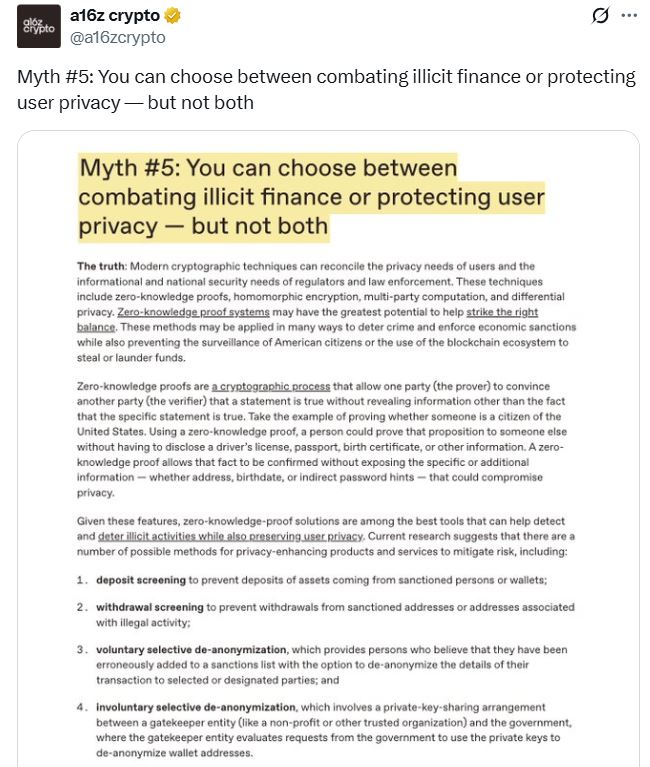

The crypto-focused funding arm of enterprise capital agency Andreessen Horowitz argues that trendy cryptographic strategies, similar to zero-knowledge proofs, can defend consumer privateness however nonetheless permit regulation enforcement to crack down on unhealthy actors.

In a report on Tuesday, a16z Crypto coverage companion Aiden Slaven and regulatory counsel David Sverdlov stated that ZK-proofs, which confirm the authenticity of information with out disclosing any detailed personal info, have the “biggest potential” by exhibiting the origin of funds, however with out publicly revealing personal info.

Their report comes solely two weeks after Roman Storm, the co-founder of the crypto mixing service Twister Money, which permits customers to masks the origin and vacation spot of cryptocurrency, was discovered responsible of prices associated to conspiracy to run an unlicensed cash enterprise.

Legislation enforcement and prosecutors within the Twister Money case argued that mixing providers that obscure the origin of funds helps facilitate felony exercise by offering a way of hiding ill-gotten positive aspects.

“If customers are capable of furnish such proofs upon exchanging crypto for fiat foreign money, the cash-out factors may have affordable assurances that the crypto didn’t derive from proceeds of crime, whereas the customers are capable of retain privateness over their onchain transactions,” Slaven and Sverdlov stated.

ZK-proofs have broad number of privacy-related makes use of

Slaven and Sverdlov additionally recommend ZK-proofs have a use past simply finance; they can assist with different on a regular basis duties, similar to proving the citizenship of a rustic or equal.

“Utilizing a zero-knowledge proof, an individual may show that proposition to another person with out having to reveal a driver’s license, passport, beginning certificates, or different info,” they stated.

“A zero-knowledge proof permits that reality to be confirmed with out exposing the precise or further info — whether or not tackle, birthdate, or oblique password hints — that might compromise privateness.”

US Securities and Alternate Fee Commissioner Hester Peirce echoed an analogous sentiment on Aug. 4 on the Science of Blockchain Convention, arguing that privacy-protecting applied sciences needs to be safeguarded.

Privateness tech prepared for mainstream adoption

Critics typically increase scalability considerations about cryptographic privateness know-how, however developments similar to lowering computational overhead are making it extra sensible for larger-scale implementation, in response to Slaven and Sverdlov.

“Cryptographers, engineers, and entrepreneurs proceed to enhance the scalability and value of zero-knowledge proofs, making them an efficient software for fulfilling the wants of regulation enforcement, whereas preserving particular person privateness,” they stated.

The US authorities’s July crypto report flagged ZK-proofs as a technique to guard consumer privateness whereas enabling compliance checks. JPMorgan’s personal blockchain, Nexus, additionally makes use of the know-how for tokenized money settlements and interbank messaging.

Associated: SEC’s Peirce defends transaction privateness as Twister Money verdict looms

Different cryptographic privateness know-how value exploring

In addition to ZK-proofs, Slaven and Sverdlov stated there are different choices value exploring, similar to homomorphic encryption, a kind of cryptographic approach that permits a part of information, similar to numbers, for use with out decrypting different personal information, similar to names.

Different potentialities embody multiparty computation, which permits a number of folks to work collectively to calculate with out anybody revealing their personal information to anybody, and differential privateness, which ensures aggregated information collected by means of strategies like surveys can’t be used to determine people.

“New applied sciences — from the telegraph and phone to the web — have all the time sparked contemporary anxieties about privateness’s impending demise,” Slaven and Sverdlov stated.

“Blockchains have confirmed no totally different, and privateness on blockchains is usually misunderstood as both making a harmful stage of transparency or a haven for crime.”

Journal: Solana Seeker evaluate: Is the $500 crypto cellphone value it?