Key takeaways:

-

Bitcoin’s choices market indicators excessive concern, however historic patterns present potential for important rebounds.

-

World financial pressures from US commerce tariffs negatively affected merchants’ sentiment.

Bitcoin (BTC) fell beneath $113,000 for the primary time in over two weeks, stunning merchants and triggering the liquidation of $113 million in leveraged lengthy positions. The sharp decline adopted the $124,176 all-time excessive on Thursday, elevating questions on whether or not the bull market is over because the macroeconomic surroundings grows extra unsure.

SEC investigation and company AI disappointments

Bitcoin’s value correction accelerated after studies that the US Securities and Change Fee (SEC) is allegedly investigating fraud and inventory manipulation at Alt5 Sigma, an organization that not too long ago partnered with US President Donald Trump’s World Liberty Monetary in a $1.5 billion deal.

World Liberty, whose web site lists President Donald Trump as “co-founder emeritus,” raised roughly $550 million by way of two public token gross sales, advertising and marketing itself as a DeFi and stablecoin platform. In June, Trump disclosed incomes $57.4 million from his stake in World Liberty Monetary, whereas Eric Trump is slated to hitch Alt5 Sigma’s board.

Cryptocurrency traders additionally reacted to a 1.5% drop within the Nasdaq 100 after MIT NANDA analysis, primarily based on 150 company interviews and 300 public synthetic intelligence deployments, discovered that 95% of firms failed to attain speedy income progress from AI pilot applications.

US import tariffs and weakening confidence within the Fed

One other issue driving threat aversion was the US’s new 50% import duties on 407 extra aluminum- and steel-containing merchandise. The affected objects embrace on a regular basis items akin to automobile components, plastics, and specialty chemical substances, prompting economists to lift issues about provide chain disruptions and better shopper costs.

UBS funding financial institution lifted their gold value forecast to $3,700 by September 2026, based on CNBC. UBS strategists count on gold value to rally from below-trend financial progress, Federal Reserve coverage easing and a weaker greenback. Investor issues over the US fiscal deficit and questions on Fed independence additionally underpin the outlook.

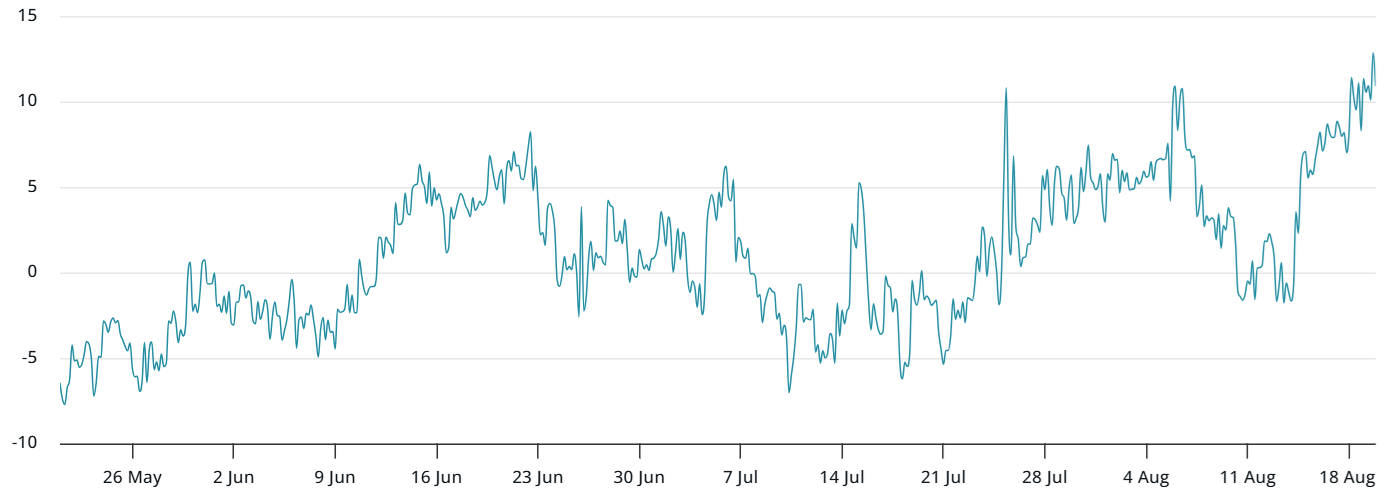

Amid rising fears of financial contraction and the potential impression on firms linked to Trump’s World Liberty Monetary, demand for draw back safety surged in Bitcoin derivatives markets. The BTC choices skew metric turned bearish on Friday and has continued to deteriorate, reflecting heightened investor warning.

The Bitcoin 30-day choices delta skew (put-call) surged to 12%, its highest stage in over 4 months. Underneath impartial situations, this indicator sometimes oscillates between -6% and +6%, reflecting balanced pricing for name (purchase) and put (promote) choices. Ranges above 10% sign excessive concern however are hardly ever sustained.

Associated: Bitcoin ‘liquidity zones swept’ however uptick in open curiosity hints at BTC restoration

A previous spike to 13% delta skew occurred on April 7, when Bitcoin dropped beneath $74,500 for the primary time in 5 months. Buyers who embraced the danger then noticed good points of 40% over the next month as Bitcoin rallied to $104,150 by Might 8.

There is no such thing as a proof that Bitcoin’s bull run has ended. Merchants’ concern typically overshoots rational expectations. In truth, the cryptocurrency would possibly even profit from potential outflows within the inventory market, suggesting that present turbulence doesn’t invalidate the market’s longer-term bullish development.

This text is for common data functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don’t essentially replicate or symbolize the views and opinions of Cointelegraph.