Harvard economist Kenneth Rogoff, who as soon as predicted Bitcoin would sooner crash to $100 earlier than it hits $100,000, has admitted lots has modified since his feedback seven years in the past — although he seemingly nonetheless hasn’t come round to Bitcoin.

“Virtually a decade in the past, I used to be the Harvard economist that mentioned Bitcoin was extra prone to be value $100 than 100K. What did I miss?” he wrote on X on Wednesday, referring to a section on CNBC’s “Squawk Field” in March 2018.

Rogoff is a former chief economist of the Worldwide Financial Fund (IMF) and in addition creator of ‘Our Greenback, Your Drawback’, which was printed in Could.

In 2018, Rogoff mentioned that authorities regulation would set off a drop in Bitcoin costs.

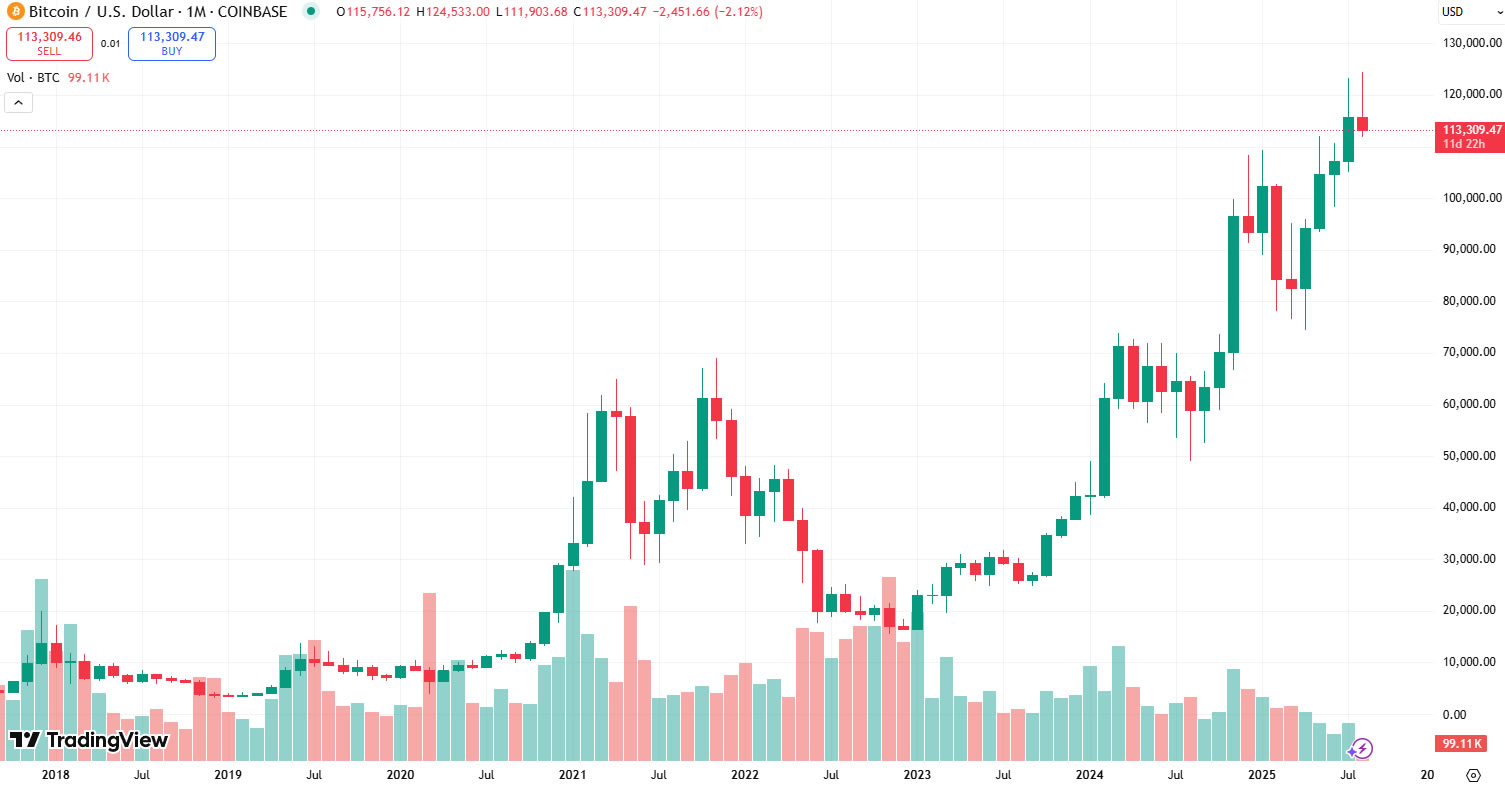

Nevertheless, because the Trump administration gained the November election, it broke $100,000 in December 2024 and has surged greater than 80% to a brand new all-time excessive.

“I used to be far too optimistic in regards to the US coming to its senses about smart cryptocurrency regulation,” he mentioned, indicating his stance on crypto hasn’t modified.

Bitcoin competes with fiat forex

“Second, I didn’t recognize how Bitcoin would compete with fiat currencies to function the transactions medium of selection within the twenty-trillion greenback international underground economic system,” he continued on X.

Nevertheless, Bitcoin has grow to be an inflation hedge in lots of nations the place native currencies have been massively devalued by governments.

Illicit exercise tied to cryptocurrencies was round $50 billion in 2024, based on Chainalysis, however it is a drop within the ocean and fewer than 1% of what’s laundered utilizing money.

“Third, I didn’t anticipate a state of affairs the place regulators, and particularly the regulator in chief, would have the ability to overtly maintain lots of of thousands and thousands (if not billions) of {dollars} in cryptocurrencies seemingly with out consequence given the blatant battle of curiosity.”

Associated: Trump-linked American Bitcoin seeks Asia acquisitions to spice up BTC holdings: Report

Crypto X decides to take it as a win anyway

Bitwise’s chief funding officer, Matt Hougan, responded, stating that Rogoff “Didn’t think about {that a} decentralized undertaking, which drew energy from folks and never centralized establishments, might succeed at scale.”

In the meantime, a researcher at digital property brokerage FalconX, David Lawant, mentioned he was “very grateful” to Rogoff, as his guide ‘The Curse of Money’ was “so horrible” that it was “one of many issues that pushed me to BTC.”

Head of digital property analysis and VanEck, Matthew Sigel, posted his record of Bitcoin’s loudest critics on Tuesday, rating Rogoff in ninth place. He “wrote Bitcoin’s obituary too early from inside his personal echo chamber,” mentioned Sigel.

“Perhaps you missed it since you dwell in an echo chamber, identical as once you lock replies,” he added, referring to Rogoff stopping folks from replying to his posts on X.

“Fundamentals matter: fiat debasement, demographic wealth shifts, and international demand for a impartial reserve asset.”

Paradoxically, the Harvard Administration Firm, which is answerable for managing the college’s $53 billion endowment fund, reported a $116 million funding in BlackRock’s spot Bitcoin ETF earlier this month.

⚡ FLASHBACK: In 2018, a Harvard economist mentioned $BTC is extra prone to hit $100 than $100K.

Now they invested $116M. pic.twitter.com/YDdZylmzdk

— Cointelegraph (@Cointelegraph) August 10, 2025

Journal: Solana Seeker evaluation: Is the $500 crypto cellphone value it?