The derivatives arm of buying and selling platform Robinhood has sued regulators in Nevada and New Jersey in a bid to move off any potential enforcement motion from the states over its sports activities occasion contracts.

In a pair of complaints on Tuesday towards Nevada and New Jersey gaming regulators and their attorneys basic, Robinhood Derivatives mentioned it began providing the occasion contracts within the states after federal courts earlier this 12 months allowed prediction market Kalshi to supply the contracts.

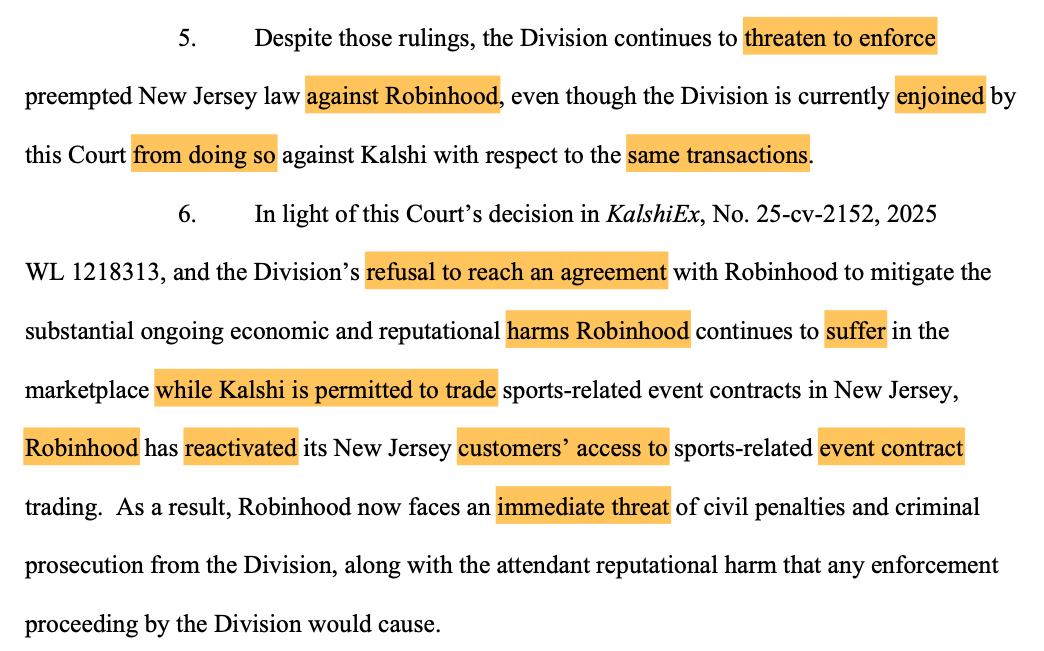

Robinhood claimed in separate lawsuits that after these rulings, Nevada and New Jersey continued attempting to cease the corporate from providing the contracts despite the fact that the courts stopped it “from doing so towards Kalshi with respect to the identical transactions.”

Kalshi sued Nevada and New Jersey gaming regulators in March, claiming cease-and-desist letters from the states over providing its sports activities betting contracts are moot as it’s regulated by the Commodity Futures Buying and selling Fee.

Federal courts in each states sided with Kalshi and stopped the regulators from taking enforcement motion towards the corporate. Each lawsuits are nonetheless ongoing.

Robinhood claims hurt if not allowed to supply contracts

Robinhood claimed that if the state regulators are permitted to take motion towards it however not Kalshi, then it’ll lose out to the platform within the sports activities occasion contracts area.

Occasion contracts let customers guess on the result of occasions corresponding to sports activities video games or election outcomes, and have their roots in utilizing blockchains for transparency and coping with resolving the reality of the contract.

Robinhood mentioned its platform facilitates the position and liquidation of occasion contracts for its customers, which commerce on Kalshi.

It mentioned that given every state’s “refusal to acknowledge what this Courtroom has already held — that its threatened enforcement of state regulation is probably going preempted by federal regulation — Robinhood had no selection however to file this lawsuit to guard its clients and its enterprise.”

Regulators declined Robinhood’s arguments

Robinhood claimed in its lawsuits that the gaming regulators from each states denied its assertions that it needs to be allowed to supply occasion contracts after the courts sided with Kalshi.

It mentioned in its New Jersey go well with that it contacted the state’s Division of Gaming Enforcement to clarify that it needs to be allowed to supply the contracts via Kalshi with a federal court docket’s determination permitting Kalshi to supply them.

“Division officers knowledgeable Robinhood that they may not conform to chorus from enforcement motion even whereas this Courtroom’s order was in place regarding Kalshi,” the corporate mentioned. It accused regulatory officers of not responding to a request to satisfy on the difficulty regardless of “a number of follow-ups.”

Associated: Banking foyer fights to alter GENIUS Act: Is it too late?

Robinhood mentioned the same situation performed out in Nevada after an area federal court docket sided with Kalshi, with its grievance claiming the state’s Gaming Management Board informed the corporate that if it supplied the contracts, it’d view it as “wilful violations” of regulation

It mentioned the regulator declined its proposal to quickly provide its clients based mostly within the state the identical contracts supplied on Kalshi.

In each complaints, Robinhood has requested the courts to challenge an order to cease the regulators from taking motion towards it and has filed for a short lived restraining order towards every.

Journal: Will Robinhood’s tokenized shares REALLY take over the world? Execs and cons