After 4 years within the wilderness, bitcoin

alternate traded notes (ETN) are set to return to London and the change might show extra vital than many count on.

Beginning Oct. 8, these merchandise, which permit retail buyers to realize publicity to the cryptocurrency with out shopping for it themselves, will turn out to be accessible after being banned by the Monetary Conduct Authority (FCA) in January 2021. The regulators argued on the time that excessive volatility, susceptibility to fraud and the issue of valuation made them too dangerous for retail buyers.

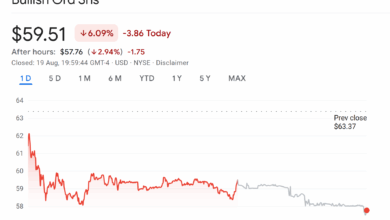

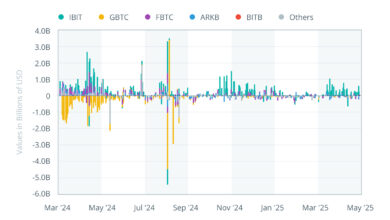

However the ban additionally left the U.Okay. lagging behind developments elsewhere. The U.S. spot exchange-traded funds have been a powerful success, with greater than $65 billion {dollars} flowing into bitcoin and ether (ETH) ETFs since their inception in January final yr, knowledge from SoSoValue present. European buyers even have entry to a variety of exchange-traded merchandise. U.Okay. buyers have been compelled to look overseas for regulated publicity, usually turning to Technique (MSTR) inventory as a proxy.

“The significance of bitcoin alternate traded notes coming to London is being underestimated,” Charlie Morris, the founding father of digital asset funding agency ByteTree, mentioned in an interview. “London is the world’s second-largest monetary heart, and plenty of funds have contact factors with London, whether or not or not it’s custody, buying and selling, authorized or settlement.”

The ban, for instance, locked merchandise complying with UCITS, the European framework for regulated mutual funds and ETFs, from accessing crypto in the event that they needed to have contact with the London-based monetary system.

“It will change. Bitcoin is about to be opened as much as the worldwide fund market, and there might be authorized readability. This might be as necessary because the USA launches final yr, and probably extra so over time. Sustained demand for bitcoin stays underpinned for years to come back by way of alternate traded notes,” Morris mentioned.

The reversal indicators a recalibration. Britain, as soon as an early crypto hub with initiatives from then Chancellor Rishi Sunak and companies like Jersey-based CoinShares, is shifting to reassert relevance. Trade figures reminiscent of former Chancellor George Osborne, who’s now an adviser to Coinbase, have warned that London dangers falling behind if it doesn’t embrace innovation.

“The Monetary Conduct Authority’s reversal indicators greater than a rule change. It’s a clear signal that the winds are shifting within the U.Okay.’s monetary panorama, with policymakers now eager to maintain the nation related in a fast-evolving world market,” mentioned Bitcoin OG Nicholas Gregory.

Even so, the advanced construction of the nation’s investment-advice trade might imply take up is slower than proponents assume, mentioned Peter Lane, CEO of Jacobi Asset Administration. Simply because the merchandise are authorized, does not imply they are going to be supplied to purchasers.

“The U.Okay. adviser community is extremely fragmented, with IFAs [independent financial advisers], restricted and tied advisers all working beneath completely different fashions,” he mentioned. “It is going to take time for companies throughout these teams to guage the implications of the crypto ETN ban being lifted, assess suitability frameworks, and construct the mandatory due diligence processes earlier than they’re ready to think about providing or recommending such merchandise to purchasers.”