Michael Saylor’s Technique (MSTR) has dropped to its lowest stage in almost 4 months amid a broader decline in crypto treasury companies, a Bitcoin dip, and after Saylor indicated the corporate would decrease restrictions on issuing extra shares.

The inventory worth has fallen 8% since Monday, and the plunge additionally comes alongside an 8.6% decline in Bitcoin’s (BTC) worth since hitting a brand new all-time excessive of $124,128 final Thursday.

Saylor lowers the edge for promoting MSTR to purchase Bitcoin

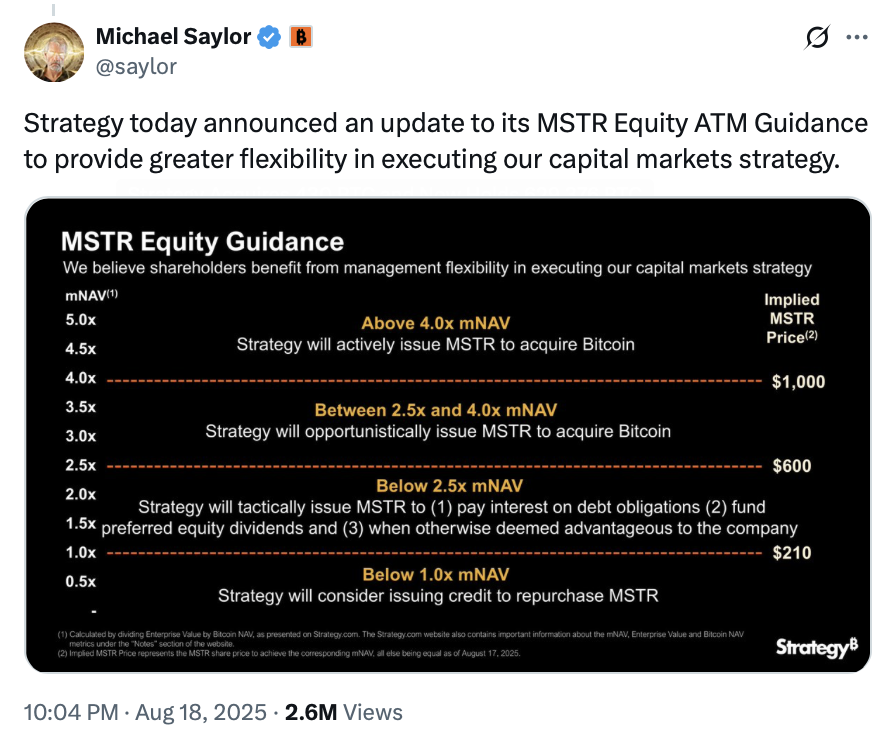

“Technique at this time introduced an replace to its MSTR Fairness ATM Steerage to offer better flexibility in executing our capital markets technique,” Saylor mentioned in an X publish on Monday, together with a chart exhibiting adjustments to the corporate’s skill to challenge shares under its earlier restrict.

The replace specified that when MSTR trades under 2.5 instances its internet asset worth (mNAV) — which reveals how a lot kind of the market values a Bitcoin-holding firm than its precise BTC stash — the corporate can “tactically challenge MSTR” to cowl debt curiosity, fund most popular fairness dividends, and “when in any other case deemed advantageous to the corporate.”

Some MSTR shareholders slammed the change, arguing it was a stark reversal of its Q2 earnings report, which solely talked about issuing shares under this stage to pay money owed or fund most popular fairness dividends.

Others, nevertheless, noticed it as a constructive for Bitcoin, as it will probably enable MSTR to purchase extra.

Technique’s mNAV stands at 1.55 on the time of publication, in line with Technique knowledge.

Saylor’s announcement divides the neighborhood

Crypto dealer Kale Abe mentioned, “He’s actually telling you straight up he’s gonna purchase a… ton extra BTC.”

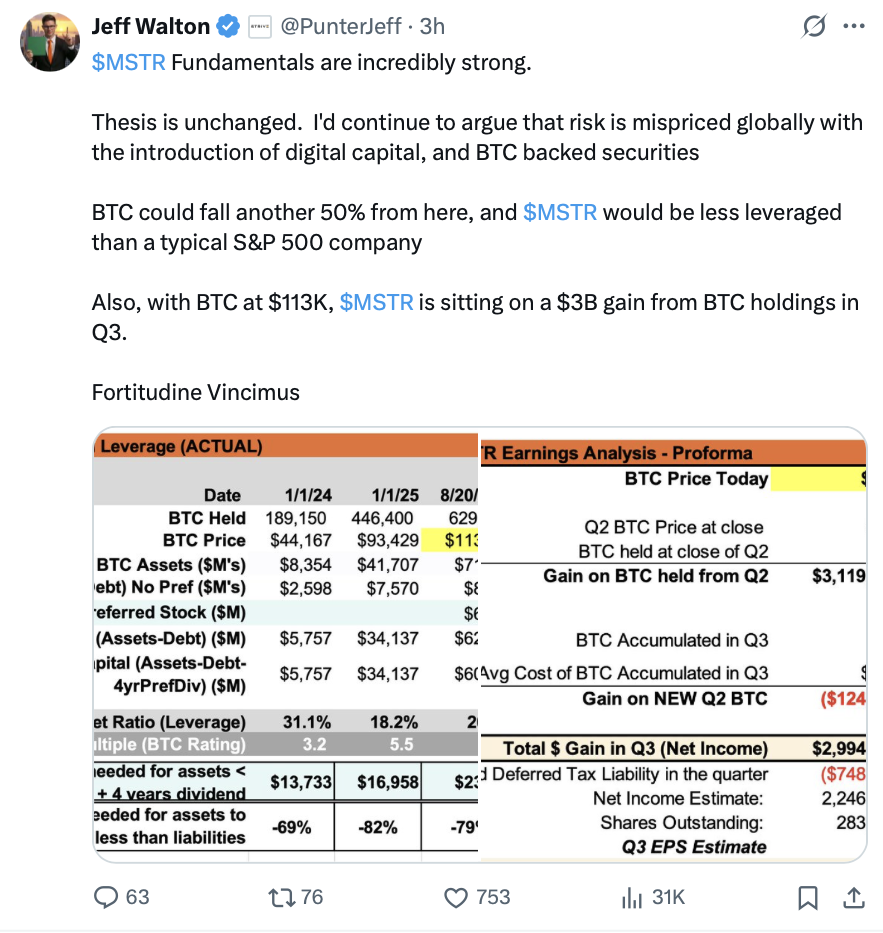

On the time of publication, the agency holds 629,376 Bitcoin, price roughly $71.34 billion, in line with SaylorTracker.

Associated: Michael Saylor indicators Technique will purchase the Bitcoin dip

One other commentator, Josh Man, who claims to be a previous shareholder, mentioned, “The top of the corporate mentioned he wouldn’t promote under 2.5 mNAV, so I purchased. He made this settlement with the shareholder on the stay earnings launch. After which he bought under mNAV 2.5.”

In the meantime, Bitcoin maxi and developer Endre Stolsvik mentioned it could be a extra possible choice for Technique.

“The ‘no challenge under mNAV 2.5’ was too strict, on condition that we’re distant, now at 1.59,” Stolsvik mentioned.

Over the previous month, MSTR has declined 21.04%, and is now buying and selling at $336.57. The final time MSTR traded at this stage was April 17, when Bitcoin was $84,030.

A number of different public corporations holding Bitcoin have additionally posted inventory worth declines over the previous month. MARA Holdings (MARA) is down 19.44%, Coinbase World Inc (COIN) is down 26.97%, and Riot Platforms (RIOT) is down 14.69%.

Journal: Solana Seeker evaluate: Is the $500 crypto telephone price it?