven standing of presidency debt. On this macroeconomic situation, Bitcoin is more and more cementing its place as a hedge towards inflation.

As of June 13, BTC has outperformed the S&P 500, gold and the Nasdaq 100 by posting 375.5% good points over a three-year interval, as in comparison with 59.4%, 85.3% and 86.17%, respectively.

Do you know? The Bitcoin Core builders have determined to extend the OP_RETURN information transaction restrict from 80 bytes to 4 megabytes, as confirmed in an replace on GitHub. Though this replace to the code by means of the Bitcoin Core 30 launch has sparked a debate throughout the group, it’s aimed toward addressing considerations with information storage strategies and bettering the unspent transaction output (UTXO) set. This launch is scheduled to go dwell in October 2025.

The rise of Bitcoin’s prominence within the trendy investor’s portfolio

The US Securities and Trade Fee’s approval of the spot Bitcoin exchange-traded funds (ETFs) on Jan. 10, 2024, was a watershed second for Bitcoin’s position within the portfolio of recent buyers, each conventional and retail. The 12 Bitcoin spot ETFs buying and selling within the US have complete property beneath administration (AUM) of $132.5 billion as of June 11, 2025, per information from Bitbo. It’s a monumental determine contemplating these ETFs have solely been buying and selling for over 300 days.

Beneath is the entire timeline of the US SEC approving the itemizing of Bitcoin spot ETFs:

- 2013: Cameron and Tyler Winklevoss, founders of the Gemini cryptocurrency trade, file the first-ever spot Bitcoin ETF utility with the SEC. Grayscale launches the Bitcoin Funding Belief.

- 2017: Citing considerations concerning the asset’s market maturity and manipulation, the SEC rejects the Winklevoss ETF utility.

- 2018: The SEC rejects the refiled ETF utility from the Winklevoss twins by citing insufficient market controls.

- 2020: Grayscale converts its belief into an SEC reporting entity, aiming to extend the transparency of funds.

- 2021: The SEC approves the primary US Bitcoin futures ETF utility filed by ProShares whereas persevering with to reject spot ETF purposes.

- 2023: Grayscale sues the SEC after the rejection of its utility to transform its Bitcoin belief right into a spot ETF. A US Appeals Courtroom guidelines that the SEC did not justify the rejection, thus forcing it to rethink the applying.

- Mid-2023: The world’s largest asset supervisor, BlackRock, recordsdata for a spot Bitcoin ETF. A wave of spot Bitcoin ETF purposes follows from companies resembling Constancy, Franklin Templeton, WisdomTree and others.

- Jan. 10, 2024: The SEC approves 11 spot Bitcoin ETFs, which start buying and selling on US exchanges the next day.

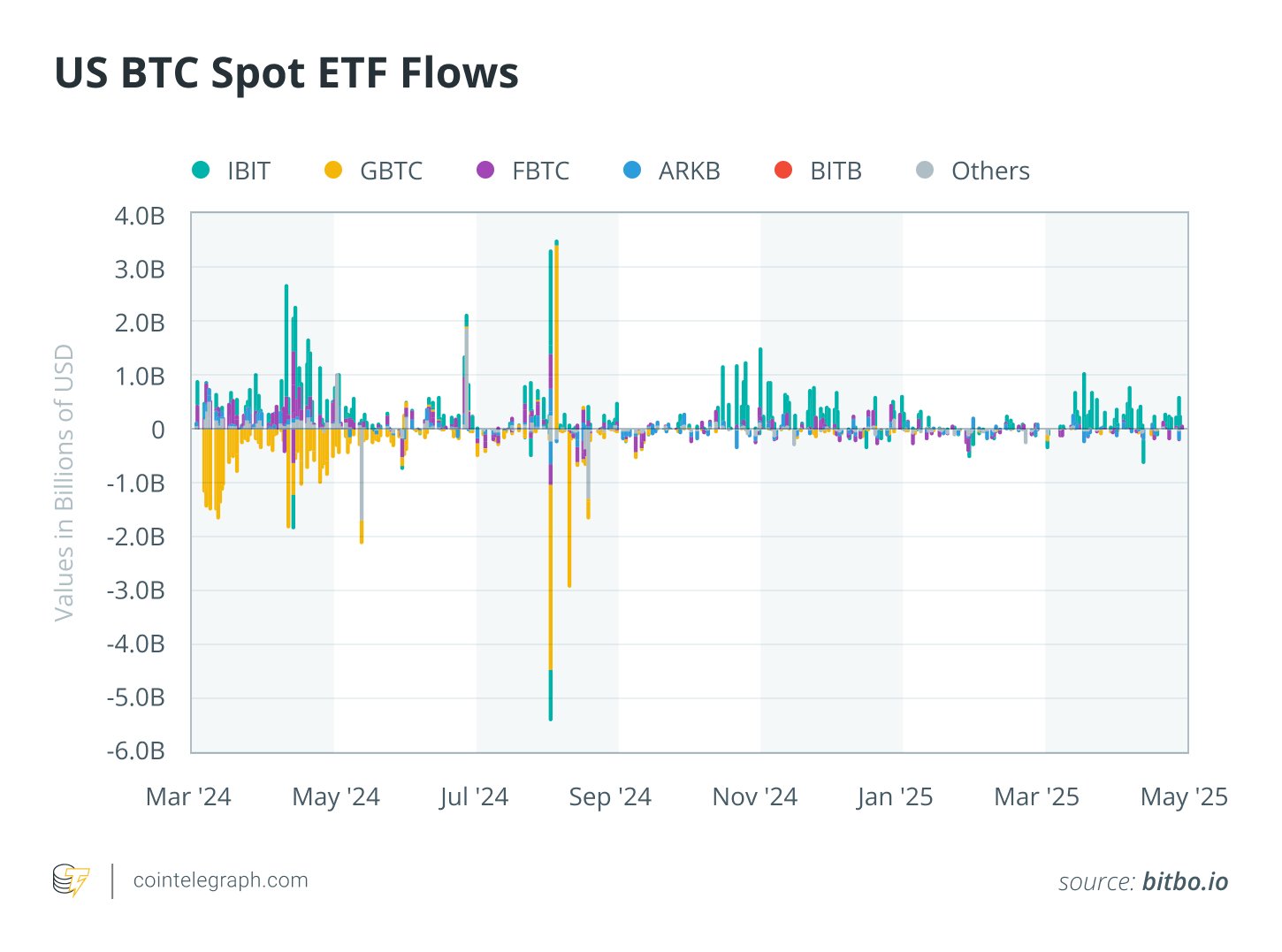

Since then, the inflows and outflows of those ETFs have various together with the sentiment of the market, however they’ve damaged a number of information and are anticipated to proceed to take action as a consequence of institutional curiosity within the asset. The chart under exhibits the every day inflows and outflows of the US BTC spot ETFs since their launch on Jan. 11, 2024.

In line with calculations aligned with the trendy portfolio idea (MPT), the Sharpe ratio of a portfolio may be optimized round a 16% allocation to Bitcoin, as revealed in a report by Galaxy launched on Might 27, 2025.

- Fashionable portfolio idea (MPT): It’s a framework developed by Nobel Laureate Harry Markowitz within the Nineteen Fifties to assemble optimum funding portfolios. Since then, it has been used as a trusted analytical instrument to mannequin situations of an excellent portfolio allocation to completely different asset courses.

- Sharpe ratio: This metric measures the risk-adjusted return of an funding. It’s a method to measure how a lot return you’re getting for the chance you’re taking.

At this stage of portfolio allocation, the Sharpe ratio for BTC could be round 0.94. Compared, the estimated Sharpe ratio of US Treasury bonds is between 0.3 and 0.5, per information from Curvo. This implies US Treasury bonds provide much less return for a similar stage of danger. In easy phrases, Bitcoin offers you about 0.94% additional return for each 1% of danger, making it a extra environment friendly funding than bonds for those who’re snug with the upper danger.

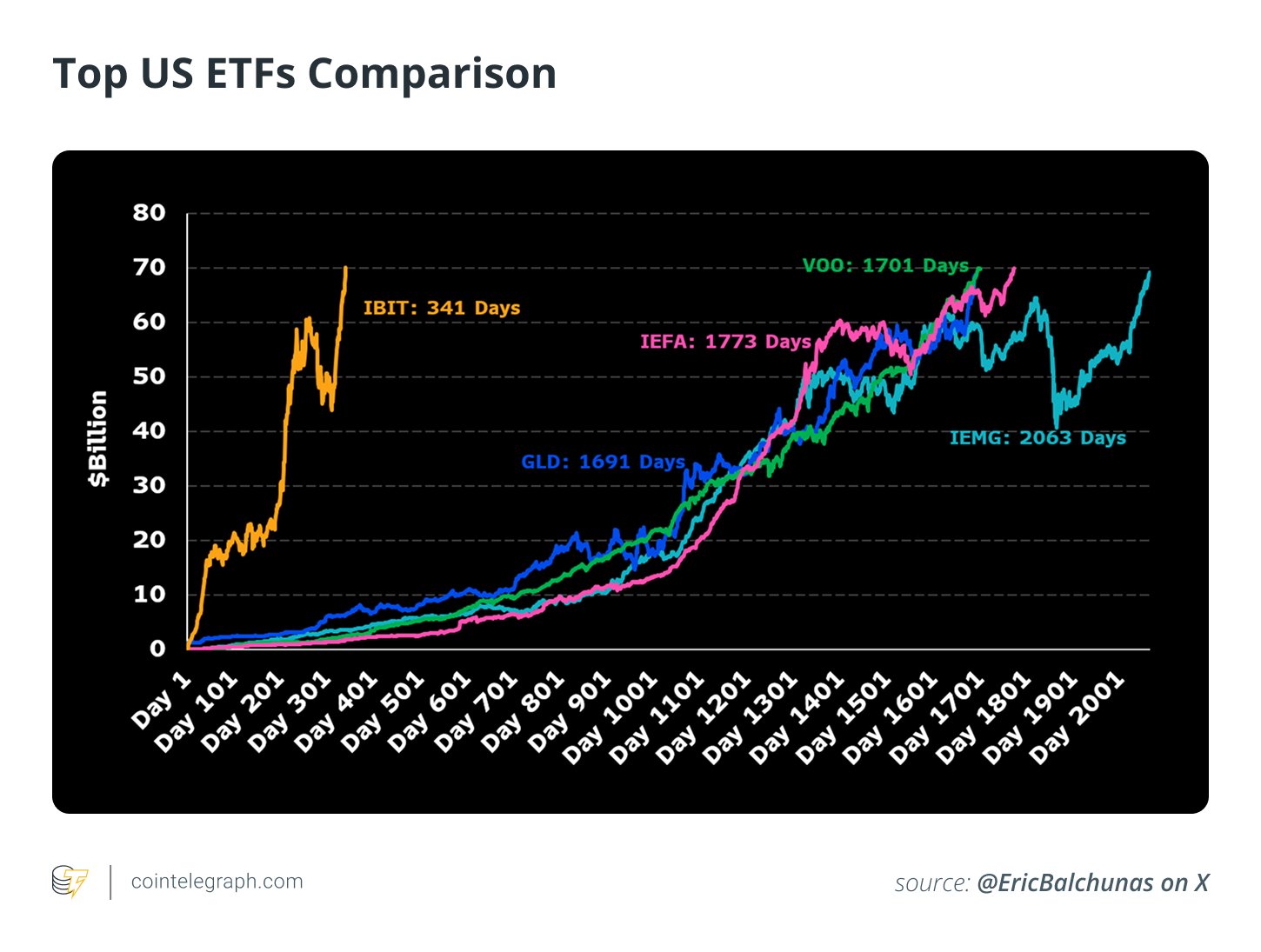

Do you know? On June 9, 2025, BlackRock’s iShares Bitcoin Belief ETF (IBIT) grew to become the quickest ETF in historical past to surpass $70 billion in AUM. As senior Bloomberg ETF analyst Eric Balchunas confirmed on X, the fund reached this mark in simply 341 days, 5 occasions quicker than the SPDR Gold Shares (GLD) ETF, the earlier file holder.

Bitcoin or sovereign bonds: Which one is extra profitable to buyers in 2025?

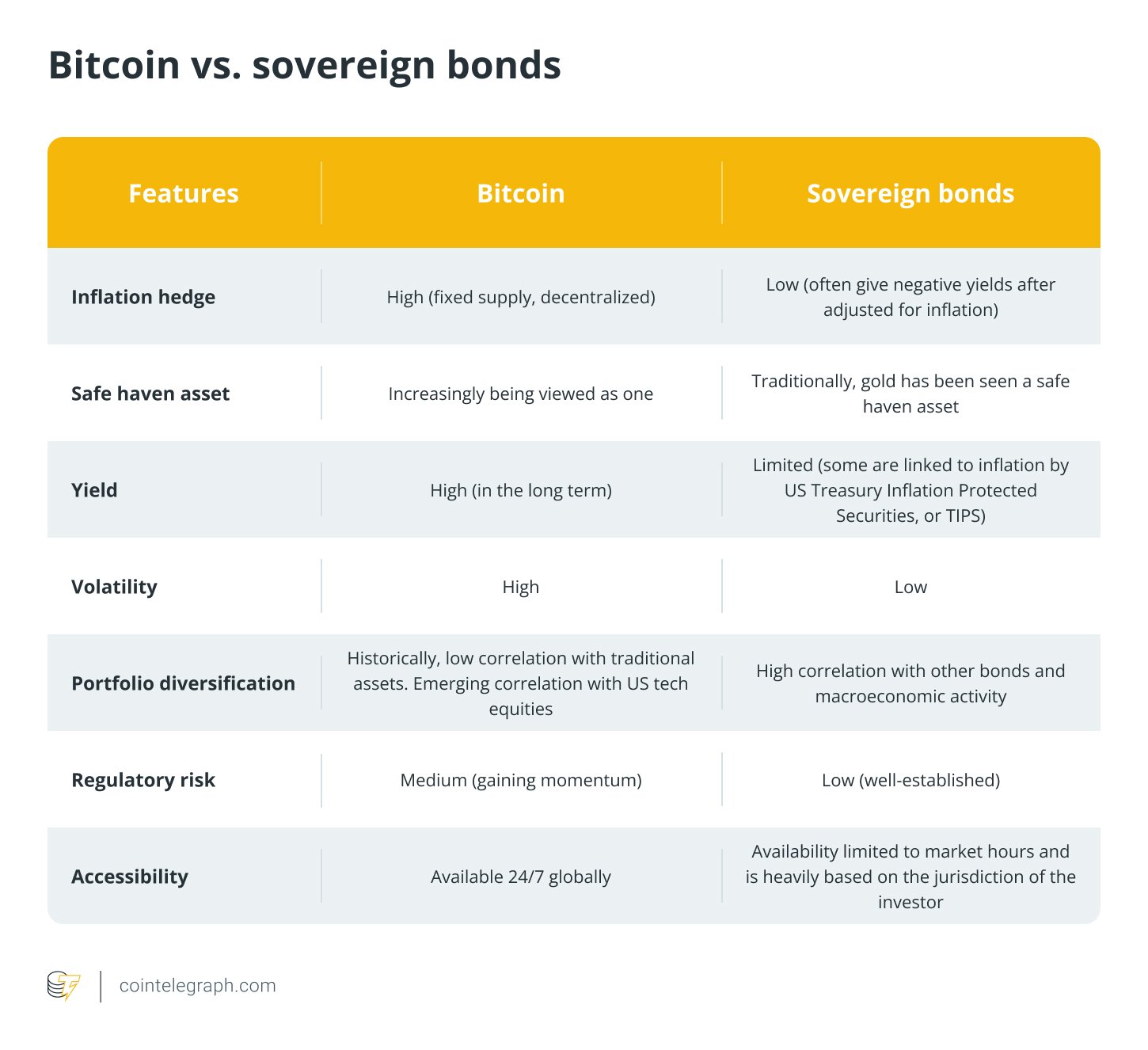

There are a number of the explanation why even risk-averse buyers are contemplating investing in Bitcoin as an alternative of sovereign bonds — from yield, volatility, regulatory issues and accessibility, amongst others.

Beneath is a comparative overview of the 2 asset courses and their distinctive options for buyers:

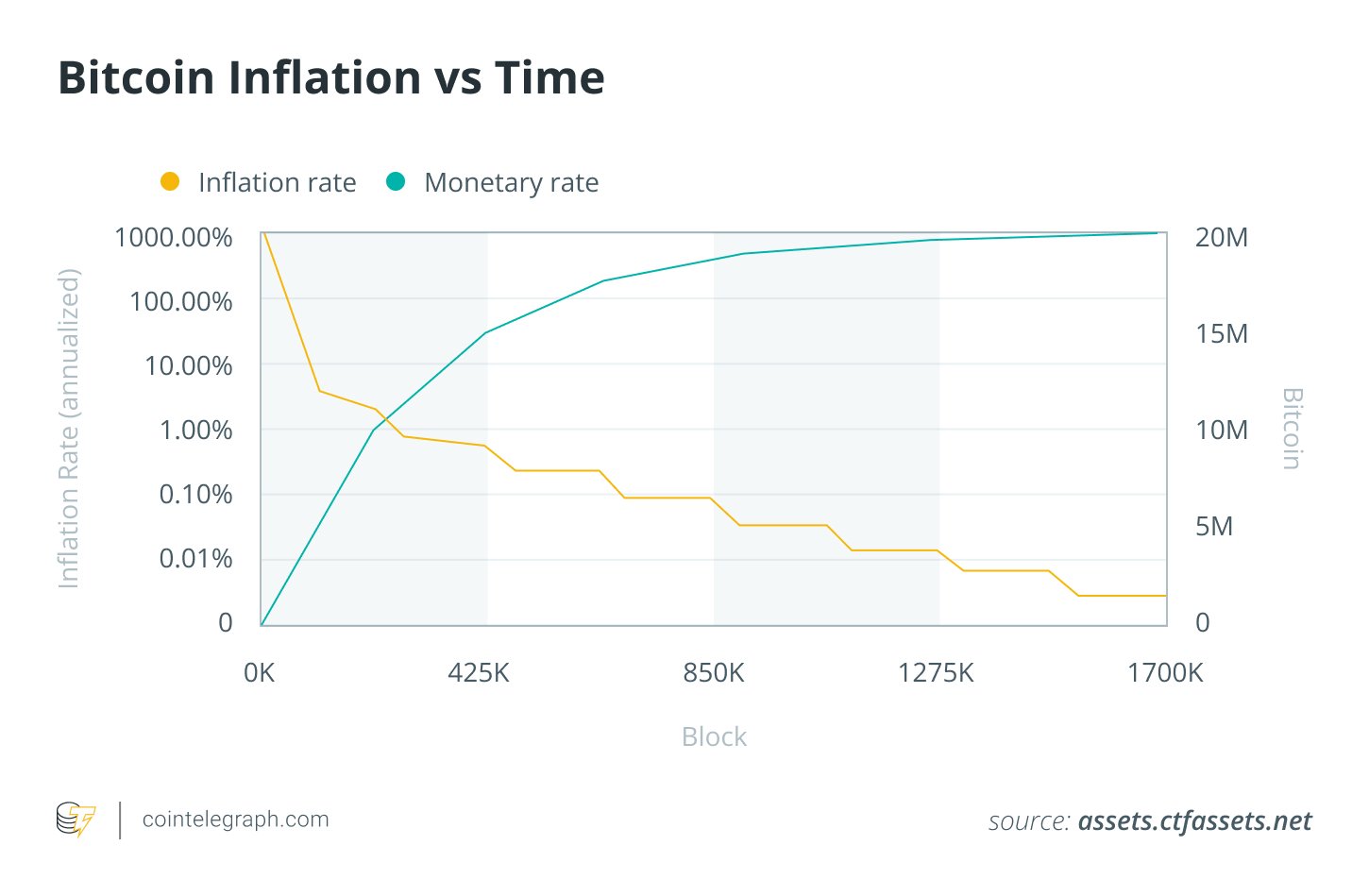

Whereas the returns on Bitcoin aren’t assured, the asset’s worth reached an all-time excessive of $112,087.19 on June 10, 2025. PlanB’s stock-to-flow mannequin estimates that, on the charge as of June 12, mining the entire BTC provide would take round 55 years, with out accounting for halving occasions. Accounting for halving occasions, the entire provide of 21 million Bitcoin can be mined by 2140. This low charge of influx into the availability contributes to the narrative that Bitcoin is a scarce asset, which is able to solely develop into scarcer as Bitcoin halving occasions reduce down the block rewards on every new block mined on the community by 50%.

Billionaire buyers like Larry Fink, Stanley Druckenmiller and Paul Tudor Jones are more and more turning to Bitcoin as a hedge towards inflation and authorities mismanagement. Fink sees Bitcoin as a contemporary different to gold amid what he calls the very best embedded inflation in many years.

Druckenmiller not solely helps Bitcoin however has brazenly shorted US bonds, criticizing the Fed’s charge coverage as disconnected from market actuality. In the meantime, Jones warns of spiraling US debt and expects policymakers to inflate their means out, reinforcing Bitcoin’s attraction as a retailer of worth. Collectively, these Wall Avenue titans are signaling a shift: lengthy Bitcoin, brief bonds.

Do you know? Michael Saylor’s Technique (beforehand referred to as MicroStrategy) has acquired 582,000 BTC for the reason that firm began buying the tokens in August 2020. These tokens had been bought at a mean value of $70,086 following its newest buy of 1,045 BTC on June 9. Technique at present owns 2.771% of the utmost capped provide of Bitcoin.

How Bitcoin’s mounted provide and easy accessibility are disrupting conventional portfolio constructions

The Bitcoin community’s inception led to the start of a brand new monetary asset class. BTC is likely one of the solely property on the planet that’s immutable, provenly scarce and has a completely capped provide.

As a result of it’s hardcoded within the core protocol of the community, there can by no means be greater than 21 million Bitcoin minted. As of June 11, 2025, over 19.8 million BTC has been minted, per Bitbo information. This accounts for 94.6% of the entire provide.

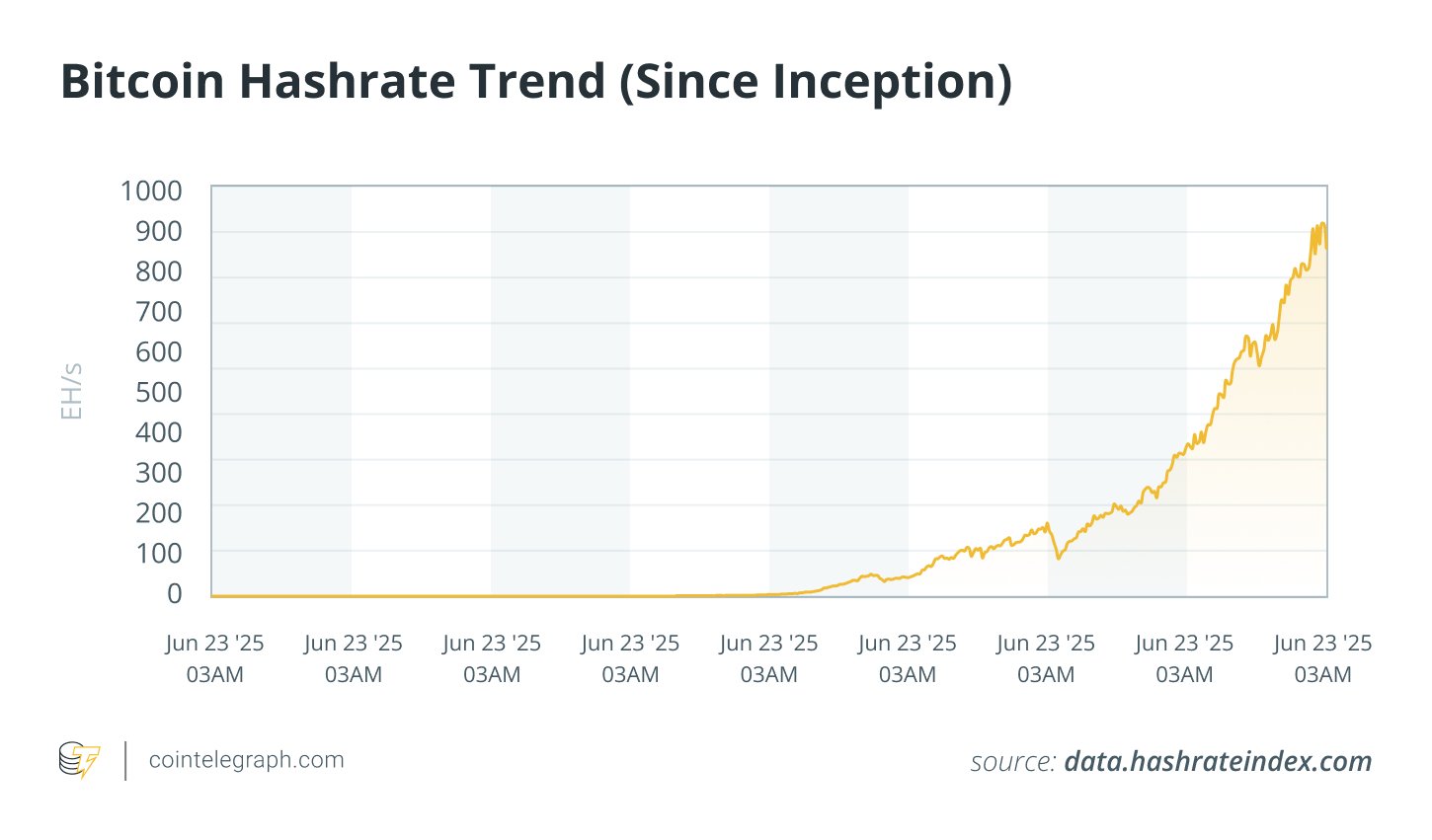

On Might 26, the Bitcoin community’s hashrate hit an all-time excessive of 913 exahashes per second (EH/s), a 77% enhance from the 2024 low of 519 EH/s. The hashrate represents the entire computational energy that’s utilized by the proof-of-work miners to validate transactions and add blocks to the community. This entails that miners more and more have to spend extra computational energy to contribute to the community.

In distinction, the availability of sovereign bonds is ready by the federal government, which might concern new bonds when wanted. Thus, there is no such thing as a notion of shortage for bonds issued by the federal government.

Moreover, sovereign bonds are closely restricted by a couple of components, particularly for retail buyers:

- Restricted platforms for entry: Retail buyers usually can’t entry authorities bonds straight and need to depend on intermediaries like asset managers, banks or brokers.

- Advanced settlement infrastructure: These bonds are usually cleared by means of institutional settlement homes like Euroclear and Clearstream, which aren’t designed for retail utilization.

- Lack of speedy liquidity: Authorities bonds are solely accessible to buyers through the buying and selling hours of that specific nation, which doesn’t enable buyers to unwind their place exterior market hours, on weekends and on financial institution holidays.

- International sovereign bonds: Buying overseas sovereign bonds requires buyers to have entry to worldwide brokerage accounts and likewise includes foreign money danger and vital geopolitical danger.

Since Bitcoin is a decentralized and accessible asset with 24/7 availability, it overcomes lots of the challenges that investing in sovereign bonds might pose. Moreover, as crypto wallets proceed to enhance person expertise and simplify onboarding, and as entry to each centralized and decentralized crypto exchanges expands, Bitcoin is turning into much more accessible at a fast tempo. This ease of entry, when in comparison with sovereign bonds, is certain to assist buyers considering the shift from sovereign bonds to BTC.