Transfer over Jackson Gap and inflation fears. The actual driver behind the latest swoon in crypto and inventory markets is probably going the approaching liquidity drain stemming from the U.S. authorities’s Treasury Basic Account (TGA), a checking account held on the Federal Reserve that’s poised for a big buildup.

Bitcoin

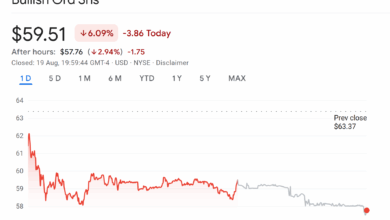

has declined by over 8% to $113,500 since hitting report highs above $124,000 final Thursday, in line with CoinDesk information. Costs for different main tokens equivalent to ether (ETH), XRP , and solana’s SOL (SOL) have additionally corrected, dragging the broader market decrease. The CoinDesk 80 Index has dropped 13% since final Thursday.

The bullish momentum has additionally weakened on Wall Avenue, the place the tech-heavy Nasdaq index fell by practically 1.40% to $23,384 on Tuesday, having hit a report excessive of $23,969 per week in the past.

Most market commentary has attributed the losses on Wall Avenue and in crypto markets to investor de-risking forward of Federal Reserve (Fed) Chair Jerome Powell’s scheduled speech at this week’s Jackson Gap occasion. The prevailing view is that persistent inflation information might forestall Powell from assembly the market’s dovish expectations.

Nevertheless, David Duong argues that the first driver of the sell-off is the concern of a liquidity drain from the anticipated TGA refill.

“Jackson Gap and PPI are simply excuses for market gamers to trim threat forward of the U.S. Treasury’s TGA liquidity drain (~$400B) within the weeks forward. This explains why bitcoin has misplaced development alongside many fairness names. However we predict the trail ahead seems clearer in September,” David Duong, head of institutional analysis at Coinbase, mentioned on X.

What’s the Treasury Basic Account?

The Treasury Basic Account is the U.S. authorities’s working account on the Federal Reserve, which is used to gather taxes, customs duties, proceeds from the sale of securities, and public debt receipts, whereas facilitating authorities funds.

Simply as our financial savings financial institution accounts, the TGA steadiness fluctuates day by day, rising with receipts and falling with funds.

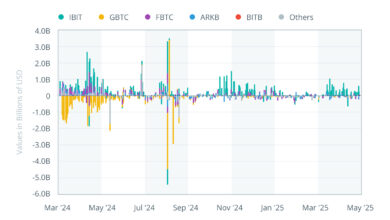

The Treasury sometimes spends the money steadiness in periods of fiscal uncertainty, such because the evergreen debt ceiling saga, to make sure the federal government meets its obligations. The so-called TGA spend sometimes provides to liquidity within the system, greasing threat belongings, as seen in early 2023 and early this yr.

The alternative happens when the Treasury seeks to rebuild its steadiness by issuing extra debt than essential to fund its obligations. This tends to suck out liquidity from the system.

The TGA refill is occurring beneath fragile situations

The TGA steadiness has risen from roughly $320 billion to over $500 billion since late July, in line with information supply MacroMicro. Looking for Alpha estimates that the Treasury might must challenge new debt value $500-$600 billion within the subsequent two to 4 months to revive the TGA to wholesome ranges.

The rebuild is occurring in opposition to the backdrop of fragile situations than in earlier years, in line with Delphi Digital.

“In comparison with 2023, the monetary system now faces fewer liquidity buffers, tighter steadiness sheet capability, and a diminished overseas bid for Treasuries. The structural potential to soak up large-scale issuance has weakened throughout all main channels. If the Federal Reserve maintains its tightening stance or delays a pivot, the ensuing mismatch between provide and accessible demand may drive up funding charges and spill over into broader threat belongings, together with crypto,” Marcus Wu, analysis analyst at Delphi Digital, mentioned in an explainer.

Wu added that the final large-scale rebuild, which occurred within the second half of 2024, was compensated by different pro-liquidity developments such because the $2 trillion within the Fed’s RRP facility, wholesome financial institution reserves and powerful overseas demand for the debt.

Nevertheless, these components have eroded over time, “leaving the present liquidity surroundings ripe for disruption,” Wu famous.

To chop an extended story quick, liquidity constraints pose a big problem for BTC bulls seeking to engineer a steep uptrend nicely into the year-end.

Learn extra: Cardano, Dogecoin Lead Crypto Losses as Bitcoin Merchants Worry Pullback to $100K