Bitcoin

and ether (ETH) merchants booked earnings over the previous 24 hours after the property hit file highs, whereas macro headwinds and elevated leverage added stress throughout main tokens.

Bitcoin fell again to $113,500, down greater than 1.5% on the day. Some analysts warned of the fragility of the market construction, with bitcoin slipping under key trendlines that had supported its rally.

“Bitcoin fell to $114,700, rolling again to ranges seen two weeks in the past and under the medium-term pattern line, which is a 50-day shifting common. This dynamic reinforces fears of a deeper correction, which may have an effect on your complete crypto market, doubtlessly triggering a deeper correction to $100,000, close to the 200-day MA,” mentioned Alex Kuptsikevich, chief market analyst at FxPro.

“The cryptocurrency market cap fell by one other 0.4% to $3.87 trillion. The market is plunging under the previous resistance stage, elevating speculators’ fears of a doable main correction in direction of $3.6 trillion,” he added.

Ether slid 1.8% to $4,159, down over 12% from its latest peak. The native token of Ethereum is retesting the $4,100 assist stage that had capped its rallies since March.

XRP

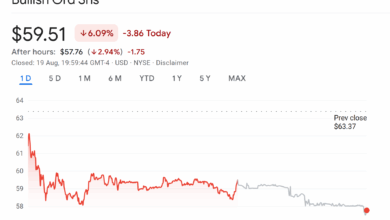

slipped 4.1% to $2.89, whereas dogecoin shed 2.4% to 21 cents. Cardano’s ADA (ADA) misplaced 6.6% to steer losses amongst main tokens.

Bitter temper sweeps the market

The temper within the crypto market has soured rapidly after a string of file highs, with merchants pressured to reckon with the macro backdrop as soon as once more. U.S. inflation knowledge stunned to the upside, cooling expectations for fast fee cuts and prompting profit-taking throughout short-term accounts.

“Bitcoin stays in minor correction mode since posting its newest file excessive within the earlier week,” mentioned Joel Kruger, market strategist at LMAX Group, mentioned in an electronic mail.

“Sentiment has been principally steered decrease by hotter-than-expected U.S. inflation knowledge, which dampened expectations for near-term fee cuts from the Fed.”

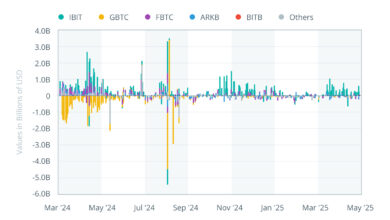

The retracement hasn’t spared ether, which mirrored bitcoin’s drop as leveraged longs unwound. Nonetheless, flows into ETH merchandise stay strong, giving some merchants confidence that the transfer is momentary.

“Ethereum has mirrored Bitcoin’s retreat, as merchants guide earnings following latest sturdy good points. Nonetheless, broader institutional curiosity stays resilient – evidenced by strong ETF flows and rising treasury allocations to ETH – which retains the medium-term outlook constructive,” Kruger added.

Institutional flows proceed to underpin sentiment at the same time as spot markets wobble. Hedge funds and asset managers proceed to boost massive allocations, indicative of the conviction behind the asset class.

In the meantime, leverage has piled up throughout derivatives markets, intensifying the danger of sharper strikes in both path.

“Report ranges of open curiosity in futures markets underscore how a lot leverage has constructed up throughout crypto,” mentioned Ryan Lee, chief analyst at Bitget, in a Telegram message.

“That leverage cuts each methods: it will probably speed up good points if momentum continues, however it additionally amplifies volatility, leaving each BTC and ETH susceptible to sharper swings on any shift in sentiment,” Lee mentioned.

Consideration now shifts to Jackson Gap, the place the Fed Chair is about to stipulate the central financial institution’s coverage stance heading into the autumn. The tackle may ship ripples throughout equities, foreign exchange, and digital property.

Learn extra: Bitcoin, Shares Hit By $400B Liquidity Drain From U.S. Treasury Account, Not Jackson Gap: Analysts